Will PEPE Coin Jump After Massive Whale Buy?

PEPE is once again in the spotlight after a whale scooped up nearly 179 billion tokens worth 2 million USDT, sparking speculation of a fresh rally. The move comes at a time when the meme coin has been consolidating in a tight range, with technical indicators flashing signs of an impending breakout. With whales positioning themselves ahead of what could be the next big move, traders are now asking the obvious question: is PEPE gearing up for a surge, or is this just another false signal?

PEPE Price Analysis: Whale Activity Signals Renewed Interest

A whale recently spent 2 million USDT to acquire 178.9 billion PEPE tokens, as shown by on-chain data. The accumulation happened through multiple transactions where around 44–45 billion PEPE were purchased in chunks of about half a million USDT each. This level of buying suggests that smart money is positioning for a potential move higher, adding confidence to retail traders who often follow whale wallets as market signals.

The interesting detail here is timing. The purchases came after a relatively quiet consolidation period, meaning this accumulation could be the first sign of a breakout attempt. When whales buy aggressively in down or sideways markets, they typically anticipate either a liquidity event or an upside rally.

Jerome Powell’s Jackson Hole speech , where he signaled a likely interest rate cut in September, indirectly adds fuel to speculative assets like PEPE. Lower rates weaken the dollar and push liquidity into risk-on markets, often boosting meme coins alongside stocks and mainstream crypto.

With inflation easing and the Fed turning slightly dovish, traders may rotate capital into high-volatility tokens for bigger returns. The timing of Powell’s comments, combined with a whale spending $2M on PEPE, creates a narrative that both macro policy and on-chain signals are aligning to support a potential rally in the coin.

