Litecoin Price Eyeing Ultra Bullish Breakout As Whale Interests Peak

The long-term prospects of the Litecoin price are in the spotlight amid a significant development tied to MEI Pharma and general market whales.

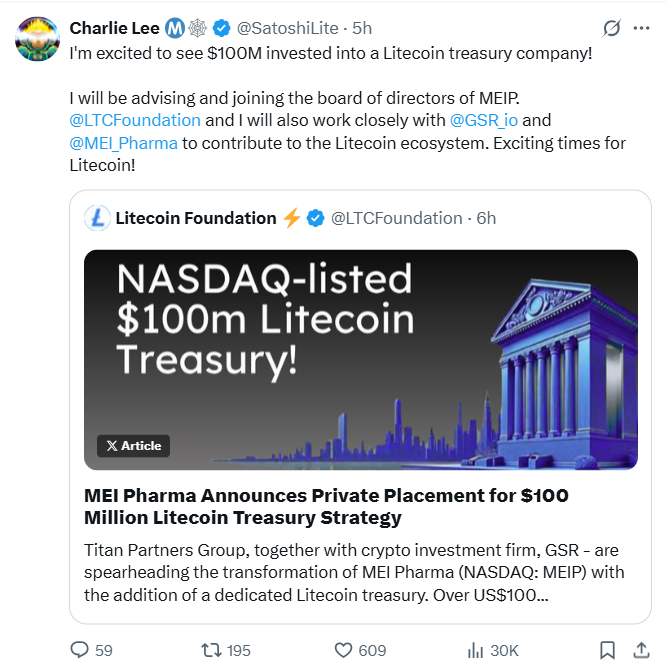

Notably, the Nasdaq-listed firm has announced plans to add Litecoin to its corporate treasury.

The company has set aside $100 million for this new strategy with Titan Partners Group and crypto investment firm GSR backing the move.

Notably, as part of the plan, Litecoin creator Charlie Lee joined MEI Pharma’s Board of Directors.

MEI Pharma Adds Litecoin to Its Treasury Reserve

Litecoin made headlines this week after MEI Pharma, a publicly listed pharmaceutical firm, announced the creation of a $100 million LTC treasury.

The move was announced on July 18 and received support from Titan Partners Group and the crypto investment firm GSR.

According to the announcement, the Treasury Reserve had already received over $100 million in commitments.

The Litecoin Foundation, a nonprofit organization that supports the growth and adoption of LTC, has also joined the initiative as an investor.

This marked the first time Litecoin had been used in a corporate treasury of this scale.

In comparison, other top altcoins, such as Ethereum and XRP, are integrated into various corporate treasuries.

The company stated that the decision aligns with the broader strategy of increasing the role of cryptocurrency in institutional finance.

As part of the new strategy, MEI Pharma appointed Litecoin creator Charlie Lee to its Board of Directors.

Lee has been closely involved in the development of Litecoin since launching it in 2011. His new role suggested a more hands-on approach to how Litecoin could function within a company’s financial structure.

Lee noted that Litecoin has been active for over a decade, offering low-cost and accessible transactions to users worldwide.

Furthermore, he noted that this digital asset is already being used for payments, remittances, and retail. Consequently, bringing Litecoin into a corporate environment was a logical next step.

Charlie Lee Joins the Board After Investor Roadshow

It is worth mentioning that shortly after the treasury announcement, Charlie Lee shared some behind-the-scenes details from his investor meetings.

In a social media post, he stated that he had held 40 meetings over three days to present Litecoin’s potential to investors.

Some meetings began as early as 5 a.m., showing the level of interest from the East Coast financial sector.

It is essential to note that Lee has long been regarded as a central figure in the cryptocurrency space.

Over the years, he has advocated for improvements within the Litecoin network, including the addition of privacy features and upgrades such as SegWit.

He has also contributed to the broader ecosystem by supporting development labs, mining operations, and infrastructure for both Litecoin and Bitcoin.

His addition to MEI Pharma’s board suggested that the company plans to take a serious approach to managing its digital assets.

Litecoin Price and $120 Ambition

As of the time of writing this publication, the Litecoin price was trading around $101, down nearly 6% for the day.

It held above key support levels, including the 50-day, 100-day, and 200-day exponential moving averages, which were all between $90 and $92.

Analysts noted a potential golden cross between the 50-day and 100-day EMAs, which could signal further upward movement.

Trading volume reached $1.47 million, and technical indicators, such as the MACD, continued to support a bullish case.

However, the Relative Strength Index was pegged at 74, which placed it in overbought territory.

More importantly, that suggested some caution, with the chance of a pullback toward $90 if profit-taking begins.

Still, eyes remain on whether Litecoin price can push past the $120 price zone in the long term as institutional interest and whale embrace have started picking up momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

President Trump Recognizes Cryptocurrency’s Growth Over Stocks

Thumzup Media Goes on a Cryptocurrency Shopping Spree

In Brief Thumzup Media Corporation diversifies with a $250 million cryptocurrency investment plan. The company aims to minimize single-asset risk and leverage U.S. regulatory progress. Donald Trump Jr.'s investment has heightened attention and potential market impacts.

Bitcoin Treasury Strategies Intensify Amid Regulatory Changes

Massive 4.8 Trillion SHIB Trade Fuels Bullish Momentum for Shiba Inu