Bitcoin $112,815 remains stable above $114,000 but experienced slight losses over the weekend. Altcoins like AVAX saw declines exceeding 5%, whereas Ethereum $4,793 displays strong momentum for a new all-time high, trading actively at $4,770. This article delves into crucial price targets for ZK Coin enthusiasts and the developments in the Ethereum space.

ZK Coin Price Targets

Ether’s resurgence to record levels has prompted analysts to update and share altcoin price targets. If ETH breaks records, it likely signifies that money is redirecting from Bitcoin to altcoins , initiating an altcoin bull run.

ZK Coin, once a standout amidst competitive markets, has stayed in the shadows recently. Despite hitting a low in June due to increased supply, it still holds potential in its first bull market. Investors and analysts, notably the pseudonymous CryptoBullet, remain optimistic about ZK Coin’s future prospects.

An analyst sharing the above chart highlighted that after recent supply-linked declines, ZK Coin found its bottom and escaped a descending wedge, potentially accelerating its rise. Their price target for ZK Coin is $0.42, with a main target of $0.94 and a best-case scenario target of $2. As it hovers around $0.06, these targets appear promising.

Ethereum (ETH)

ETH, maintaining a price level around $4,700, hasn’t reached its ultimate peak. Though exceeding its previous all-time high from 2021, ETH’s actual zenith remains higher. Additionally, its Total Value Locked (TVL) hasn’t reached new highs, indicating room for growth. Which critical levels are to watch?

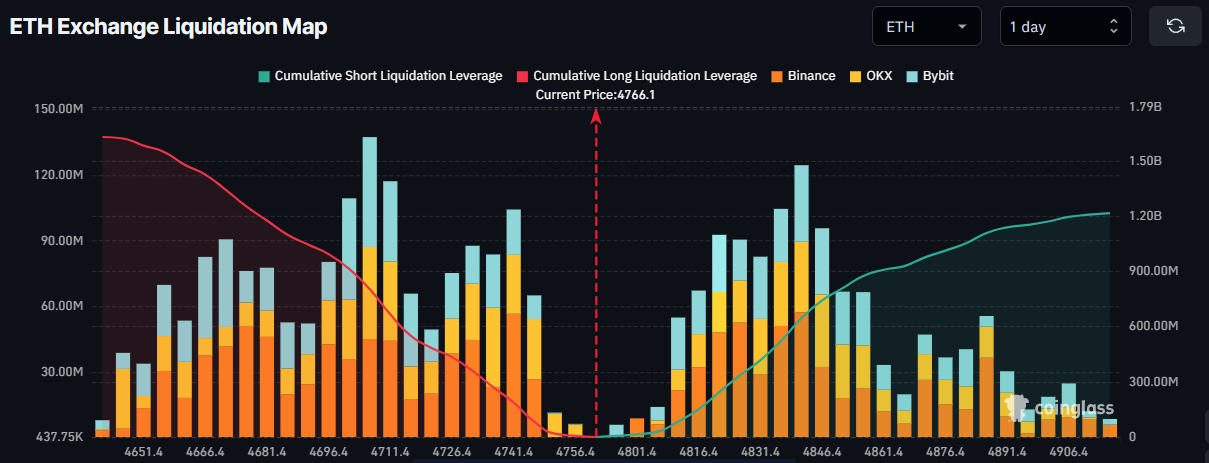

In the realm of futures trading, a $1.1 billion contention exists. To witness substantial liquidation, either the all-time high or $4,700 level needs to be breached. Currently, the path of least resistance appears upward.

