Bitcoin market cycles not anchored around halvings: Analyst

Bitcoin’s market cycles are not anchored around its halving events as widely believed, according to analyst James Check, who says other factors drive bull and bear cycles.

“In my opinion, Bitcoin has experienced three cycles, and they are not anchored around the halvings,” Check said on Wednesday, referring to the blockchain’s cutting of mining rewards that typically occurs every four years.

He said that market cycles are anchored around the “trends in adoption and market structure,” with the market’s 2017 peak and 2022 bottom being the transition points.

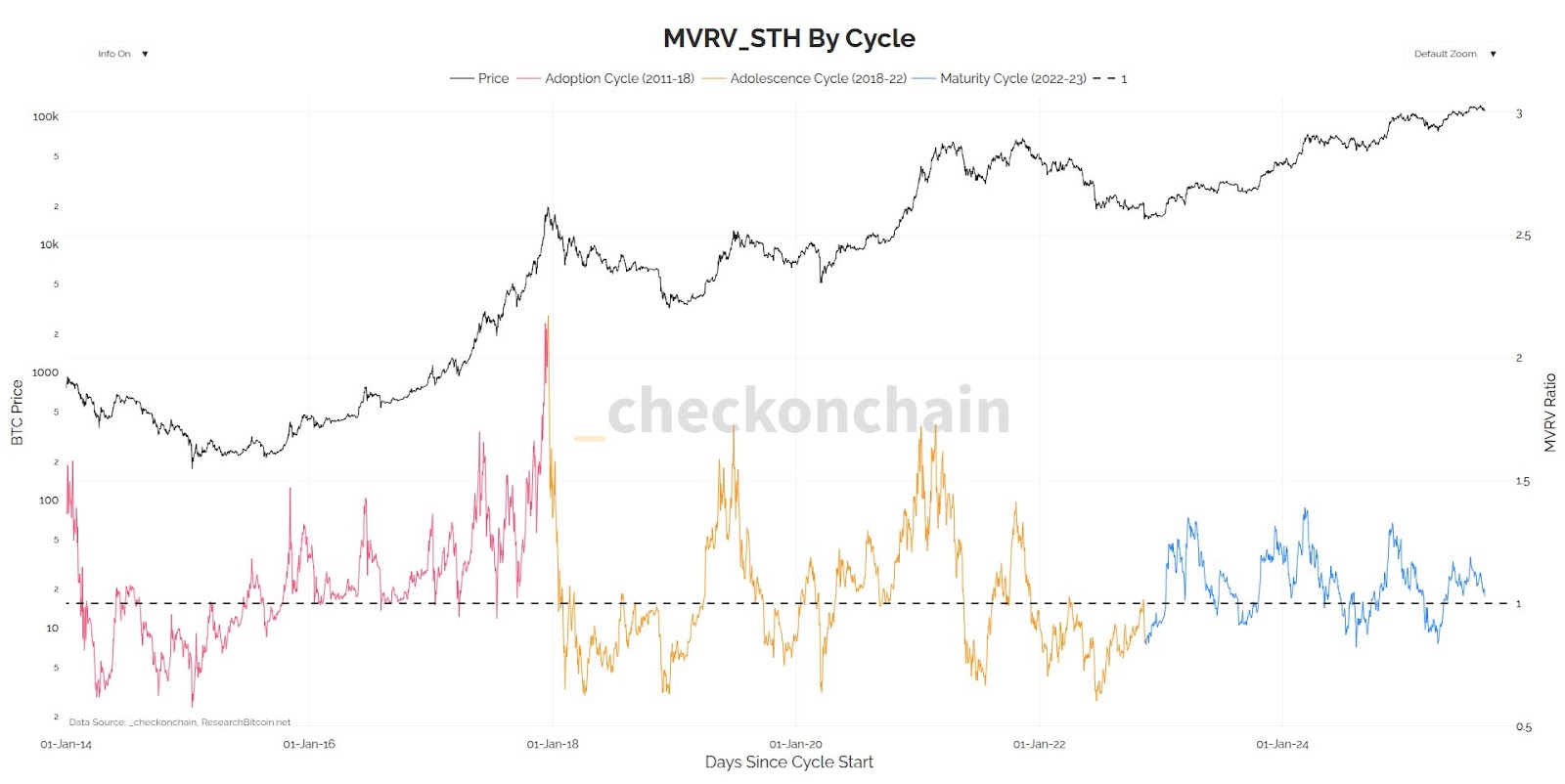

Check highlighted the three previous cycles as an “adoption cycle” from 2011 to 2018, driven by retail early adoption, an “adolescence cycle” from 2018 to 2022, driven by “Wild West boom and bust with leverage,” and the current “maturity cycle” from 2022 onward, driven by “institutional maturity and stability.”

“Things changed after the 2022 bear market, and folks who assume the past will repeat likely miss the signal because they are looking at the historical noise,” he said.

Halving cycle theory still on track

Check’s analysis goes against the popular theory that Bitcoin (BTC) market cycles typically span four years and are anchored around its halving events, which induce a supply shock due to the decreased block reward and greater demand.

This is when the bull market peak year comes in the year after the halving event, as it has done in 2013, 2017, 2021, and appears to be on track to repeat the pattern in 2025.

Check also said that Bitcoin is “literally the only other endgame asset alongside gold,” implying that the current cycle may be extended.

End of the four-year cycle?

There have been a number of recent predictions that the traditional four-year cycle is over, and this bull market could extend into next year due to institutional participation.

Related: Is the four-year crypto cycle dead? Believers are growing louder

Earlier this month, Bitwise chief investment officer Matthew Hougan said of the cycle that it is “not officially over until we see positive returns in 2026. But I think we will, so let’s say this: I think the 4-year cycle is over.”

