Aave founder once responded: The protocol related to the WLFI proposal remains valid

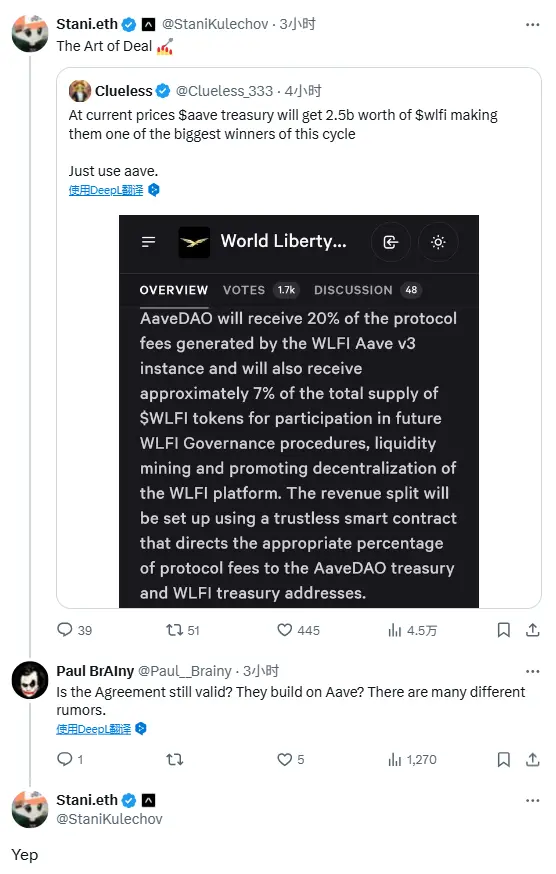

According to ChainCatcher, Aave founder Stani.eth responded at 20:30 today to questions regarding “Is the agreement between WLFI and the AAVE protocol still valid? Are they really building on Aave? There are many different rumors circulating,” stating that the protocol remains valid.

“At current prices, the Aave treasury will receive WLFI worth $2.5 billion, making it one of the biggest winners of this cycle.” In response to this view, the Aave founder prominently reposted and commented, “The art of the deal.”

As previously reported by ChainCatcher, on-chain analyst @ai_9684xtpa posted an analysis on X, stating that according to previous proposals, Aave, as a WLFI lending ecosystem partner, will have WLFI in this Aave v3 instance adopt the same reserve factor mechanism as the main Aave instance.

AaveDAO will receive 20% of the protocol fees generated by the WLFI Aave v3 instance, and will also obtain about 7% of the total WLFI token supply, to be used for future participation in WLFI governance processes, liquidity mining, and promoting the decentralization of the WLFI platform.

The distribution of proceeds will be implemented through a trustless smart contract, which will directly allocate the corresponding proportion of protocol fees to the AaveDAO treasury address and the WLFI treasury address.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Uniswap generated $5.99 million in revenue over the past 24 hours

A Bitcoin OG Transfers $292 Million Worth of BTC to HyperLiquid and Swaps for ETH

An address triples its long position on XPL in one day, with unrealized profits of $1.946 million

ETHZilla Announces Common Stock Offering of up to $10 Billion to Acquire More ETH