Bitcoin long-term holders account for 69.2%, on-chain signals indicate that the top of the bull market is gradually approaching

CryptoChan2024/12/27 07:21

By:CryptoChan

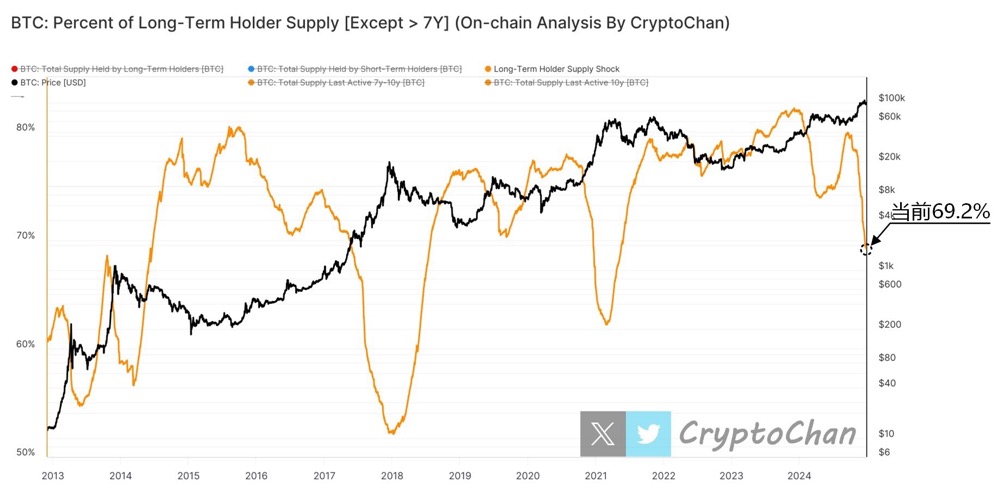

According to the latest data from on-chain analyst CryptoChan, long-term

Bitcoin holders (excluding addresses that have held coins for more than 7 years) currently hold 69.2% of their chips. Historically, this proportion usually drops to between 57% and 62% at the top of the bull market (see Figure 1), indicating that the market is gradually entering the later stage of the bull market.

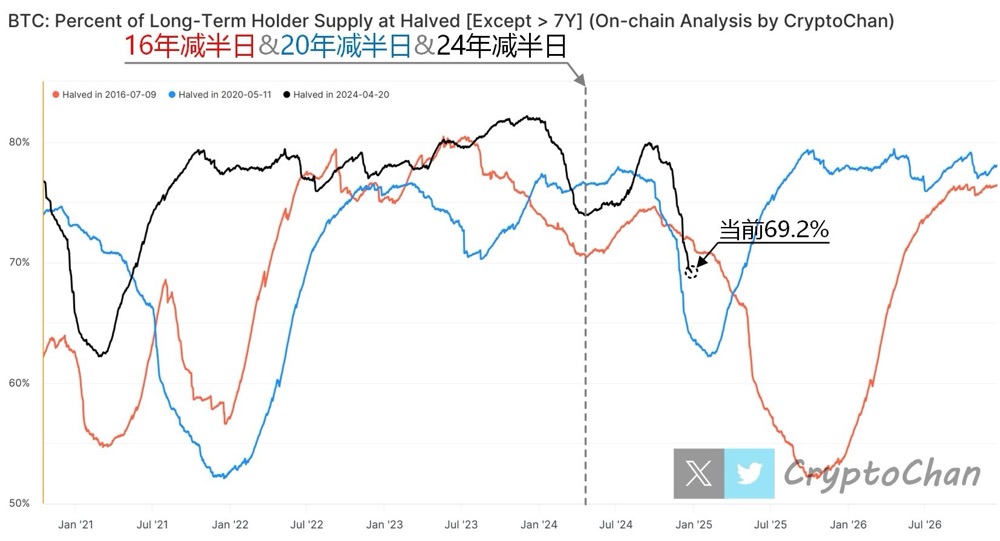

Combining with the analysis in Figure 2, the data shows the key pattern during the halving cycle by comparing the changes in the long-term holder's chip proportion during the halving cycles of 2016, 2020, and 2024: during the price rise stage after each halving, the chip proportion of long-term holders gradually decreases as the market heat rises, and reaches a cyclical low point during the bull market peak stage. This trend shows that the Bitcoin market is gradually approaching the top area.

The current long-term holder ratio of 69.2% is highly consistent with the historical law of the halving cycle. If the proportion continues to decline to the historical top range (57% -62%) in the future, the market may be approaching the peak stage of this bull market. For investors, this is an important risk warning, but it also means that they need to carefully weigh their position strategies, grasp the market rhythm to reduce the risks brought by potential fluctuations.

3

13

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Algeria Implements Full Ban on Cryptocurrencies

Coinspaidmedia•2025/08/05 23:50

Japan’s FinTech Sector Could Triple by 2033

Coinspaidmedia•2025/08/05 23:50

Ethena USDe Stablecoin Sees Significant Market Cap Surge

Coinlive•2025/08/05 23:45

Acting CFTC Chair Initiates Crypto Spot Trading on DCMs

Coinlive•2025/08/05 23:45