Bitcoin’s September Correction Warning by Analysts

- Bitcoin expected to move sideways before a correction in September.

- Experts predict significant short-term volatility for BTC.

- Long-term bullish sentiment persists among key analysts.

Bitcoin may face a significant price correction in September, according to analysts, following a cycle of summer rallies seen in previous years.

Nascent consolidation supports caution among investors, as historical patterns and institutional insights suggest looming volatility, potentially impacting BTC and related cryptocurrency markets.

Bitcoin’s price action has been notably sideways, with analysts stating that a painful correction might be imminent in September. This prediction stems from observing historical trends and market influences.

Key figures, including analyst Benjamin Cowen, highlight the similarity with previous post-halving cycles, where a summer rally is often followed by a September drop.

Bitcoin’s post-halving cycle often includes July–August rallies, followed by a painful correction in September, before moving into a cycle top in late Q4. – Benjamin Cowen.

Such predictions underline the potential impact on market sentiment, potentially cooling investor enthusiasm. Market structure changes and ETF inflows are partly responsible for this sideways movement.

Experts suggest that an eventual correction might signal a buying opportunity before a Q4 recovery, driven by institutional investments, as noted by Coin Central .

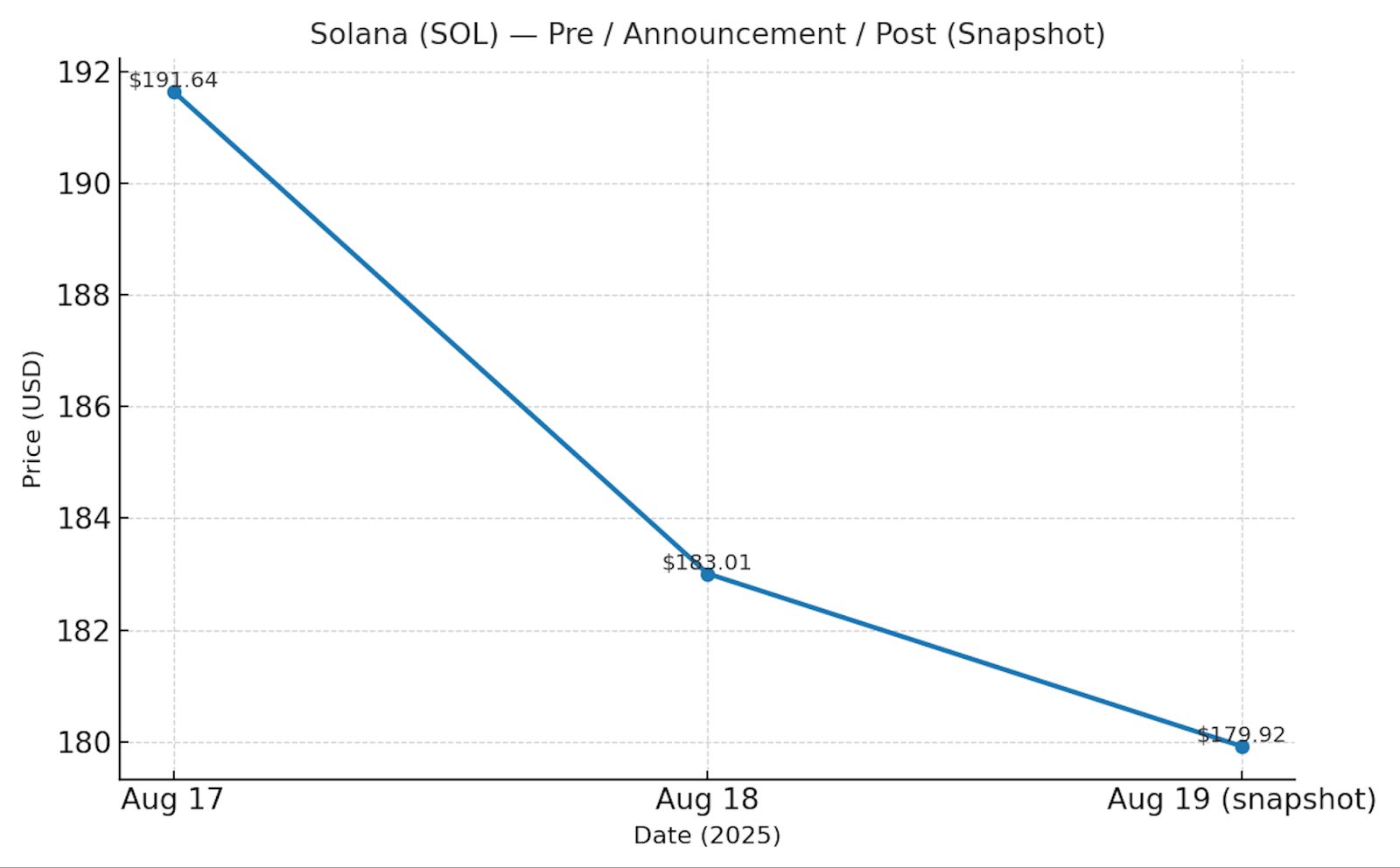

The current setup implies potential volatility for Bitcoin and correlated assets, such as Ethereum and Solana. Analysts emphasize looking for patterns similar to 2013 and 2017, where a September correction preceded a significant Q4 rally, as discussed by Bitcoin Magazine .

Long-term, analysts remain optimistic, anticipating bullish outcomes from ETF approvals and greater market regulation. Such moves could pave the way for a renewed price surge heading into 2025, aligning with expert forecasts shared by Peter Brandt .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SoftBank shares drop 5%, snapping 9-day rally after $2 billion Intel deal

Share link:In this post: SoftBank shares fell over 5% after it announced a $2 billion deal to buy Intel stock at $23 per share. Asian markets dropped across the board as investors waited for the U.S. Fed’s Jackson Hole meeting. Jerome Powell is expected to signal a possible rate cut, with futures showing an 83% chance for September.

Texas judge sides with Logan Paul’s effort to dismiss CryptoZoo lawsuit

Share link:In this post: Judge Ronald Griffing said Logan Paul’s bid to remove a lawsuit over the collapse of CryptoZoo should be allowed. Griffin also urged the class-action plaintiff to update all but one of its 27 claims against Paul, the one linking him to commodity pool fraud. The judge dismissed Paul’s bid to accuse CryptoZoo co-founders of the project’s failure.

XRP & Solana ETF delays spark volatility – Stay or exit before October?

Share link:

Ethereum ETFs supply holdings to exceed BTC ETF’s holdings by September

Share link:In this post: Ethereum ETFs now hold over 6.5M ETH, with projections showing a September flip as they close in on Bitcoin ETFs’ share of the circulating supply. US spot ETH ETFs saw $59M in outflows on August 15 after record weekly inflows of 649,000 ETH pushed totals above $3.7B. Institutional investors dominate Ethereum with 19.2M ETH, while retail holdings fall sharply, highlighting shifting market influence amid price swings near $4,450.