Why the AI Boom Isn’t Lifting AMAT Stock: What Investors Should Know

Applied Materials, Inc. (NASDAQ: AMAT) remains a crucial backbone of the global semiconductor industry in 2025, supplying the machines and technology that power chip manufacturing for everything from consumer gadgets to artificial intelligence (AI) supercomputers. With the AI sector driving record demand for computing power, many investors expect equipment suppliers like AMAT to soar. Yet, the recent stock performance and business model realities tell a more balanced story.

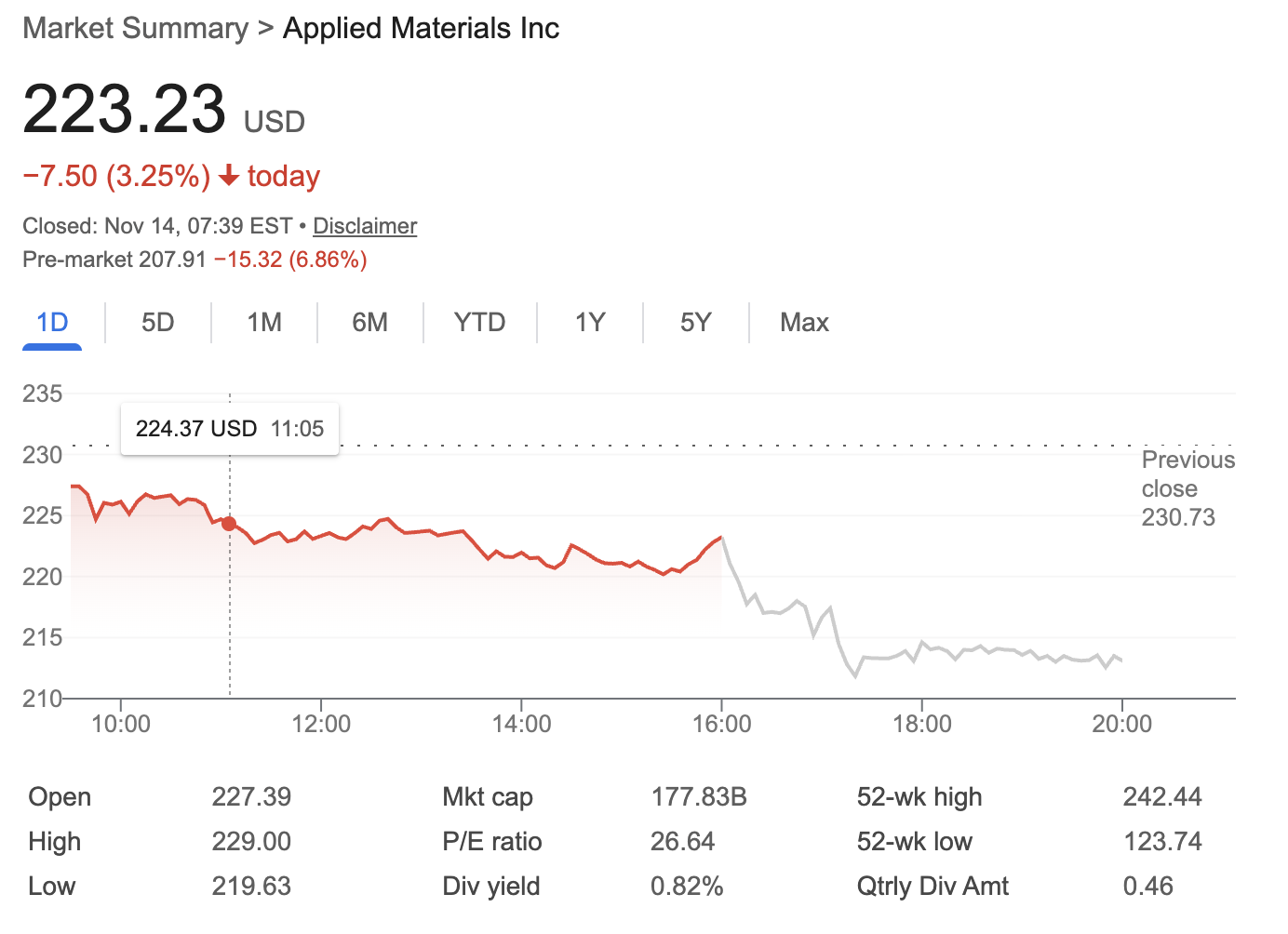

Source: Google Finance

Current Stock Price and Performance

As of early June 2025, AMAT trades around $223 per share, following strong earnings beats throughout the past fiscal year. Despite these financial successes, AMAT's stock suffered occasional sharp declines—most notably, a 4% slide immediately after its Q4 2024 earnings, even though both revenue and earnings per share (EPS) beat market expectations.

Why does this happen? It’s because investors are looking past current numbers to long-term challenges, including tighter US export controls—which have sliced AMAT’s China sales by nearly half—and caution about how much the AI boom will benefit traditional chip-equipment makers.

Why the AI Boom Isn’t Sending AMAT Stock to the Moon

The past two years have seen an “AI investment frenzy” as tech giants pour money into building data centers and training AI models. You might assume every company involved in the chipmaking chain is riding this wave to new highs.

However, AMAT's experience reveals a counterintuitive reality:

1. Industry Leader, But Still a “Cyclical Stock”

AMAT is virtually irreplaceable in the short term within the semiconductor equipment industry. Its technology and scale are unrivaled, making it both scarce and stable among global suppliers.

But—crucially—for all its strength, AMAT is still a cyclical stock. Its fortunes rise and fall along with the spending cycles of big chip manufacturers (such as wafer fabs and memory plants). When those manufacturers are in an expansion phase, AMAT’s sales and profits surge. But in mature or slow periods of the chip industry cycle, AMAT's performance tends to quiet down or flatline.

2. AI Demand Has Limits for Equipment Investments

The core business question is: Does the AI boom drive a big upturn in capital expenditures at AMAT’s major customers?

