Cold Wallet, XRP, Ethena & Chainlink: Unlocking Undervalued Assets in a Post-Presale Era

- 2025 post-presale crypto era prioritizes security, regulation, and DeFi infrastructure, with Cold Wallet, XRP, Ethena, and Chainlink leading innovation. - SEC's XRP ruling (commodity classification, $125M penalty) and ProShares ETF drove $1.2B inflows, projecting $12.60 price by year-end. - Ethena expanded cross-chain TVL to $10B via LayerZero, while Chainlink's TVS doubled to $84-95B, securing DeFi through oracle networks. - Cold Wallet's $0.3517 fixed price, 2M users post-Plus Wallet acquisition, and C

The era of 2025 has ushered in a new wave of crypto innovation, where security, regulatory clarity, and decentralized finance (DeFi) infrastructure are redefining risk-reward dynamics. Four projects—Cold Wallet, XRP , Ethena (ENA), and Chainlink (LINK)—stand out as pivotal players in this transformation. By analyzing their roles in asset protection, institutional adoption, cross-chain scalability, and oracle-driven security, we uncover how these assets are reshaping the crypto landscape.

XRP: Regulatory Clarity Fuels Institutional Adoption

The U.S. Securities and Exchange Commission (SEC) concluded its five-year lawsuit with Ripple Labs in August 2025, classifying XRP as a commodity in secondary markets and imposing a $125 million penalty on institutional sales [3]. This resolution eliminated regulatory ambiguity, enabling XRP to be categorized as a utility token. Ripple’s On-Demand Liquidity (ODL) service, which leverages XRP for cross-border payments, processed $1.3 trillion in Q2 2025, attracting over 300 financial institutions [1].

Institutional confidence further surged with the launch of the ProShares XRP ETF (UXRP) in July 2025, which amassed $1.2 billion in assets under management. Analysts project XRP could reach $12.60 by year-end, driven by ETF inflows and the October 2025 SEC decision on additional XRP ETFs, which could unlock $5–8 billion in institutional capital [4].

Ethena: Cross-Chain DeFi Expansion

Ethena (ENA) has emerged as a DeFi powerhouse, with a total value locked (TVL) of $10 billion across 23 blockchains via LayerZero [5]. Its cross-chain interoperability addresses a critical gap in DeFi, enabling seamless asset movement and liquidity aggregation. This scalability positions Ethena to capitalize on the era’s demand for decentralized, multi-chain financial tools.

Chainlink: The Bedrock of DeFi Security

Chainlink (LINK) remains indispensable for DeFi’s trust layer, with its Total Value Secured (TVS) exceeding $84–95 billion—nearly double from 2024 [6]. By providing real-time data feeds and secure oracle services, Chainlink mitigates smart contract risks, a critical factor in an environment where transparency is paramount. Its partnership with Intercontinental Exchange (ICE) to integrate forex and precious metals data further cements its role as a bridge between DeFi and traditional markets [7].

Cold Wallet: Asset Protection

Cold Wallet has redefined security with a fixed launch price of $0.3517 and a potential 100× return. Its model includes cashback incentives and security audits from Hacken and CertiK, addressing user concerns about asset safety [8]. The acquisition of Plus Wallet added 2 million active users, while referral programs and a CoinMarketCap listing have accelerated adoption [8]. Cold Wallet’s focus on utility-driven security aligns with broader trends in crypto asset protection, making it a compelling long-term play.

Conclusion: A New Paradigm for Risk and Reward

The convergence of regulatory clarity, DeFi innovation, and robust security frameworks is reshaping crypto’s risk-reward profile. XRP’s institutional adoption, Ethena’s cross-chain scalability, Chainlink’s oracle infrastructure, and Cold Wallet’s asset protection mechanisms collectively highlight a maturing ecosystem. For investors, these projects represent undervalued opportunities in a market increasingly defined by trust, utility, and institutional alignment.

Source:

[1] Cold Wallet, LINK, ADA , and ENA represent 2025 crypto growth through utility, oracle infrastructure, privacy innovation, and DeFi expansion.

[2] Chainlink and the Future of DeFi: Navigating 2025's blockchain-driven financial system

[3] SEC Ends Lawsuit Against Ripple, Company to Pay $125 Million Fine

[4] The SEC's October 2025 XRP ETF Decision and Its Implications for Institutional Crypto Adoption

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AiCoin Daily Report (August 28)

The Impact of Developer Protections on Tech Sector Growth

How do crypto mining companies leverage small arrangements for big profits?

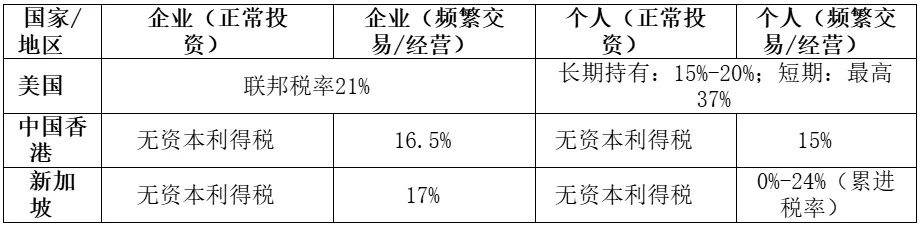

Tax arrangements are not a one-size-fits-all formula but need to be "tailor-made" according to the specific circumstances of each enterprise.