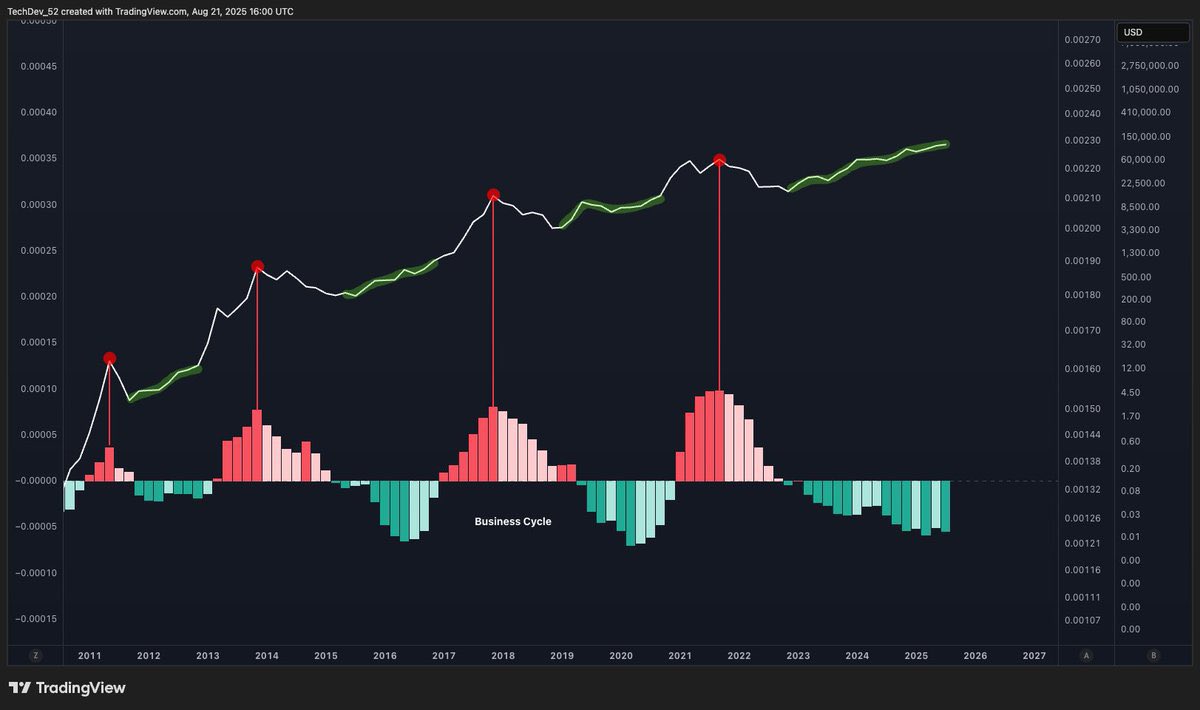

Entrepreneur “TechDev” told his 546,000 followers on X on Tuesday that “The business cycle’s dynamics are all that’s been needed to understand Bitcoin’s,” and illustrated the peaks and troughs from previous cycles.

The analysis suggests that shifts from bearish to bullish phases are driven by liquidity dynamics rather than the traditional four-year halving cycle, and the only difference this time is the extended bullish phase.

Current cycle is ending, says Glassnode

Analysts at Glassnode said on Aug. 20 that Bitcoin was still tracking its traditional cycle patterns. On Tuesday, they reiterated that recent profit taking and elevated selling pressure “suggests the market has entered a late phase of the cycle.”

Meanwhile, position trader Bob Loukas had a more pragmatic take on market cycles.

“I hear often, ‘There are no more Bitcoin cycles’. Reality is, we’re always in cycles. We just can’t help ourselves. We pump until it bursts, because we just want more. Then we start again. Only difference is how much shrapnel you avoid and how quickly you reset.”

Magazine: Bitcoin is ‘funny internet money’ during a crisis: Tezos co-founder

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Strategic Inflection Point: How Ethereum and Arbitrum Are Reshaping Institutional Crypto Infrastructure

- Ethereum's $566B market cap and 60% stablecoin dominance solidify its role as institutional blockchain infrastructure. - Arbitrum's 2025 upgrades (12x faster transactions, 50+ Orbit chains) enable scalable multi-chain solutions for institutional use. - Cold Wallet's $6.3M presale addresses institutional demand for secure, multi-chain custody amid Ethereum/Arbitrum growth. - Infrastructure investments align with $9.4B Ethereum ETF inflows and PayPal/Euler Labs' Arbitrum expansions, signaling $10T crypto f

