Powell May Introduce Uncertainty Over Rate Cuts at the Jackson Hole Symposium

According to ChainCatcher, citing Jinshi News, Mike Sanders, Head of Fixed Income at Madison Investments, stated that Federal Reserve Chair Jerome Powell may attempt to inject some "uncertainty" into market expectations for rate cuts at this Friday's Jackson Hole Global Central Bank Annual Meeting. Currently, the probability of a Fed rate cut in September, as priced in by the money markets, is as high as 84%. However, Powell is likely to want to temper this confidence in case subsequent data falls short of expectations. Sanders noted that data released between Jackson Hole and the September FOMC meeting could significantly alter the market outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

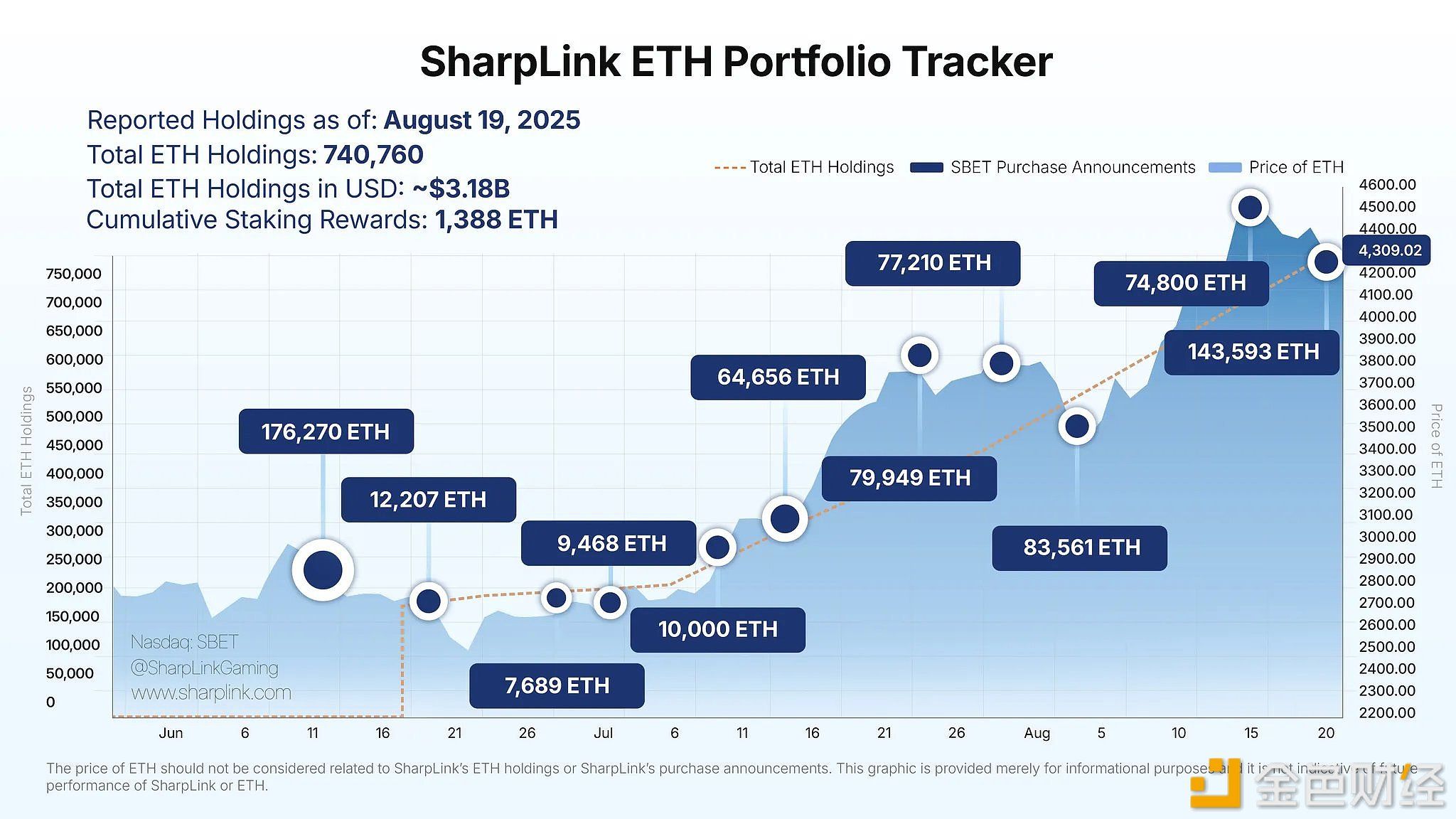

SharpLink holds over 740,000 ETH, with a total value of $3.18 billion

Analysis: Shift in Investor Sentiment Leads to Decline in US Tech Stocks

BTC Surpasses $114,000

Greeks.Live: Market Divided on Whether Bear Market Has Begun, Overall Sentiment Remains Bearish on Short-Term Trends