BitMEX co-founder Arthur Hayes has predicted that Bitcoin will “test” $100,000 and Ethereum will drop to $3,000, just hours after unloading over $13 million worth of crypto assets, according to on-chain data.

His market outlook, tied to worsening macroeconomic indicators and a potential U.S. tariff bill, has sparked conversation across the industry ahead of his scheduled keynote at WebX Asia in Tokyo later this month.

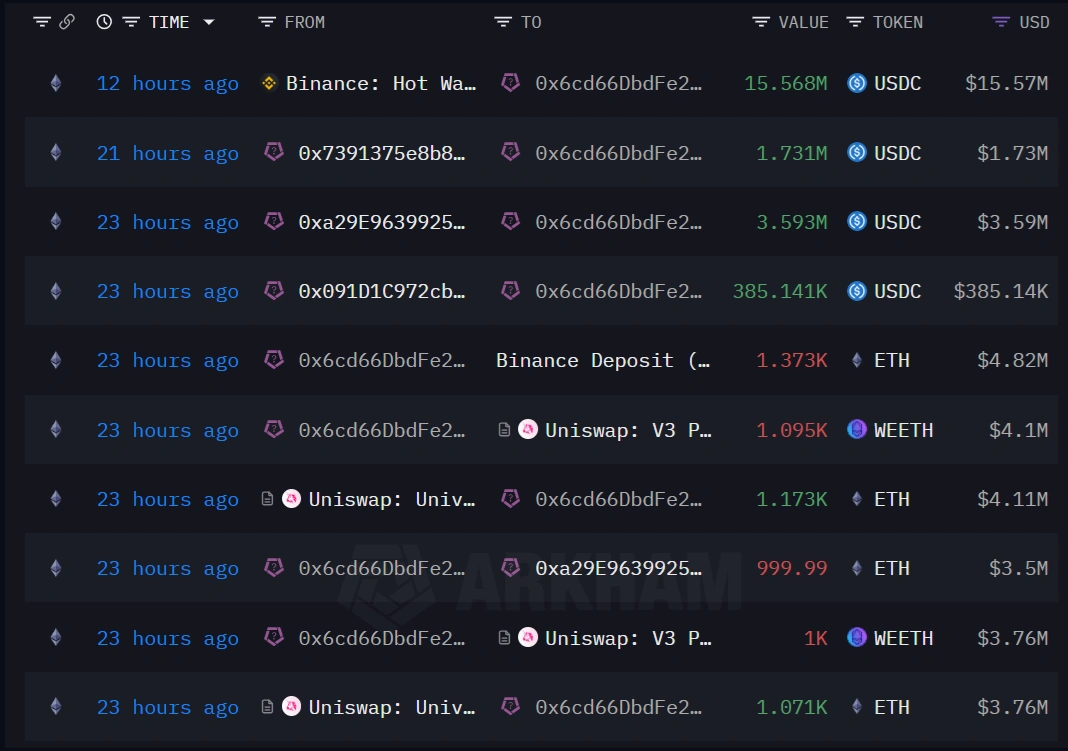

The move came to light after Lookonchain, an on-chain analytics platform, posted on X that Hayes had sold large quantities of Ether (ETH), Ethena (ENA), and PEPE tokens in a short window. The transactions, executed within six hours, sent clear signals of a major repositioning by one of the most closely followed voices in the crypto space.

Arthur Hayes’ transfer history. Source: Arkham Intelligence

Arthur Hayes’ transfer history. Source: Arkham Intelligence

Hayes explains his bearish sentiment on the macro picture

In a follow-up post on his personal X account , Hayes addressed speculation about the liquidation. “US Tariff bill coming due in 3Q … at least the market believes that after NFP print. No major economy is creating enough credit fast enough to boost nominal GDP. So $BTC tests $100k, $ETH tests $3k,” he wrote.

The reference to the U.S. Non-Farm Payroll (NFP) report, which showed a sharp slowdown in job creation, with only 73,000 new jobs added in July. Hayes points to those underwhelming numbers as the reason for his concerns around waning economic momentum.

In his view, the combination of weak labor market data and the expiration of U.S. tariff suspensions in Q3 signals a slowdown in credit creation that will weigh heavily on nominal GDP growth. Hayes argues that in such an environment, speculative assets like crypto will face significant pressure.

Sell-off spurs market speculation

In total, Lookonchain estimates Hayes sold 2,373 ETH, worth about $8.3 million, 7.76 million ENA valued at $4.6 million, and 38.86 billion PEPE, worth approximately $414,000. The speed and size of the transactions were seen as noteworthy, especially given the relatively low liquidity in altcoins like ENA and PEPE.

However, not everyone believes the sales signal panic. Some analysts argue that the BitMEX co-founder is simply capitalizing on recent price rallies while preparing for potential downside risk amid macro turbulence.

Hayes has promised to unpack his outlook in full during a keynote address at WebX Asia in Tokyo on August 25, one of the most anticipated conferences in the Asian crypto calendar.

The timing of Hayes’ market commentary is also crucial. Should the BitMEX co-founder’s macro predictions prove correct, traders may see a major correction before fresh capital enters the space, particularly from institutional investors.

For now, his forecast points to the growing influence of macroeconomic policy on digital asset markets.

Get seen where it counts. Advertise in Cryptopolitan Research and reach crypto’s sharpest investors and builders.