Investment advisers ’dominating’ with $18.3B in Bitcoin, Ether ETFs

Investment advisers are the largest trackable cohort outside of retail that are buying Bitcoin and Ether exchange-traded funds, according to new data from Bloomberg Intelligence.

Bloomberg ETF analyst James Seyffart said in an X post on Wednesday that investment advisers are “dominating the known holders” of Ether ETFs, investing over $1.3 billion or 539,000 Ether

ETH$4,552in Q2 — an increase of 68% from the previous quarter.

Source: James Seyffart

Source: James Seyffart

The same was observed in US spot Bitcoin ETFs . Seyffart said on Monday that “advisers are by far the biggest holders now,” with over $17 billion of exposure in 161,000 Bitcoin .

In both cases, the exposure from investment advisers was nearly twice that from hedge fund managers.

However, Seyffart said this was based on data filed with the SEC, which represents only a fraction of all the spot Bitcoin ETF holders.

“This data is mostly 13F data. It only accounts for about 25% of the Bitcoin ETF shares. The other 75% are owned by non-filers, which is largely going to be retail,” he added.

Crypto ETF data tells a story, analysts say

Vincent Liu, the chief investment officer at Kronos Research, said the data signals a shift from speculative flows to long-term, portfolio-driven allocations.

“As the top holders, their strategic positioning provides deeper liquidity and a lasting foundation for crypto’s integration into global markets,” he told Cointelegraph.

Liu said that as more advisers adopt Bitcoin and Ether ETFs, crypto will be recommended and recognized as a long-term diversification tool within traditional portfolios, complementing equities, bonds, and other mainstream assets.

“As more altcoins join the ETF space and yield-bearing assets like staked Ether gain approval, advisers can use crypto not just to diversify portfolios but also to generate returns, driving broader and longer-term adoption.”

Room for advisers to lean further into crypto ETFs

Some have speculated that the number of financial advisers in crypto ETFs could explode as regulations come into force. In July, Fox News Business predicted that trillions of dollars could flood the market through financial advisers.

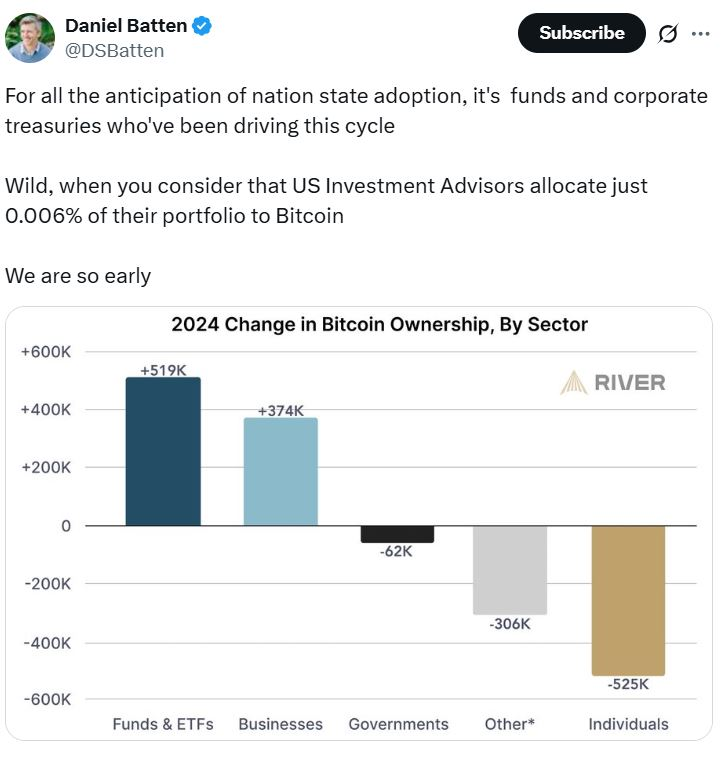

Source: Daniel Batten

Source: Daniel Batten

Pav Hundal, lead market analyst at Australian crypto broker Swyftx, told Cointelegraph that investment adviser holdings in Bitcoin ETFs have grown by about 70% since June, triggered by softening in the US regulatory context, coupled with an almost unprecedented demand for risk-on assets.

“We’re likely still only in the early chapter of growth. Like with any investment that starts to build momentum, you get two types of participants: those who arrive early and those who come later out of fear of missing out,” he said.

