U.S. stocks fall for a fourth consecutive day as investors question lofty valuations

According to ChainCatcher, citing Jintou, U.S. stocks declined for the fourth consecutive day as investors questioned lofty valuations ahead of a flurry of retail earnings reports and the upcoming central bank symposium. The S&P 500 fell 0.7%, while the Nasdaq dropped more than 1%. Howard Marks, co-chairman of Oaktree Capital Management, stated that stock valuations are expensive relative to fundamentals. Torsten Slok, chief economist at Apollo Management, pointed out that consumer spending is under pressure due to factors such as slowing job growth, the resumption of student loan repayments, and an increase in evictions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

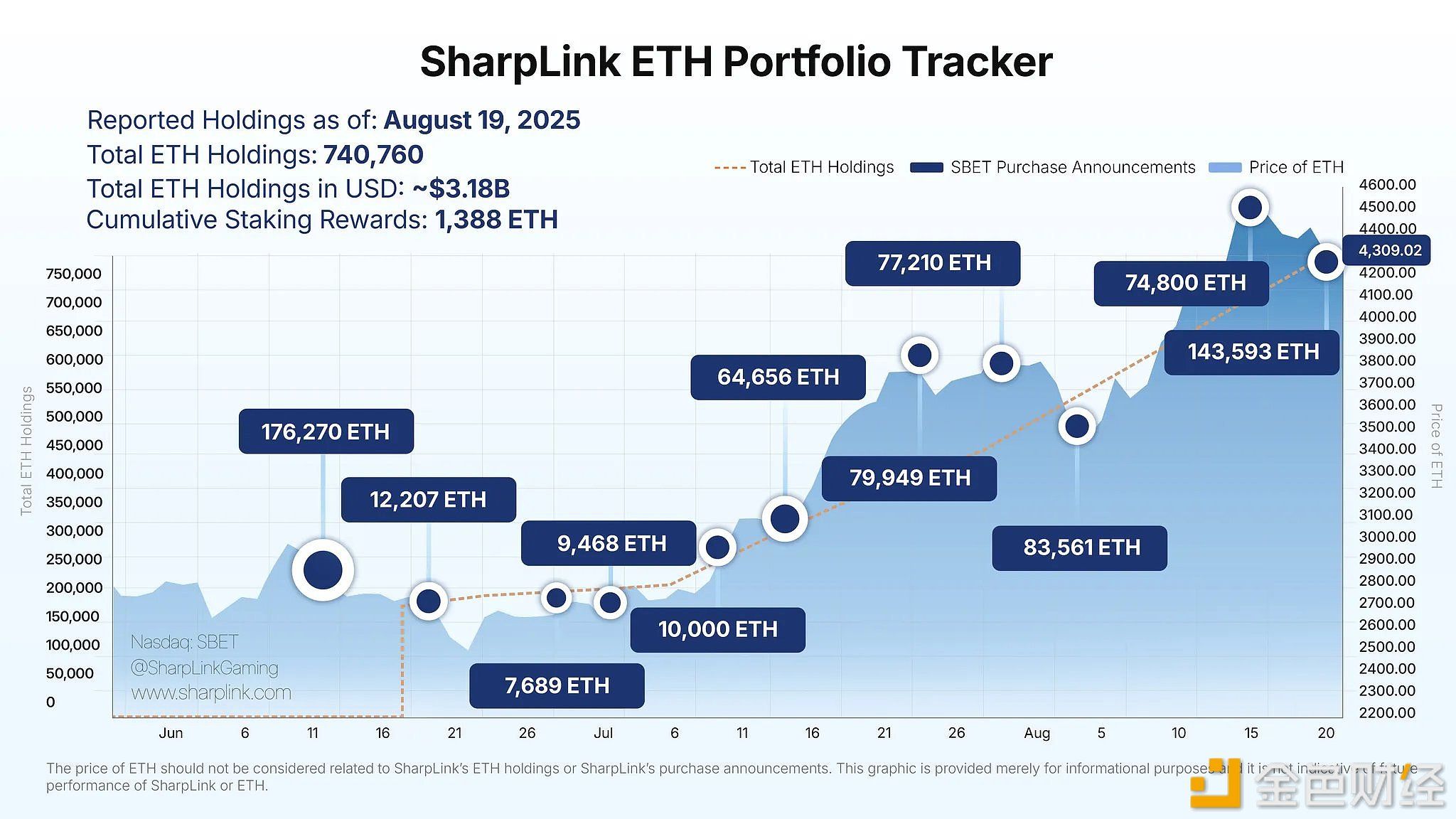

SharpLink holds over 740,000 ETH, with a total value of $3.18 billion

Analysis: Shift in Investor Sentiment Leads to Decline in US Tech Stocks

BTC Surpasses $114,000

Greeks.Live: Market Divided on Whether Bear Market Has Begun, Overall Sentiment Remains Bearish on Short-Term Trends