In reality, the new wave of AI chips is often produced on the same manufacturing lines originally used for mobile phone or consumer chips. Thanks to this “capacity reuse,” global wafer fabs do not need to invest as heavily in new production lines or equipment as one might expect. Instead, they’re repurposing existing infrastructure to meet most of the early AI-driven demand.

That means the overall increase in capex (capital expenditures) by fabs—where AMAT gets its revenue—is less dramatic than headline AI news would suggest.

3. Regulatory Risks and Geopolitical Limits

Recent years have seen the US tighten restrictions on exporting advanced semiconductor equipment to China. For AMAT, this market had previously made up close to 40% of sales; now, it’s in the mid-20% range. This has become a significant headwind, regardless of broader global semiconductor growth.

Looking Forward: Investor Considerations

Near-term:

-

AMAT will likely maintain its leading position, thanks to technological barriers and global demand for advanced processes (2nm and below, new packaging, etc.).

-

Cyclical factors remain dominant: When the chip industry expands, AMAT gains; when capex slows, so does AMAT’s momentum.

Long-term:

-

While AI brings incremental opportunities (especially as next-gen chip architectures roll out and demand exceeds the capabilities of current lines), investors should not expect endless exponential growth.

-

AMAT, as a “tools and equipment” leader, is essential but is not a pure-play beneficiary of the AI revolution; it depends on industry capex cycles, not simply on how hot the AI narrative runs in the media.

Conclusion

Applied Materials (AMAT) is a stable, dominant player—its technology is critical, and its market position is robust. But as an investor in 2025, it’s important to remember:

-

AMAT is a top-tier cyclical stock, not a growth stock untethered from industry cycles.

-

The AI boom helps, but due to existing capacity reuse and regulatory hurdles, it hasn’t sparked a dramatic, sector-wide upturn in AMAT’s equipment sales… yet.

-

Long-term value depends on monitoring semiconductor investment cycles, not just AI headlines.

For investors seeking long-term stability in the semiconductor supply chain, AMAT remains a worthy consideration, but expect its performance to ebb and flow with the broader industry cycle—not to mirror the meteoric rise of pure AI hardware or software companies.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.