SharpLink buys $250 million in Ethereum, raising total holdings to nearly 800,000 ETH

Key Takeaways

- SharpLink Gaming has increased its Ethereum holdings to nearly 800,000 ETH, valued at nearly $3.6 billion.

- The company earned 1,799 ETH in staking rewards and recently approved a $1.5 billion stock buyback plan.

Share this article

SharpLink Gaming, which manages one of the largest Ethereum treasuries, disclosed Tuesday that it had added 56,533 ETH at an average of $4,462 last week, bringing its stash to 797,704 ETH.

With ETH changing hands above $4,500 at press time, SharpLink’s ETH holdings are valued at approximately $3.6 billion. The company’s stash makes it the second-largest corporate Ethereum holder after BitMine Immersion and one of the biggest players in crypto treasuries.

Co-CEO Joseph Chalom said the latest purchase reflects SharpLink’s disciplined approach to building its Ethereum treasury.

“With nearly 800,000 ETH now in reserve and strong liquidity available for further ETH acquisitions, our focus on building long-term value for our stockholders while simultaneously supporting the broader Ethereum ecosystem remains unwavering,” Chalom stated.

The company reported total staking rewards of 1,799 ETH since launching its treasury strategy in June. SharpLink maintains approximately $200 million in cash available for additional ETH acquisitions.

Last week, the company’s Board authorized a $1.5 billion stock buyback program as part of its capital markets strategy. The company will buy back shares when they trade at or below the net asset value of its Ether holdings, aiming to improve its ETH-per-share ratio.

Share this article

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

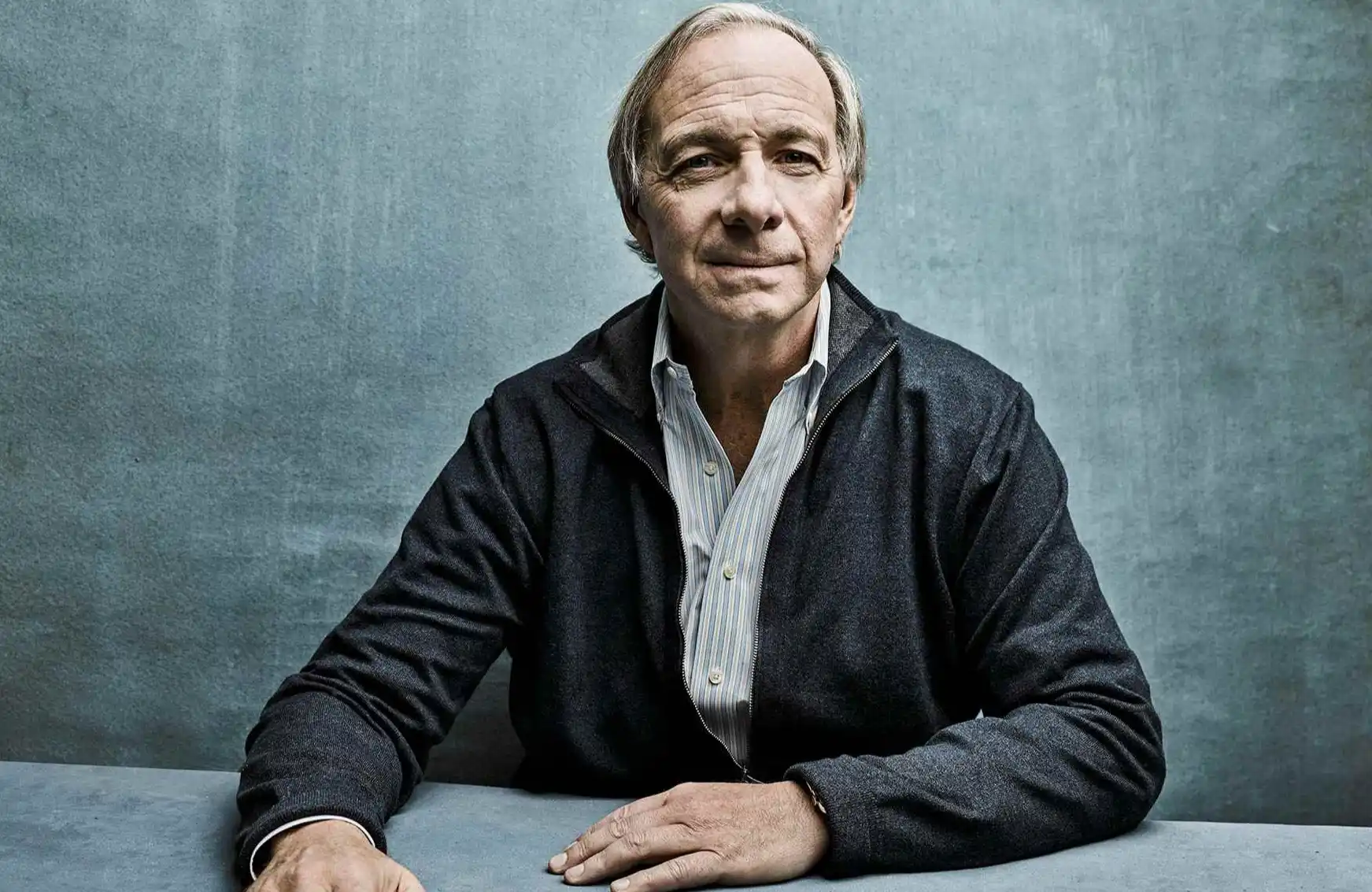

Conversation with Ray Dalio: From Asset Allocation to Wealth Inheritance, 10 Financial Principles for Chinese Friends

In the long run, cash is a very poor investment.

What exactly is the Ethereum meme that even Tom Lee is paying attention to?

Will there be a meme trend based on the Tom Lee concept?

[Long English Thread] Ethereum's New Journey: Towards 10,000 TPS and the Ultimate Vision of "ZK Everything"