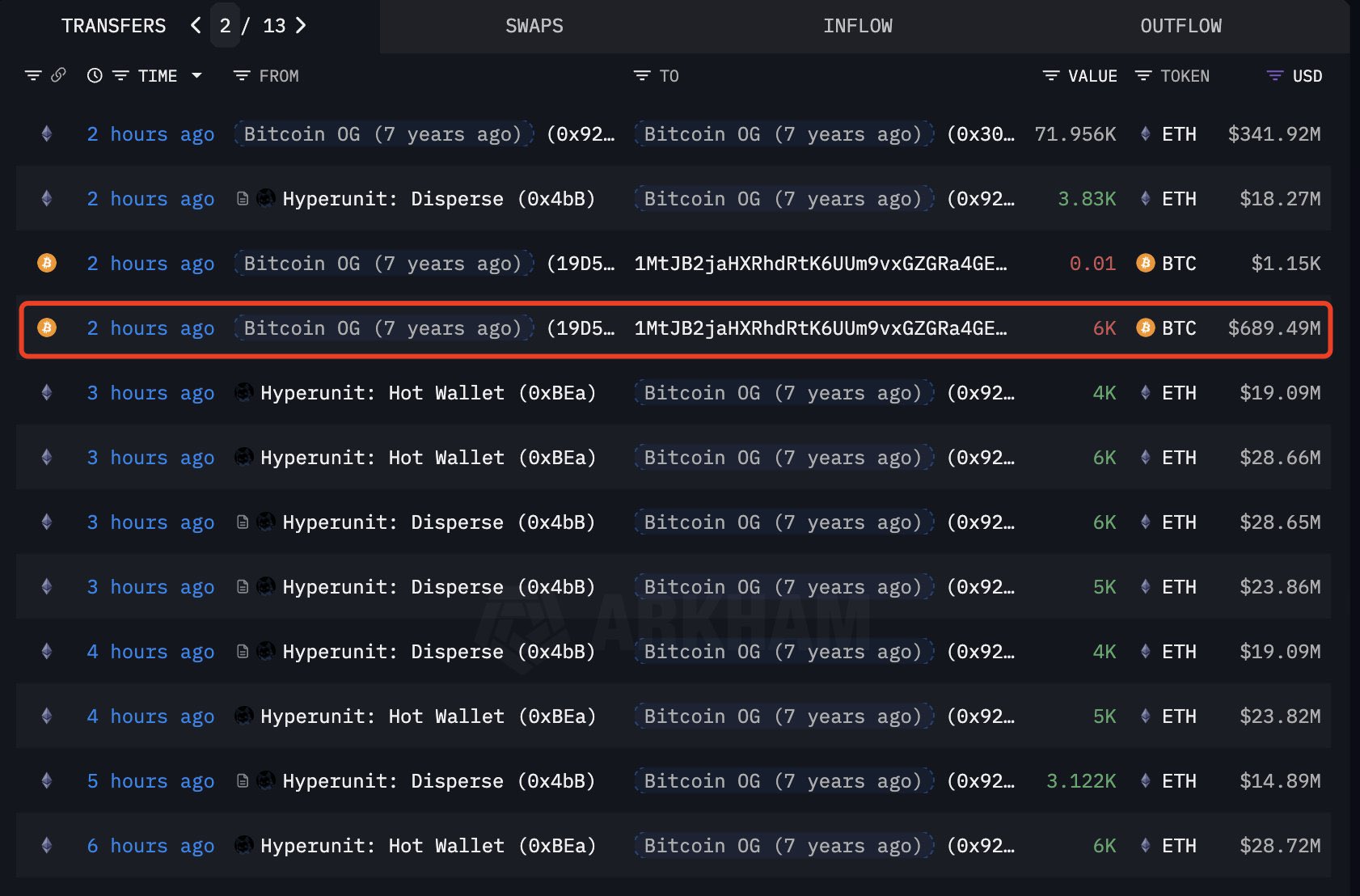

Today, Rover highlighted a fascinating occurrence regarding Ethereum. An ancient whale from the Satoshi era has commenced spending 6,000 BTC to acquire ETH.

“A Satoshi-era Bitcoin whale transferred 6,000 BTC valued at $689.5 million to purchase ETH.

So far, they’ve amassed: 278,490 $ETH (worth $1.28 billion), averaging $4,585 per ETH.

Also, there remains an open long position of 135,265 ETH (valued at $581 million).”