“That dynamic plays out across both institutions and retail investors. With Ethereum pressing into new all-time highs, and US policymakers hinting at a softer monetary stance as the labor market shows cracks, the setup is there for advisers to lean in further.”

Regulation to play a role in crypto ETF growth

Meanwhile, Kadan Stadelmann, chief technology officer of the blockchain-based Komodo Platform, told Cointelegraph the data makes it clear “Main Street, through their financial advisers, is seeking access to crypto markets through Wall Street.”

“Ether ETFs are experiencing the success of Bitcoin ETFs, but on a smaller scale, representing a shift from early to institutional adoption. And we’re not talking about smaller Wall Street firms, but the biggest names, such as BlackRock and Fidelity,” he added.

The top holders of the Ether ETFs according to 13F data as of Q2. Source: James Seyffart

The top holders of the Ether ETFs according to 13F data as of Q2. Source: James Seyffart

However, in the long run, Stadelmann thinks “regulatory realities” will play a role in the growth of financial advisers in the crypto market.

The US Securities and Exchange Commission launched Project Crypto in July to foster blockchain innovation, and the US House passed the Genius Act in the same month, which represented regulatory clarity long called for by crypto lobbyists.

“In lower Manhattan, crypto is definitely more seen as an equity than a revolution, and the move by these big players has merely been followed by financial advisers, who now have the confidence of regulatory clarity,” Stadelmann said.

However, Stadelmann thinks that if a less crypto-friendly government were to be voted in at the next election, it could throw a spanner in the works,

“The approach to crypto could include crackdowns, which could put a freeze over the institutional crypto market, and strike fear into the hearts of financial advisers that they could lose their licenses if they offer the products,” he said.

“That is yet to be seen, and Democrats could leave the new status quo due to market demands.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP's Distribution Phase and Path to $20: A Bullish Investment Case

- XRP’s $20 price target is supported by technical indicators, institutional adoption, and macroeconomic catalysts, with consolidation near $3.00 and key resistance levels at $3.01–$3.03. - Ripple’s ODL service processed $1.3T in Q2 2025, while SEC lawsuit resolution unlocked $7.1B liquidity and ETF inflows signaled growing institutional confidence in XRP. - Macro factors like potential $8.4B ETF inflows and 80% approval probability by October 2025, plus XRP’s role in 300+ financial institutions, amplify i

Ethereum’s Strategic Dominance in the Stablecoin Era: A Wall Street-Backed Opportunity

- Ethereum dominates 50% of the global stablecoin market ($102B in USDT/USDC) by August 2025, driven by institutional adoption and regulatory clarity. - Institutional investors allocated $3B to Ethereum staking by Q2 2025, with tokenized assets surging to $412B, including $24B in real-world asset tokenization. - The U.S. GENIUS Act (July 2025) mandated 1:1 HQLA reserves for stablecoins, while Ethereum ETFs attracted $10B in assets, outpacing Bitcoin counterparts. - Ethereum's Pectra/Dencun upgrades reduced

Chimpzee Charity Tickets and the Rise of Impact-Driven ReFi NFTs: How $50 Reusable NFTs Are Bridging Crypto Speculation and Environmental Stewardship

- Chimpzee Charity Tickets offer $50 reusable NFTs combining crypto incentives with measurable environmental impact via tree planting and CO₂ removal. - The project’s four-tier Passport system rewards long-term participation through staking and exclusive perks, aligning financial gains with conservation efforts. - Over 20,000 trees planted and 1,000 sqm of rainforest protected through verified partnerships, with $250,000 in direct environmental funding from ticket sales. - Leveraging Ethereum’s energy-effi

Why Ethereum and Remittix (RTX) Present High-Conviction Opportunities in September 2025

- In September 2025, crypto investors balance Ethereum (macro-driven) and Remittix (utility-first) to hedge risks and capture growth. - Ethereum gains from institutional ETF inflows ($5.4B+), staking yields (4.5–5.2%), and Pectra/Dencun upgrades boosting DeFi TVL by 33%. - Remittix targets $19T remittance market with 0.1% fees, 50% fee burning, and 7,500% projected returns by 2026, outpacing Ethereum's 130%. - Low correlation between assets enables diversification: Ethereum offers stability, while RTX deli