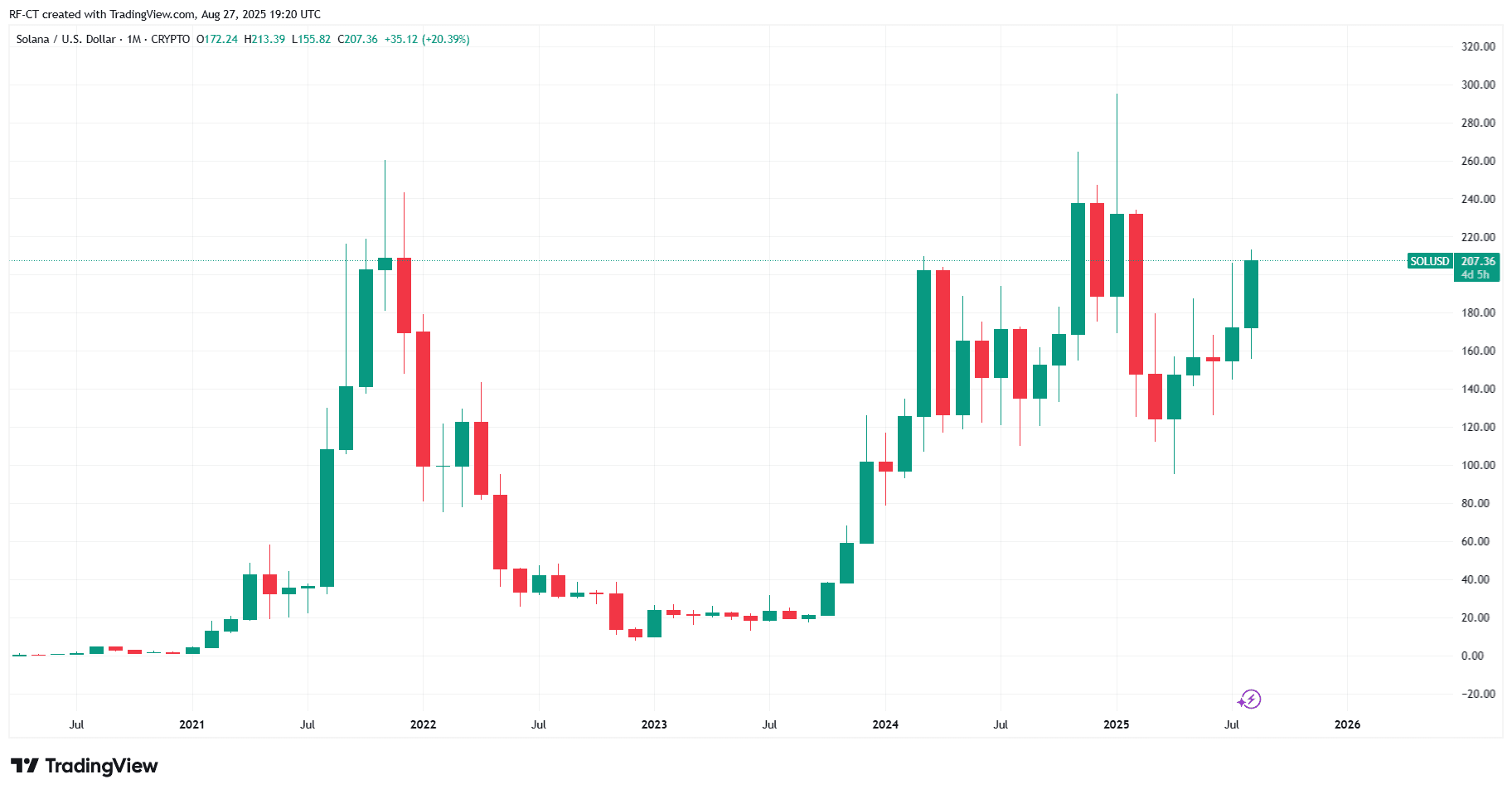

Solana Price Prediction: Can SOL Break $215 and Surge Toward $300?

Solana (SOL) is once again in the spotlight, testing critical resistance levels around $205–$215 amid a surge in institutional flows. Analysts are projecting that a breakout could propel its price toward the $300 zone if key technical thresholds hold. At the same time, Solana treasuries remain modest in staking activity, adding a layer of strategic caution to the bullish narrative.

