Celestia (TIA) Approaches Key Support with Eyes on $5 Target

- TIA hovers near $2.72 support, signaling potential for bullish reversal soon

- MACD crossover and RSI neutrality hint at a possible upside move for TIA

- Outflows slowing as TIA eyes $4 breakout to confirm bullish recovery structure

As the cryptocurrency market continues to recalibrate, several altcoins are showing signs of stabilizing around key support zones as per Michaël van de Poppe, an analyst. Celestia (TIA) is drawing attention among analysts and investors as it tests a critical support level near $2.72.

The altcoin, which surged close to $10 in December 2023, has seen a steep correction. Yet, this decline has brought it back into a demand zone that previously sparked bullish momentum.

With sentiment around altcoins showing early signs of improvement, TIA is positioning itself as a candidate for recovery, especially if broader market conditions stabilize. Analysts see this pullback as a healthy retest of support, a setup that often precedes fresh upward momentum.

#Altcoins providing a nice opportunity as they are looking for tests of support.$TIA is one of those examples, which I think will do well going forward. pic.twitter.com/LhYu7IzFpS

— Michaël van de Poppe (@CryptoMichNL) May 15, 2025

Support Zone Offers Opportunity

The $2.72 level has acted as both resistance and support in the past, creating a “flip zone” that traders watch closely. As of press time, TIA is hovering near $2.78. This price action follows a 10.63% drop in the last 24 hours, despite a 7.31% gain over the past week. Volume remains strong, with over $140 million in trades within the last 24 hours, indicating continued interest.

Importantly, the RSI now reads 48.44, suggesting the asset is neither overbought nor oversold. This neutral positioning often precedes significant price moves.

Meanwhile, the MACD line sits just above the signal line, pointing to emerging bullish momentum, although still near the zero mark. If TIA holds this support and manages to climb back above $4, a push toward the $5.50 region could become feasible.

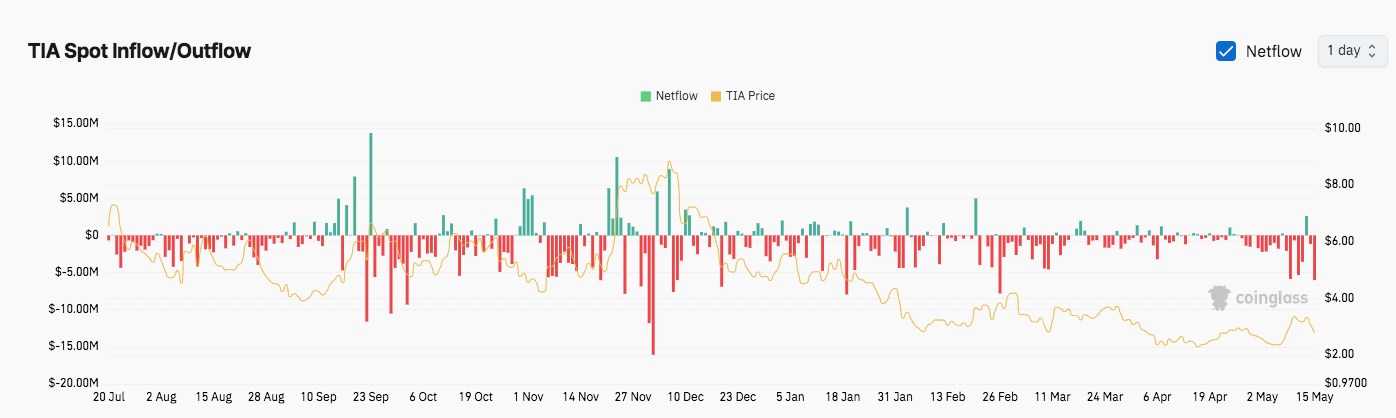

Outflows Hint at Prior Weakness

Since late July, TIA’s spot trading data has shown consistent net outflows. This pattern coincided with significant sell-offs in September and December, reflecting heightened investor caution.

Notably, inflows have been rare and short-lived. However, outflows have eased slightly in recent weeks. This shift could suggest that selling pressure is beginning to taper off.

Related: Celestia (TIA) Price Analysis: Will TIA Break Out or Break Down?

Price levels at $2 and $4 remain key. The lower range offers strong support, while $4 now acts as the immediate resistance. Sustained inflows and improving sentiment could spark a trend reversal. A break above $4 would validate bullish structure and open the path to higher targets.

2025 Outlook Remains Bullish

Despite current volatility, market predictions remain optimistic. Coincodex analysts forecast TIA trading between $5.08 and $5.88 by December 2025.

Related: Celestia (TIA) Price Prediction 2025-2030: Future Outlook Based on Market Trends and Technical Analysis

This would mark an increase of nearly 96% from current prices. If realized, investors could see gains exceeding 100%.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoins Enter Production Era as Institutions Prioritize Growth Over Cost

Stablecoins are quickly moving from pilot projects to a core part of global payment systems, according to Fireblocks’ newly released “State of Stablecoins 2025” report. The digital asset platform revealed that stablecoin transactions on its network now reach $40 billion per quarter, reflecting surging institutional use and a clear shift from experimentation to full-scale implementation.

Bitcoin Options Expiration May Signal Volatility Amid Recent US Inflation Data