Canary Capital Files for Trump Coin ETF, Triggering SEC Scrutiny and Volatility Concerns

Contents

Toggle- Quick breakdown:

- Eric Balchunas doubts ETF going through

Quick breakdown:

- Canary Capital has filed to launch a Trump Coin exchange-traded fund (ETF) in the US, aiming to provide direct exposure to the political memecoin linked to President Donald Trump.

- The filing represents a bold move into politically themed crypto assets but faces challenges from SEC regulations requiring futures products be traded for at least six months.

- The ETF could set a regulatory precedent, though analysts warn of high volatility and regulatory risks.

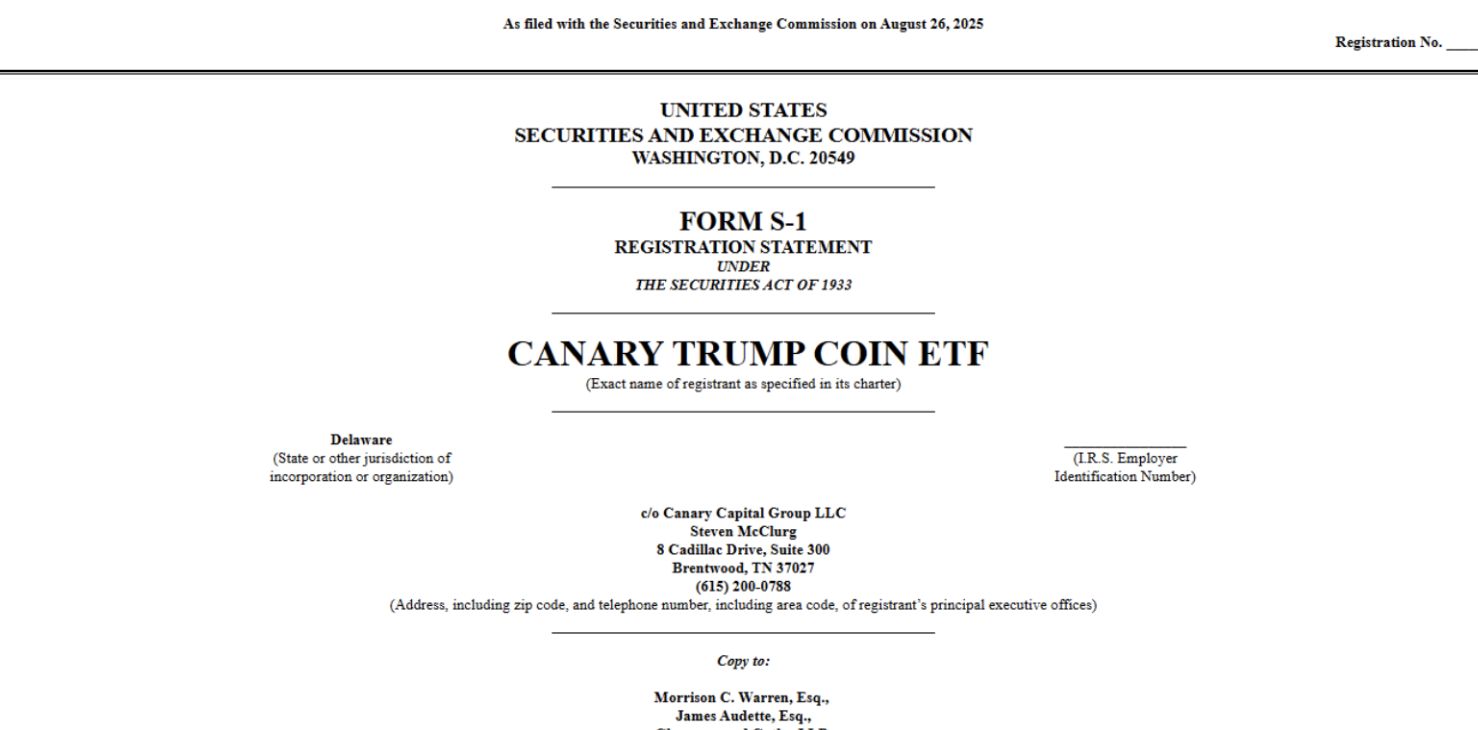

Canary Capital has submitted a landmark filing to the US Securities and Exchange Commission (SEC) to launch the first-ever exchange-traded fund (ETF) based on the Trump Coin (TRUMP), a politically-charged memecoin linked directly to former President Donald Trump. The proposed ETF aims to offer investors direct exposure to TRUMP through traditional brokerage accounts, eliminating the need for self-custody of the digital asset, under the ticker MRCA.