By TradingView - SOLUSD_2025-08-27 (YTD)

By TradingView - SOLUSD_2025-08-27 (YTD)

SOL Pressing Key Resistance Around $205–$215 Spectrum

Today, Solana’s price finds itself at a strategic juncture . Technicals show heavy trading activity near the $205–$215 range, a zone that, if breached, could unlock significant upside momentum. Futures volumes have soared—one source notes $50 billion in SOL futures exchanged recently—indicating heightened market interest and potential for breakout moves.

Institutional Flows Could Fuel the Next Leg Up

Institutional demand is stepping into the foreground. Pantera Capital’s plan to raise up to $1.25 billion to build a “Solana Co.” public treasury signals deep conviction in SOL’s upward trajectory. This kind of strategic accumulation could provide the launchpad for SOL to breach resistance levels with authority.

SOL Price Prediction: $300 Within Reach

Multiple sources align on a bullish scenario if resistance gives way:

- BraveNewCoin forecasts a breakout above $207 could validate a rally toward $300, with $176 as downside buffer and $210–$215 acting as the defining test.

- CoinStats notes that solid support at $188 and a breakout could take SOL to $215–$220, with longer-term aspirations reaching $295.83.

- FXEmpire points out that with futures surging and SOL exceeding $200, the next leg could be underway ﹘ potentially setting the stage for fresh all-time highs.

By TradingView - SOLUSD_2025-08-27 (5D)

By TradingView - SOLUSD_2025-08-27 (5D)

Putting it all together, if SOL clears the $215 barrier decisively , a move toward $300 seems fully within the realm of possibility.

Staking Activity Remains Surprisingly Low

Even as price action heats up, Solana treasuries continue to underutilize staking opportunities. The majority of institutional SOL remains un-staked, potentially limiting passive yield accumulation and pointing to cautious treasury strategies in a volatile environment.

Balancing Bullish Momentum with Risk Factors

Although optimism runs high, the downside risk remains if SOL fails to hold the $200–$202 level:

Analysts warn that dropping below this threshold could keep SOL rangebound—or worse, lead to a dip toward $150, with a break below $190 possibly targeting $170.

Meanwhile, others highlight strong whale accumulation and ecosystem buybacks pushing toward $250–$295 levels, reinforcing the bullish thesis if momentum sustains.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Wang Yongli: The Profound Impact of US Stablecoin Legislation Exceeds Expectations

Crypto assets cannot become the real currency of the crypto world.

CRO’s Sudden Surge Amid Bitcoin’s Rally: Altcoin Momentum and DeFi Recovery in a Bullish Crypto Cycle

- Cronos (CRO) surged 164% weekly amid Bitcoin's $111,000 rally, driven by Trump Media-Crypto.com's $6.4B treasury partnership. - The deal injected institutional liquidity into CRO, expanding its utility in Truth Social payments and boosting TVL by 46.16% in Q3 2025. - Cronos' POS v6 upgrades and $100M Ecosystem Fund position it as a hybrid DeFi-corporate asset, outperforming Bitcoin in percentage gains. - Bitcoin's 59.18% dominance in Q3 2025 highlights a "two-tier" market structure, with altcoins like CR

The High-Stakes Gamble of Celebrity-Backed Memecoins: Why Retail Investors Are Getting Burned

- Celebrity-backed memecoins exploit influencer hype and centralized tokenomics to manipulate prices, leaving retail investors with volatile, utility-less assets. - Insiders hoard 70-94% of supply in projects like YZY and $TRUMP, using liquidity pools and pre-launched allocations to extract millions before crashes. - U.S. regulatory ambiguity enables manipulation via wash trading and sniping, while Canadian authorities demand transparency in promotional arrangements. - Academic studies confirm 82.6% of hig

Horizon: Bridging DeFi and Financial Inclusion Through Consórcio Quotas

- Aave's Horizon project uses blockchain and Chainlink tools to democratize capital access in emerging markets via tokenized real-world assets (RWAs). - Chainlink's ACE and CCIP enable compliance automation and cross-chain interoperability, unlocking $25B in institutional liquidity through structured financing models. - The reimagined Consórcio Quotas model tokenizes cooperative loans with automated KYC/AML checks, expanding financial inclusion while meeting regulatory standards. - Strategic partnerships w