Ethereum's Undervalued Treasury Play: Why ETH and DAT Companies Offer a Stronger Case Than Bitcoin

- Ethereum (ETH) outperforms Bitcoin (BTC) in 2025 as institutional capital shifts toward ETH-based digital asset treasuries (DATs) due to staking yields and utility-driven growth. - Institutional ETH accumulation hit 4.1M ($17.6B) by July 2025, driven by 4.5–5.2% staking yields and ETF inflows surpassing Bitcoin’s, with ETH/BTC ratio hitting a 14-month high of 0.71. - Regulatory clarity (CLARITY/GENIUS Acts) and deflationary supply dynamics position ETH as a yield-generating infrastructure asset, with Sta

Bitcoin's Derivatives-Long Overhang and Spot-Derivatives Divergence: Navigating Structural Risks and Contrarian Opportunities

- Bitcoin's August 2025 market shows sharp divergence: derivatives funding rates hit 0.0084 (211% rebound) amid $1.2B ETF outflows and $900M liquidations. - Structural risks emerge as long/short ratio normalizes to 1.03, masking leveraged fragility exposed by $2.7B whale dump triggering $500M liquidations. - On-chain signals highlight overbought conditions (NUPL 0.72) and technical bearishness with 100-day EMA breakdown to $106,641. - Contrarian opportunities arise as Derivative Market Power index stabiliz

Bitcoin's $110K Correction as a Buying Opportunity

- Bitcoin's 7% correction to $115,744 in August 2025 triggered $500M in liquidations but stabilized leverage ratios, signaling a potential buying opportunity. - Institutional capital shifted toward Ethereum in Q2 2025, with whales accumulating 200,000 ETH ($515M) amid Bitcoin's structural resilience. - Technical indicators suggest $115,000 is a critical support level, with historical cycles pointing to a potential rebound toward $160,000 by Q4 2025. - Strategic entry points at $110,000–$115,000 recommend d