Ethereum (ETH) Price Prediction for July 28, 2025: ETH Blasts Past $3,900 As Bulls Eye $4,089 Liquidity Zone

After a near-vertical breakout from the $2,800 range earlier this month, Ethereum price today is consolidating near the $3,900 mark. This sits just below a critical multi-year resistance zone, with Smart Money Concepts showing ETH pushing into a high-liquidity structure that had historically triggered profit-taking. With derivative metrics flashing bullish and price action climbing along an ascending channel, traders are awaiting confirmation of the next move.

What’s Happened With Ethereum’s Price?

The daily chart showed Ethereum price piercing above its multi-month downtrend resistance in mid-July, with price now targeting the 2024 swing high near $4,089. ETH cleared all major supply zones up to this level, confirming a bullish market structure flip. A clean breakout from the compression structure between $2,400 and $2,800 triggered this vertical rally.

On the weekly timeframe, ETH is pressing into a red Smart Money liquidity zone between $3,890 and $4,200. This region acted as distribution territory during the April and May 2024 peaks and represents the final resistance before a potential run toward $4,500 and $4,800. A close above $4,089 would mark a macro BOS and open up a fresh leg higher.

Why Is The Ethereum Price Going Up Today?

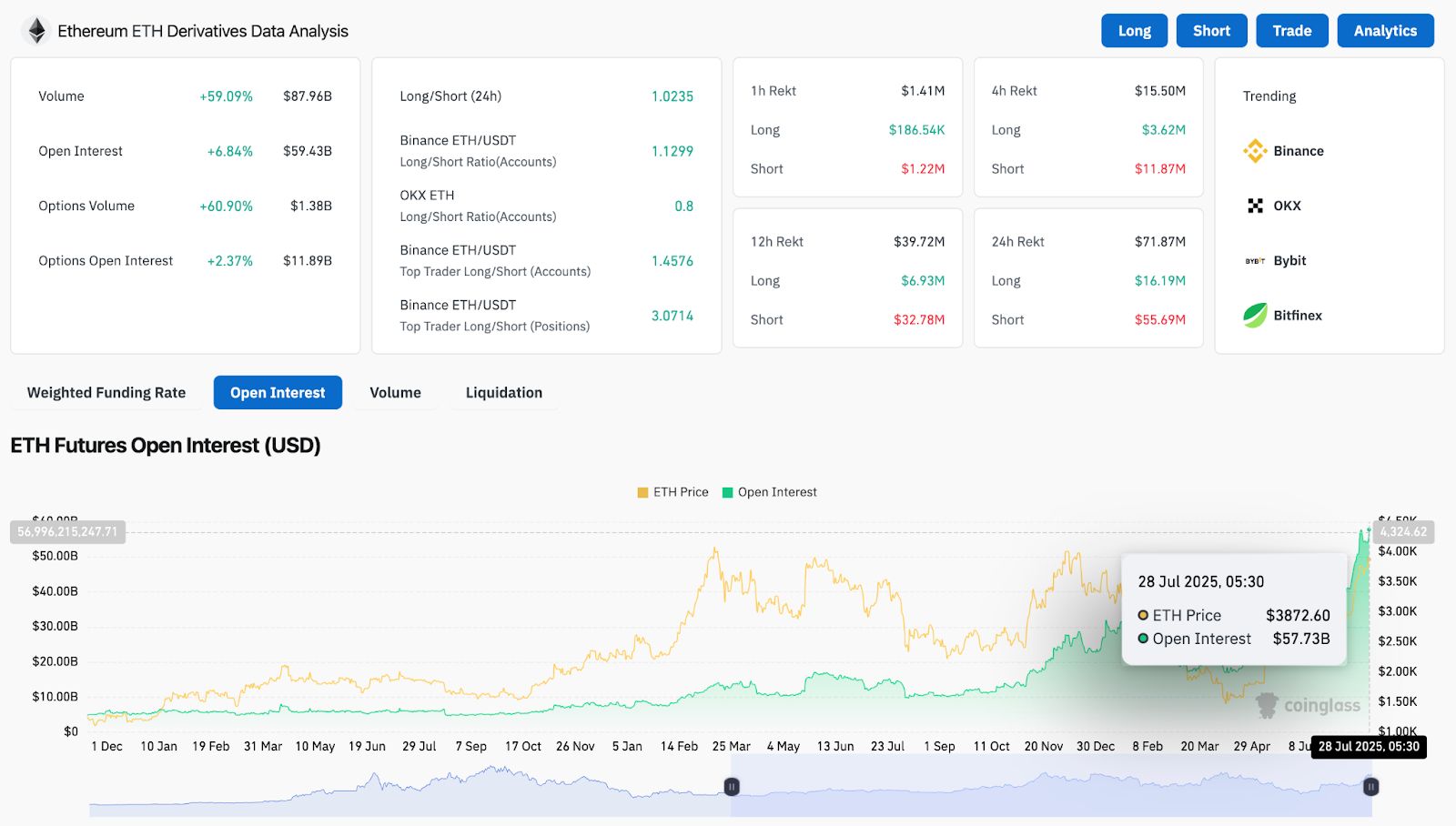

Why Ethereum price going up today is tied to a combination of technical breakout strength and heavy derivatives flow. Coinglass data showed a 59.1 percent surge in ETH trading volume over the past 24 hours, with open interest climbing 6.84 percent to $59.43 billion. Binance’s top trader long to short ratio reached 3.07, showing significant institutional positioning.

The 4-hour chart reflected strong trend momentum, with candles climbing along the upper Bollinger Band near $3,920. Price remained firmly above the EMA 20, 50, 100, and 200 cluster, which now acts as a multi-layered support base between $3,475 and $3,781.

The Supertrend flipped bullish on July 9 and continued to trail price action tightly, currently sitting at $3,701. Directional Movement Index showed the +DI at 25.3 leading over -DI at 11.5, while ADX was rising. This confirmed the growing trend strength.

Channel Structure and RSI Signal Healthy Trend Extension

On the 30-minute chart, ETH respected an ascending channel that had guided price since July 24. Price was riding the median line, with VWAP support holding around $3,883 and RSI cooling from 66 to 62, avoiding overbought territory. This gradual slope indicated controlled, low-volatility trend continuation rather than euphoric exhaustion.