Source:

SEC

Source:

SEC

Trump Coin, launched in January 2025 on the Solana blockchain, quickly gained prominence as both a political statement and a digital collector’s item. While the token briefly reached a market value exceeding $27 billion, it has since plummeted nearly 70% from its January peak, exhibiting extreme volatility tied to political events and online sentiment.

Canary’s filing under the Securities Act of 1933 differs from similar pending ETFs filed under the Investment Company Act of 1940 in that it allows for the direct holding of the coin, rather than shares in an offshore entity.

Eric Balchunas doubts ETF going through

Bloomberg ETF analyst Eric Balchunas has cast doubt on SEC approval, citing regulatory requirements that a futures product linked to the asset must trade for at least six months—something TRUMP currently lacks.

Industry voices warn about the speculative nature of such funds, with risks amplified given the memecoin’s political branding and slim fundamental utility. Canary’s filing itself describes TRUMP shares as “speculative securities” unsuitable for risk-averse investors.

If approved, the SEC’s verdict on Canary’s Trump Coin ETF could set an important precedent for politically themed digital assets entering mainstream financial products. This will mark a critical test for how regulators handle the intersection of crypto, politics, and speculative investment instruments.

Meanwhile, Canary Capital has filed a Delaware trust to potentially launch an exchange-traded fund (ETF) for the official Trump memecoin, aiming for an SEC filing under the ’33 Act. This move establishes the legal framework for the fund.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Celebrity-Backed Memecoins: A Systemic Threat to Retail Investors

- Celebrity-backed memecoins prioritize insider gains over public value, creating volatile markets with liquidity traps and artificial price collapses. - Tokens like YZY (70-94% insider allocation) and TRUMP (80% insider control) exemplify centralized tokenomics enabling rapid price manipulation and wealth concentration. - Regulatory ambiguity allows enforcement gaps, as seen in Kim Kardashian's $1.26M fine for undisclosed promotion, while self-paired liquidity pools facilitate insider exploitation. - Acad

Silver's Silent Revolution: Contrarian Signals in the Shares Silver Trust (SLV) Suggest a Strategic Entry Point for 2025

- The Shares Silver Trust (SLV) emerges as a strategic entry point for contrarian investors in 2025, driven by undervalued silver fundamentals and structural supply-demand imbalances. - Weakening U.S. dollar, industrial demand surges (10% annual solar-driven growth), and a record 87.9 gold-silver ratio signal potential for a sharp silver rebound. - Oversold technical indicators (RSI 24.84, golden cross) and $3.61B 3-month inflows highlight shifting investor sentiment toward silver’s dual role as industrial

PARTI +183.33% in 24 Hours on Strong Short-Term Momentum

- PARTI surged 183.33% in 24 hours, becoming one of the market's most volatile assets. - The price spike broke key resistance levels, driven by algorithmic trading and strong retail/institutional demand. - PARTI's 63,280% annual gain highlights its speculative nature and outperformance during market volatility. - A backtesting strategy is proposed to systematically capture explosive short-term gains through volatility-pattern trading.

Strategic Board Appointments Fuel Ecosystem Growth in Decentralized AI Infrastructure

- Strategic board appointments in decentralized AI infrastructure drive institutional adoption and ecosystem growth, with 40% of firms reevaluating board structures amid AI advancements. - Intellistake's appointment of Alessandro Spanò boosted institutional confidence, while The Crypto Company leveraged Singularity University expertise to enhance AI transparency for enterprise partnerships. - Bittensor's market-driven emission model and NEAR Protocol's Nightshade 2.0 upgrade achieved $300B valuation and 86