Fed Officials Divided on Tariff Impact and Urgency of Rate Cuts

In its new economic forecast released this week, the Federal Reserve expects economic growth to slow and inflation to rise. However, policymakers still anticipate rate cuts later this year—indicating that while they do believe tariffs will drive prices higher, the effect will not be lasting. There is significant disagreement: among the 19 officials, seven believe no rate cuts are needed this year, while eight expect two cuts, which aligns with investors’ expectations for 25-basis-point cuts at the Fed’s September and December meetings. Another two officials project one cut, and two foresee three cuts. After the decision, Fed Governor Waller and Fed’s Barkin shared their views on interest rates, with the former suggesting a possible rate cut as early as July, and the latter indicating no rush to cut. Although neither Waller nor Barkin specified their exact stance on rates, their comments represent two extremes regarding how much Trump’s tariffs will affect prices, employment, and economic growth in the coming months.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MistTrack: Beware of Malicious Google Ad Phishing Scams

Everbright Securities: Stablecoins Drive Surge in Global RMB Payment Activity

Japan’s MUFG Bank Acquires Osaka Skyscraper, Set to Launch Real Estate Tokenization Products

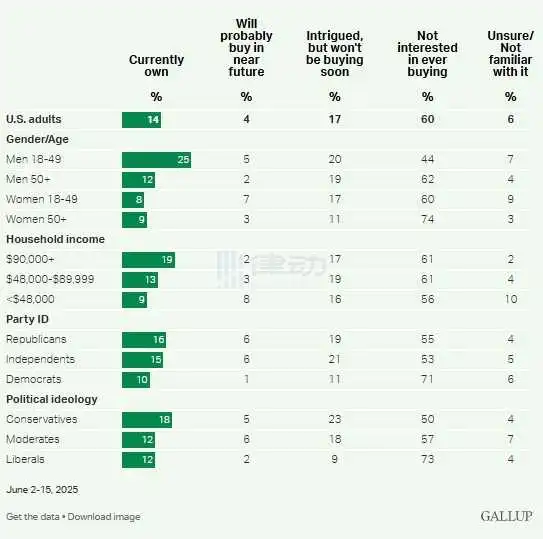

Gallup Survey: 14% of U.S. Adults Own Cryptocurrency, 60% Have No Intention to Buy