Bollinger Bands expanded again on the 4-hour chart, and price was pressing against the upper band at $3,920. If this band breaks, volatility expansion could drive ETH toward $4,050. However, traders needed to remain cautious of the long-term red zone between $4,000 and $4,200, which previously triggered a cascade of sell-offs.

ETH Price Prediction: Short-Term Outlook (24H)

Ethereum price remained structurally bullish, but momentum could temporarily slow as price tested the $3,920 to $4,089 liquidity ceiling. A clean breakout above $4,089 would have signaled continuation toward $4,300 and $4,500. These levels currently showed no immediate supply zones.

If ETH failed to break above $4,000 with volume, a healthy pullback toward $3,754 (lower Bollinger Band) and $3,680 (EMA50) was likely. These levels aligned with the prior breakout zone and offered re-entry potential for bulls.

As long as ETH held above the $3,680 to $3,754 support band, the uptrend remained intact. Volume and VWAP needed to be monitored closely to assess whether accumulation was still in play or if profit-taking began near the $4,000 mark.

Ethereum Price Forecast Table: July 28, 2025

| Indicator/Zone | Level / Signal |

| Ethereum price today | $3,903 |

| Resistance 1 | $4,089 |

| Resistance 2 | $4,300 |

| Support 1 | $3,754 |

| Support 2 | $3,680 |

| EMA Cluster (20/50/100/200) | $3,781 to $3,177 (Bullish stack) |

| RSI (30-min) | 62.00 (Cooling from overbought) |

| Bollinger Bands (4H) | Upper Band $3,920 (Volatile) |

| VWAP (30-min) | $3,883 (Session support) |

| DMI (+DI vs -DI) | +DI: 25.3, -DI: 11.5 (Bullish) |

| Supertrend (4H) | Bullish above $3,701 |

| Open Interest | $59.43B (+6.84 percent) |

| Volume (24H) | +59.09 percent, $87.96B |

| Binance Top Trader Ratio | 3.07 (Long-heavy positioning) |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ECB senior official warned that U.S. dollar stablecoins threaten local monetary policy control

Share link:In this post: The ECB has warned that stablecoins could weaken the eurozone’s monetary sovereignty. Jürgen Schaaf warns that the collapse of major stablecoins can trigger systemic risks and threaten the stability of the financial system. The ECB considers its digital euro as a necessary defense against private stablecoins.

Vietnam launches NDAChain as national blockchain to power digital economy

US-EU Tariff Deal Influences Crypto Market Dynamics

Bitcoin Hashrate Reaches New Record Amid Market Activity