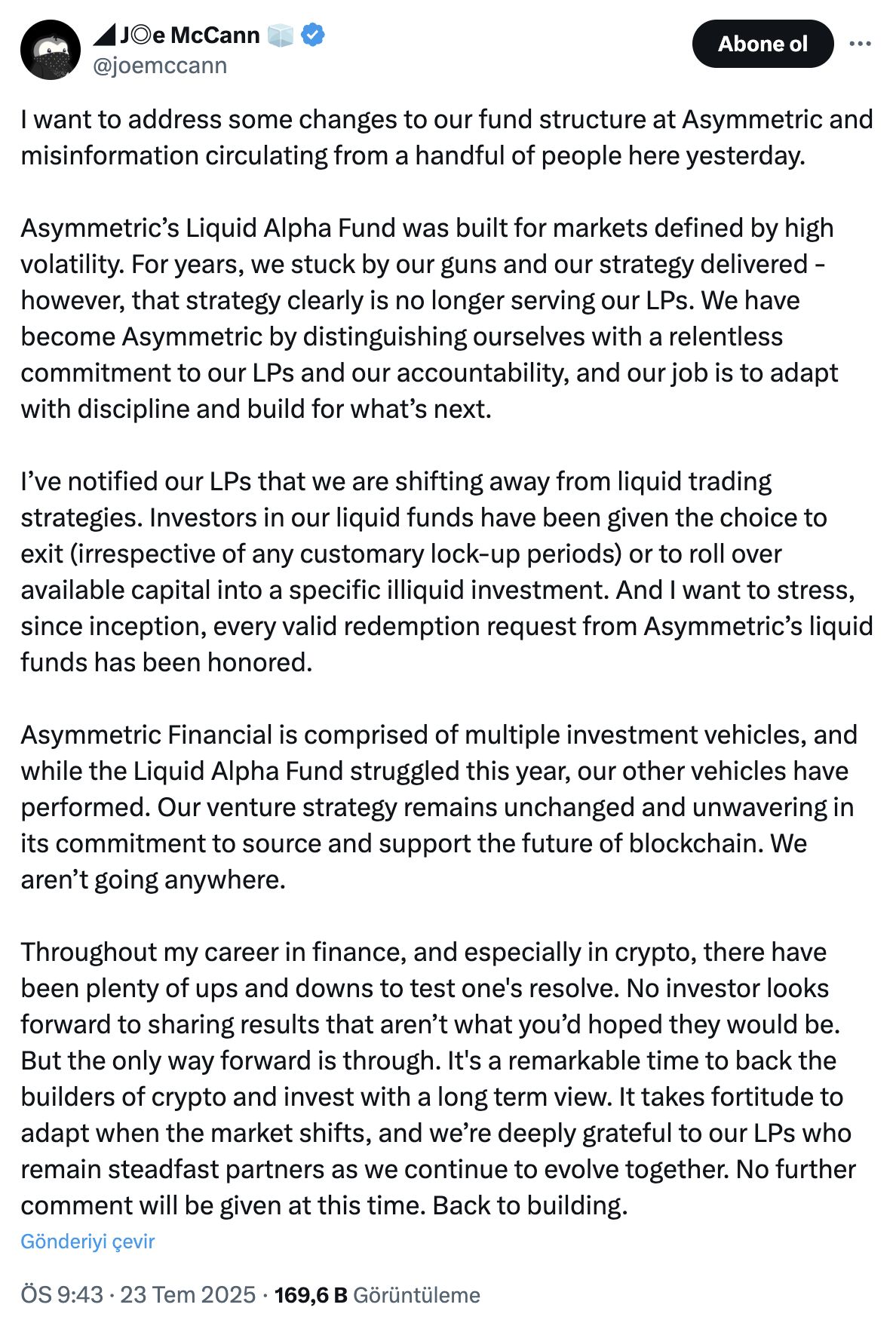

The closure of Asymmetric Capital’s Liquid Alpha Fund marks a crucial moment in the financial markets, highlighting the plight of liquidity-focused crypto funds even during dynamic market rallies. As the fund depreciated by 78% since the beginning of the year, questions emerge about the resilience of such funds. While Bitcoin $117,818 experienced a 28% rise in the same period, many funds with altcoin portfolios suffered losses. Joe McCann, the fund’s founder, noted that strategies meant for high volatility no longer benefit investors. Market experts attribute these issues to poor asset selection, leverage usage, and inadequate risk management.

Widening Performance Gap in Liquid Crypto Funds

According to Galaxy Digital’s VisionTrack index, funds focused on fundamental strategies were down by 13.7% by the end of June, while the composite index saw a 6.3% decline. Although market-neutral and quantitative strategies showed slight gains, the altcoin market faced a steep average decline of 40% in the first half of the year. Cosmo Jiang of Pantera highlighted that due to contractual obligations, many funds couldn’t hold Bitcoin, rendering comparisons with underperforming altcoins invalid. Balder Romans from Maven 11 mentioned that managers who couldn’t react in time to April’s sharp altcoin crash missed out on the May recovery and July rally.

Arthur Cheong pointed out that Asymmetric’s leveraged, memecoin-heavy positions, along with its options strategy, exacerbated the losses. Ryan Watkins observed some funds sold during declines and were late to reinvest, opting for the wrong coins. Lex Sokolin from Generative Ventures noted that while institutional interest supported Bitcoin and Ethereum $3,778 prices, similar growth in blockchain activity was missing, failing to boost smaller market-cap coins. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Pivoting Towards Fundamentally Strong Coins

Rajiv Patel‑O’Connor from Framework Ventures commented on the surprise transition from speculative memecoins to fundamentally oriented investment strategies, leaving non-revenue-generating coins stagnant. Rob Hadick of Dragonfly predicted that while low-quality coins with wide exchange distribution might rise short-term, fundamentally strong projects will stand out in the long run.

Patel‑O’Connor emphasized, “Coins must generate revenue,” as Thomas Klocanas from Strobe Ventures noted rising interest in protocols enabling fee switches or buybacks. Bomans stressed that rapid reflex, disciplined positioning, and effective liquidity and risk management are now as crucial to investment success as analytical insights.