Current Technical Setup on the Daily Chart

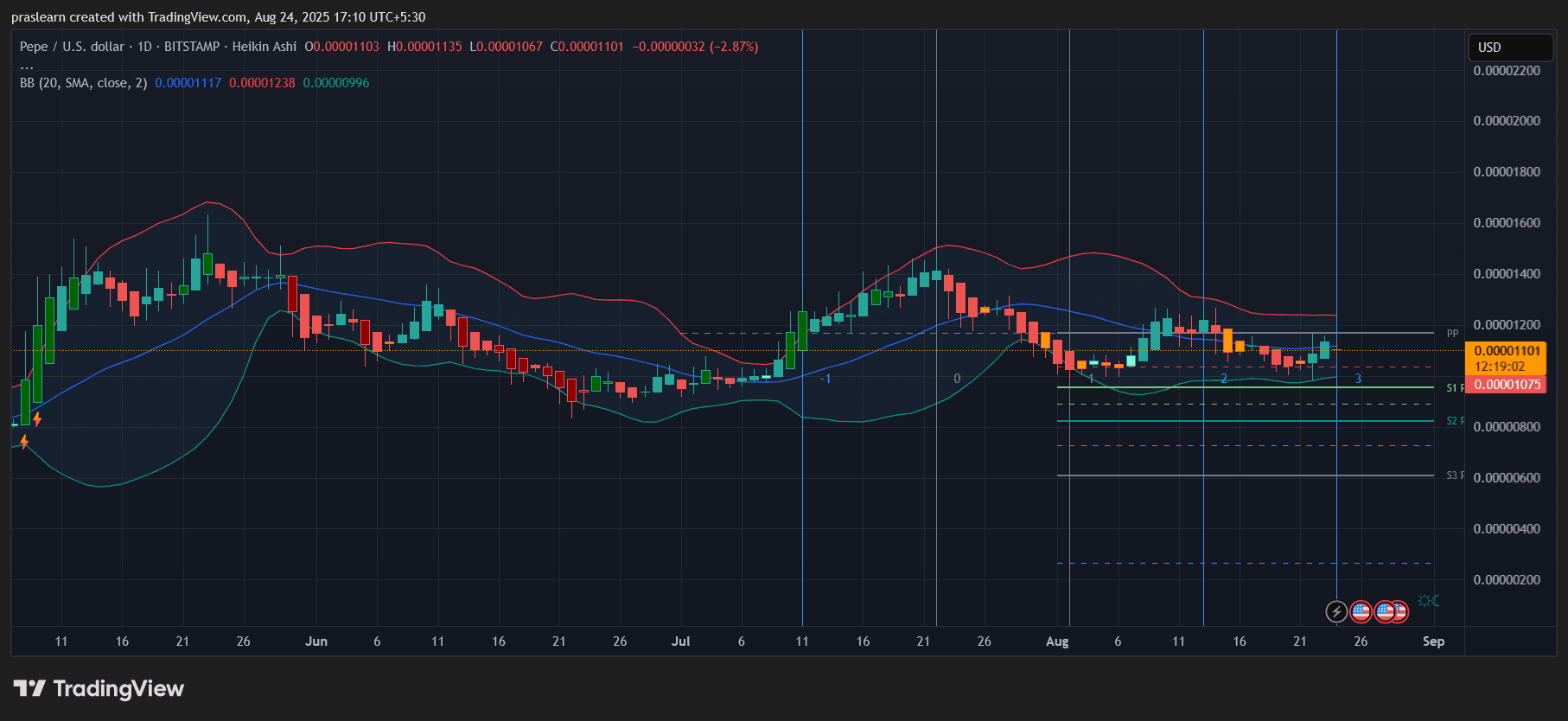

PEPE/USD Daily Chart- TradingView

PEPE/USD Daily Chart- TradingView

The TradingView chart shows PEPE trading around $0.00001101 with slight pressure after a small rejection near $0.00001135. The Bollinger Bands are tightening, which indicates volatility compression and often precedes a sharp directional move.

Support levels can be seen near $0.00001075 and $0.0000098, both acting as buffers if price faces selling pressure. Resistance stands around $0.00001200, and a clean break above this level could push PEPE toward the mid-August highs closer to $0.00001400.

The Heikin Ashi candles show a mix of red-to-green transitions, signaling momentum is not yet decisively bullish but slowly shifting. The structure points to accumulation rather than distribution, aligning with whale activity.

PEPE Price Analysis: Short-Term Price Outlook

If buying volume continues, the immediate target for PEPE would be a retest of $0.00001200. Breaking through this ceiling could trigger momentum-driven buying and push price toward $0.00001400. On the downside, failure to hold $0.00001075 may bring a test of the psychological $0.00001000 level.

Given whale buying, the probability of a deeper breakdown looks limited for now. However, traders should keep in mind that such large holders can also flip into profit-taking mode quickly if retail demand does not materialize.

Medium-Term Analysis

Over the next few weeks, $PEPE is likely to trade between $0.0000098 and $0.00001400, consolidating while whales continue their positioning. If broader market sentiment for meme coins turns positive, PEPE price could attempt a breakout above $0.00001500, opening the path to $0.00001800 levels.

The sustainability of this rally depends heavily on whether whale wallets hold their positions. If they continue accumulating instead of selling, PEPE could surprise the market with a strong September run.

Key Takeaway

Whale activity is the clearest bullish signal $PEPE has right now. The technical chart confirms consolidation and narrowing volatility, setting up the conditions for a breakout. Short-term resistance at $0.00001200 will be the key level to watch. A decisive move above it could trigger rapid upside, while failure to hold $0.00001075 may lead to another round of sideways trading.

For traders, this is the moment to track whale addresses closely and monitor whether retail interest starts following the big money.

$PEPE, $PEPECoin

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump’s latest money grab leaves his base broke again

Share link:In this post: Trump launched a new crypto venture where he profits early and his supporters lose money again. His past projects—Truth Social, $Trump, $Melania, and NFTs—left late investors with major losses. The new WLFI token offers no profits or ownership but funnels 75% of sale proceeds back to Trump.

Central bankers left Jackson Hole with no easy answers

Share link:In this post: Jerome Powell hinted at a possible September rate cut but admitted the Fed is facing a “challenging situation.” Fed officials are divided over inflation, weak hiring, and whether to cut rates now or wait. Trump threatened to fire Governor Lisa Cook and continues to pressure the Fed to lower rates.

Only 37% of Americans trust Powell as economic confidence in the Fed hits record low

Share link:In this post: Only 37% of Americans trust Powell to manage the economy, near record-low levels. Powell hinted at upcoming interest rate cuts during his final Jackson Hole speech. Trump attacked Fed official Lisa Cook and installed loyalists to reshape the central bank.

VanEck and Jito File Solana Staking ETF