Pennsylvania lawmakers are seeking to pass House Bill 1812, which will prohibit public officials and their immediate families from owning or engaging in transactions involving Bitcoin and other digital assets.

The bill is being sponsored by Rep. Ben Waxman and co-sponsored by seven other representatives in the Pennsylvania House of Representatives.

Source: @Bitcoin_Laws via X/Twitter

Source: @Bitcoin_Laws via X/Twitter

Lawmakers seek to ban elected officials from holding crypto

The bill bans public officials from holding Bitcoin and also extends to their immediate families. It aims to change the state’s ethics and financial disclosure laws in order to prevent public officials from having exposure to not just Bitcoin, but also alternative cryptocurrencies (including memecoins), non-fungible tokens, and even stablecoins.

The bill would also prohibit them from holding crypto via funds, trusts, or funds. The same applies to cryptocurrency derivatives as well as exchange-traded funds ( ETFs ), which have gained significant adoption over the past year.

Any state official who is already a holder of these nascent asset classes would be required to divest their digital asset holdings within two months of taking office to prevent potential conflicts of interest.

They would also not be allowed to own crypto for up to a year after leaving their government jobs. Those who fail to comply will face potential jail or a civil penalty of up to $50,000 and will be punished as felons.

What are the odds of the bill passing in Pennsylvania?

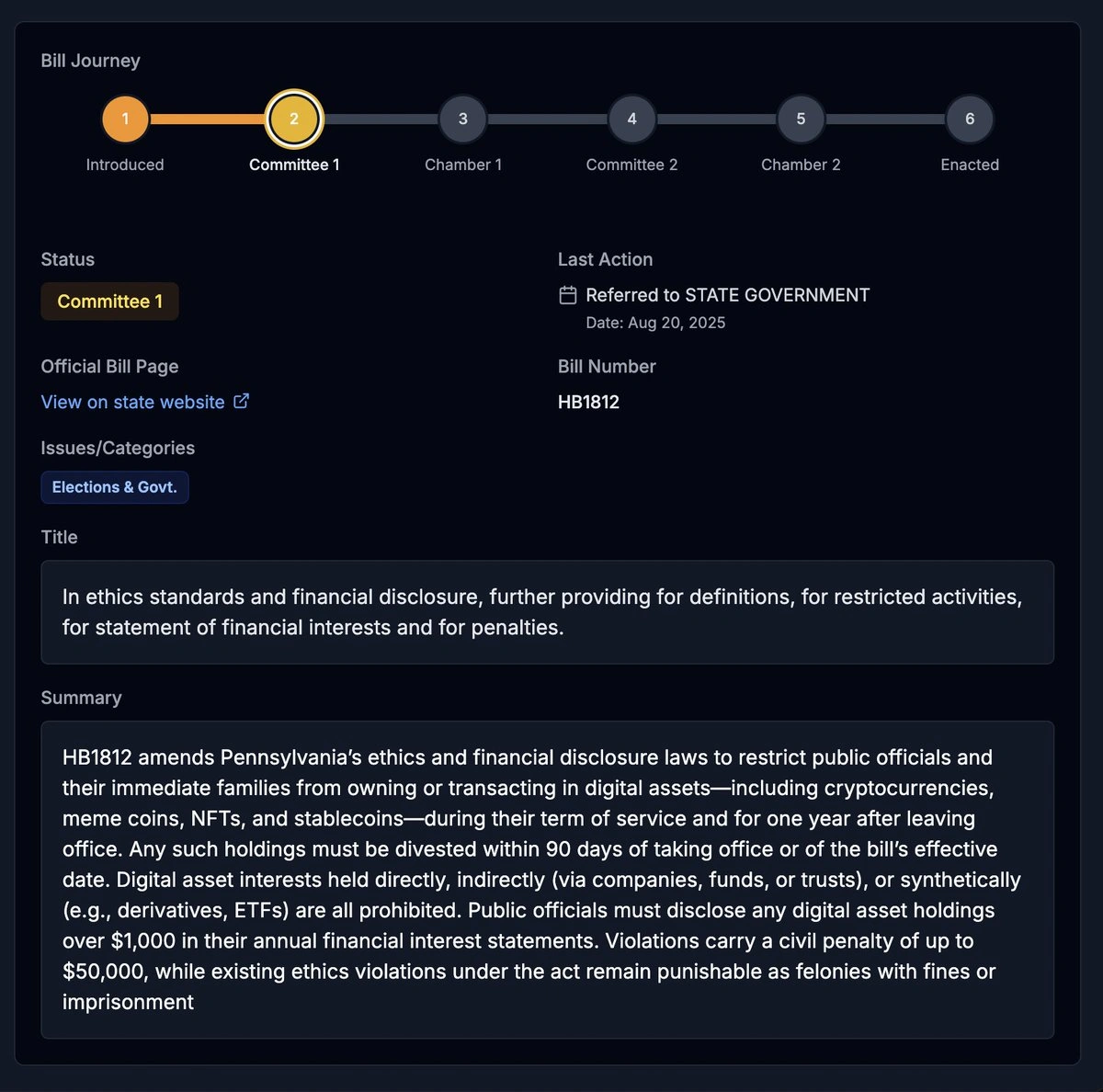

The recently introduced bill has reportedly been referred to the Committee on State Government. It is still at an early stage of the legislative bill-passing process. So for now, it is unclear if it will pass.

For now, no restrictions ban members of Congress from holding Bitcoin. However, there are existing disclosure laws that they need to comply with.

The bill highlights the growing bipartisan concern about conflicts of interest as digital assets continue to go mainstream and more infrastructure is built to support the transition.

There are other similar proposals, especially at the federal level, as more officials grow increasingly discontent with what they claim is the Trump family enriching itself through Donald Trump’s position as POTUS.

Examples of similar federal proposals include Congressman Ritchie Torres’ “Stop Presidential Profiteering from Digital Assets Act” and Senator Adam Schiff’s Curbing Officials’ Income and Nondisclosure (COIN) Act, both of which aim to impose comparable restrictions on federal officials.

Torres’ proposal will introduce legislation that would block President Donald Trump, future presidents, and members of Congress from “profiteering” on memecoins and stablecoins.

The bill would make it unlawful for someone to create, issue or promote a digital asset that “uses the name, likeness, image, or other recognizable traits of a covered individual.”

As far as the legislation is concerned, a “covered individual” is a current or former U.S. president, vice president, member of Congress, or any presidentially appointed and Senate-confirmed federal official, along with their immediate family members.

Schiff’s COIN Act virtually does the same thing; it prohibits the president, vice president, high-ranking executive branch employees, special government employees and members of Congress from issuing, sponsoring or endorsing digital assets, restrictions that also would extend to the immediate family members of said officials.

“President Donald Trump’s cryptocurrency dealings have raised significant ethical, legal and constitutional concerns over his use of the office of the presidency to enrich himself and his family,” Schiff said in a statement.

“We need far greater scrutiny of the president’s financial dealings, and to stop him and any other politician from profiting off of such schemes.”

Get seen where it counts. Advertise in Cryptopolitan Research and reach crypto’s sharpest investors and builders.