Credit Protocol Grove Expands to Avalanche Network, Plans $250 Million Investment in Tokenized Credit Products

Foresight News reports, according to Coindesk, that Grove, the credit protocol within the Sky ecosystem (formerly the MakerDAO ecosystem), has announced its expansion to the Avalanche blockchain network and plans to allocate up to $250 million to tokenized credit products. According to the announcement, Grove will invest in the Anemoy AAA-rated CLO fund (JAAA) issued by Janus Henderson through the blockchain tokenization platform Centrifuge. Centrifuge will also launch the Janus Henderson Anemoy Treasury Fund (JTRSY), which is backed by U.S. Treasury bonds.

The Grove team includes former members from Deloitte, Citi, and BlockTower, who previously helped MakerDAO expand into the tokenized Treasury market. The protocol plans to replicate this model in the structured credit sector, providing programmable access to a multi-trillion-dollar market for both crypto-native and traditional investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Glassnode: Ethereum Perpetual Futures Open Interest Ratio Hits Nearly Two-Year High

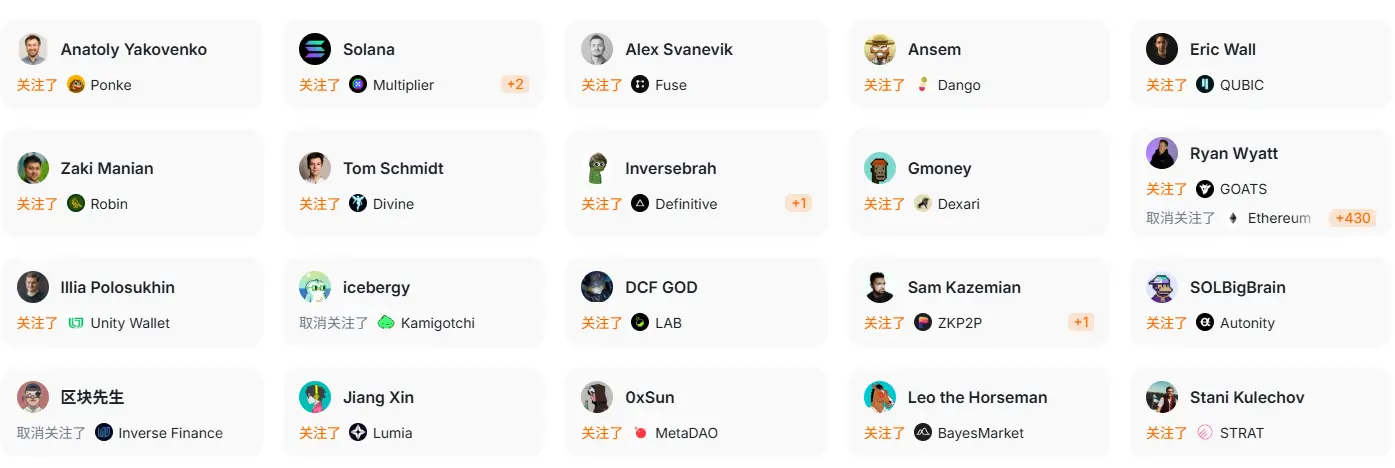

Data: In the past 24 hours, top investors have focused on projects such as Dexari, Spellborne, and Fuse

A major whale withdraws 3,500 BTC worth approximately $409 million from an exchange

CoinShares launches zero-fee SEI ETP in Europe, offering 2% staking yield