Bitcoin Realized Cap Surges Amid Price Drop

- Bitcoin’s realized cap increased despite falling spot prices.

- Driven by the movement of older coins.

- Highlighted institutional and market dynamics interplay.

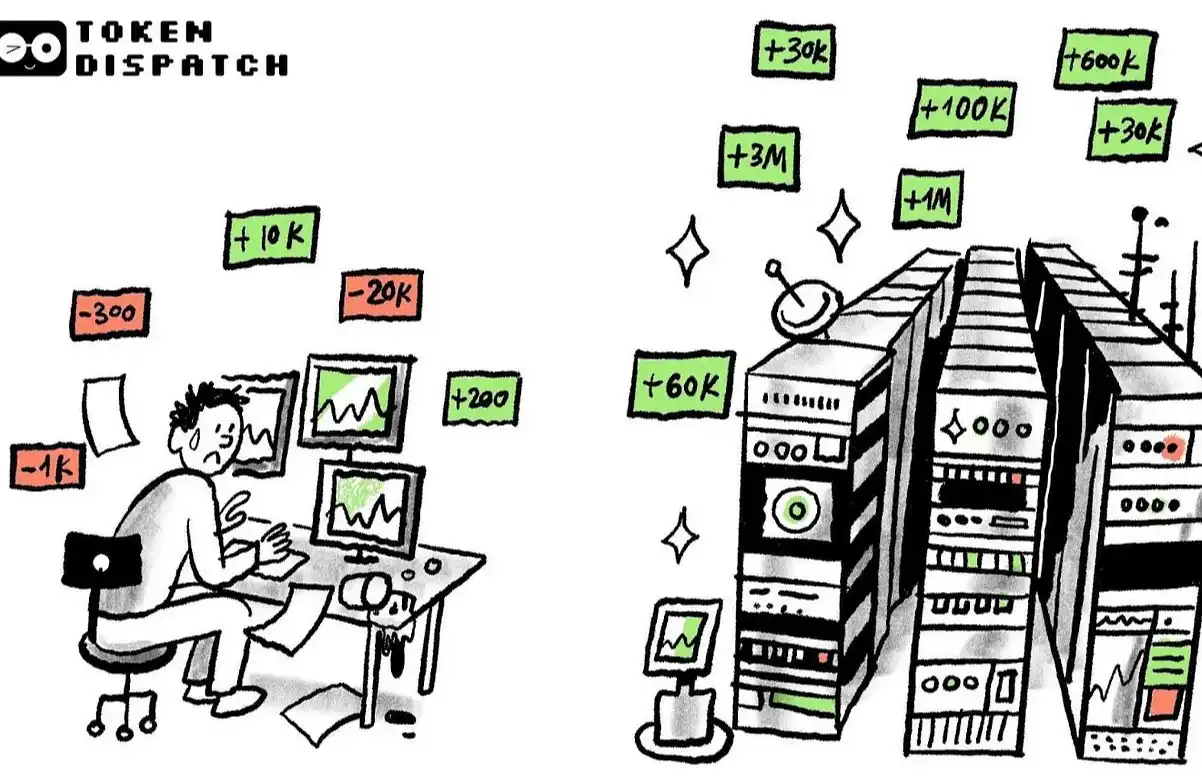

Bitcoin’s realized cap surged by over $1.1 billion amid its price drop to $112,000 due to old, low-basis coins being moved. These actions suggest profit realization or internal wallet movements rather than panic selling.

Bitcoin’s realized cap experienced a notable increase of $1.1 billion even as the cryptocurrency’s price fell to $112,000. The movement of older, low-basis coins sparked this unusual trend, captivating market observers around the globe.

This event sheds light on Bitcoin’s internal dynamics and future price implications, revealing institutional interest and the inherent volatility within the market.

Bitcoin’s realized cap surged as older coins, previously untouched and with low purchase costs, moved on-chain. The cryptocurrency’s spot price experienced a decline from its high of $127,000 to $112,000, rebounding later in the week.

This event involved contributors, traders, and data providers like CryptoQuant and Glassnode but lacked direct commentary from Bitcoin’s core developers. The shift underscores the complex interplay between long-term holders and market sentiments.

“Unusually large movements in older UTXOs have increased realized cap, often reflecting internal wallet activity or profit taking by long-term holders.” — Glassnode Analyst, source

Market reactions included increased futures trading and liquidity stress, showing robust engagement despite price fluctuations. Institutional inflows remain strong, with ETFs welcoming $880 million weekly, emphasizing enduring market confidence in Bitcoin.

Social and financial dynamics are evident as market volatility continues to surge. Industry discussions range between optimistic perspectives of opportunity and caution regarding potential exchanges and institutional strategies influencing prices.

Histories of realized cap spikes during price downturns indicate potential for local or cyclical market shifts. Traders and analysts analyze these patterns to forecast Bitcoin’s future prospects amid recent fluctuations.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto treasury stocks plunging in August after massive run-up

Share link:In this post: Crypto treasury stocks fell sharply in August after major summer gains. Ethzilla led the sector with a 114% rise, while others like Strategy dropped 16%. Companies backed by Tom Lee and Peter Thiel held up better than others.

OpenAI mulls new revenue from AI infrastructure

Share link:In this post: OpenAI is considering leasing out its AI-ready data centers and infrastructure in the future. The plan mirrors Amazon Web Services, which turned excess computing into a trillion-dollar business. OpenAI is exploring new financial instruments beyond debt to fund large-scale projects.

Interpreting Galaxy Q2 Financial Report: Hundred Billion Revenue but Unprofitable, Transforming into AI "Gold Mining"

Galaxy's cryptocurrency trading business generated $8.7 billion in revenue, but only brought in $13 million in profit (a profit margin of only 0.15%).

ETH futures data reflects traders’ fear, while onchain data points to a price recovery