Analyst: Most ETH holders are not satisfied with current price gains, and new buyers can absorb selling pressure by maintaining active purchases

BlockBeats News, July 27 — On-chain data analyst Murphy posted on social media that since July 20, the activity of “new buyers” of ETH has been very strong, indicating robust demand for ETH from new capital. Long-term holders (aggressive buyers) have also continued to accumulate ETH to some extent even as its price has been moving sideways. Meanwhile, there are not many profit-taking sellers, suggesting that most holders with unrealized gains are not satisfied with ETH’s current price, reflecting strong holding confidence.

Looking at ETH’s on-chain activity data, the number of transactions is already approaching the historical peak seen in May 2021, and the total transfer amount (in USD value) is also rising rapidly. Although ETH’s price remains below December 2024 levels (around $4,000), the on-chain transfer amount has already surpassed that period. The number of transactions represents on-chain activity, while the increase in transfer amounts indicates that more large-scale capital is actively participating.

Murphy noted that, according to Ethereum 2.0 staking data, nearly 700,000 staked ETH are currently queued for withdrawal, which means the process of shifting ETH holdings from old OGs to new institutions is about to accelerate in this cycle. However, as long as demand from “new buyers” remains strong and active, the market should be able to absorb any temporary oversupply from these tokens.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

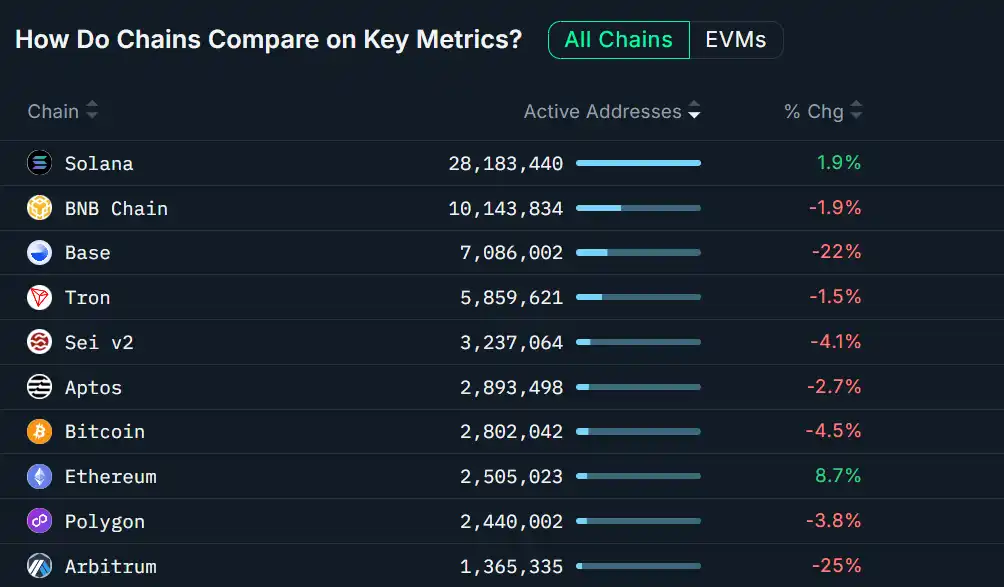

Public Blockchain Activity Rankings for the Past 7 Days: Solana Remains on Top, Ethereum Leads in Growth

Decentralized Prover Network Succinct Announces the Establishment of a Foundation