Crypto treasuries set for ‘bumpy ride’ as premiums narrow: NYDIG

The premiums of digital asset treasury (DAT) firms are falling and it’s likely to worsen in the near future unless they take action, says New York Digital Investment Group (NYDIG).

NYDIG global head of research Greg Cipolaro said on Friday that the gap between stock price and net asset values (NAV) of major Bitcoin

BTC$111,058buying firms such as Metaplanet and Strategy “continue to compress” even as BTC has reached new highs.

“The forces behind this compression appear to be varied,” Cipolaro added. “Investor anxiety over forthcoming supply unlocks, changing corporate objectives from DAT management teams, tangible increases in share issuance, investor profit-taking, and limited differentiation across treasury strategies.”

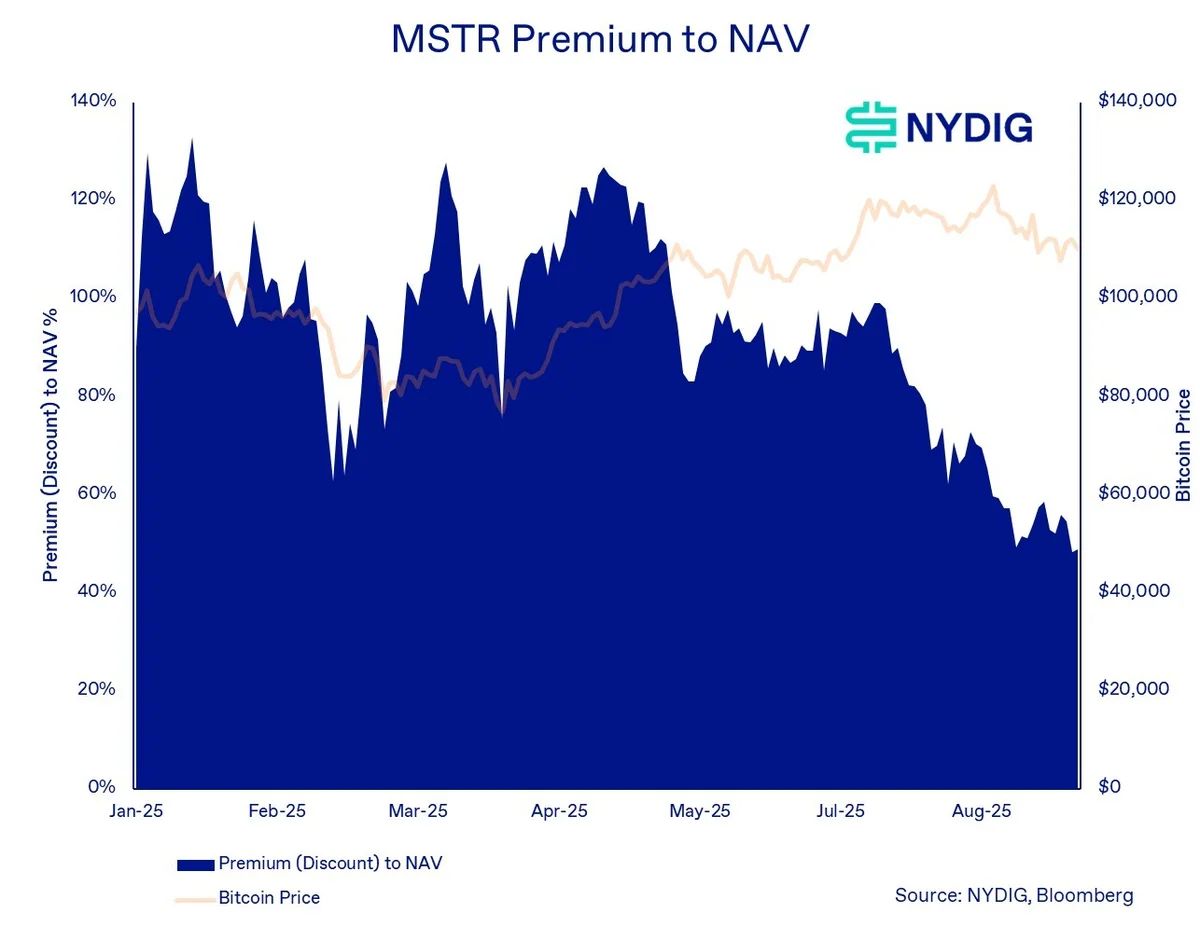

Strategy’s premium to NAV (blue) has narrowed over the past few weeks as Bitcoin (orange) has risen. Source: NYDIG

Strategy’s premium to NAV (blue) has narrowed over the past few weeks as Bitcoin (orange) has risen. Source: NYDIG

Crypto treasury firms have become the latest fad on Wall Street and have garnered billions of dollars in the last year. Investors will typically compare share prices to the value of the assets they hold as a metric to assess their health.

Share buyback programs needed to boost health

Cipolaro said a “bumpy ride may be ahead” for crypto treasury firms as many are awaiting mergers or financing deals to go public, which could see a “substantial wave of selling” from existing shareholders.

He added many treasury companies , including KindlyMD and Twenty One Capital, are trading at or below the value of recent fundraises, and a share price drop “might exacerbate selling once shares are freely tradeable.”

If shares in a treasury company traded below its NAV, “the most straightforward course of action would be stock buybacks,” Cipolaro said, which aim to increase share prices by reducing supply.

“If we were to give one piece of advice to DATs, it’s to save some of the funds raised aside to support shares via buybacks.”

Company Bitcoin holdings hit peak, but buying slows

The holdings of Bitcoin buying companies have reached a peak high this year, at 840,000 BTC, with Strategy holding 76%, or 637,000, of the total, with the rest spread across 32 other firms, according to a CryptoQuant report on Friday.

The number of purchases per month is also up, but CryptoQuant said the total amount of Bitcoin bought by the companies slowed in August to below this year’s monthly average, and the firms are scooping up less Bitcoin per transaction.

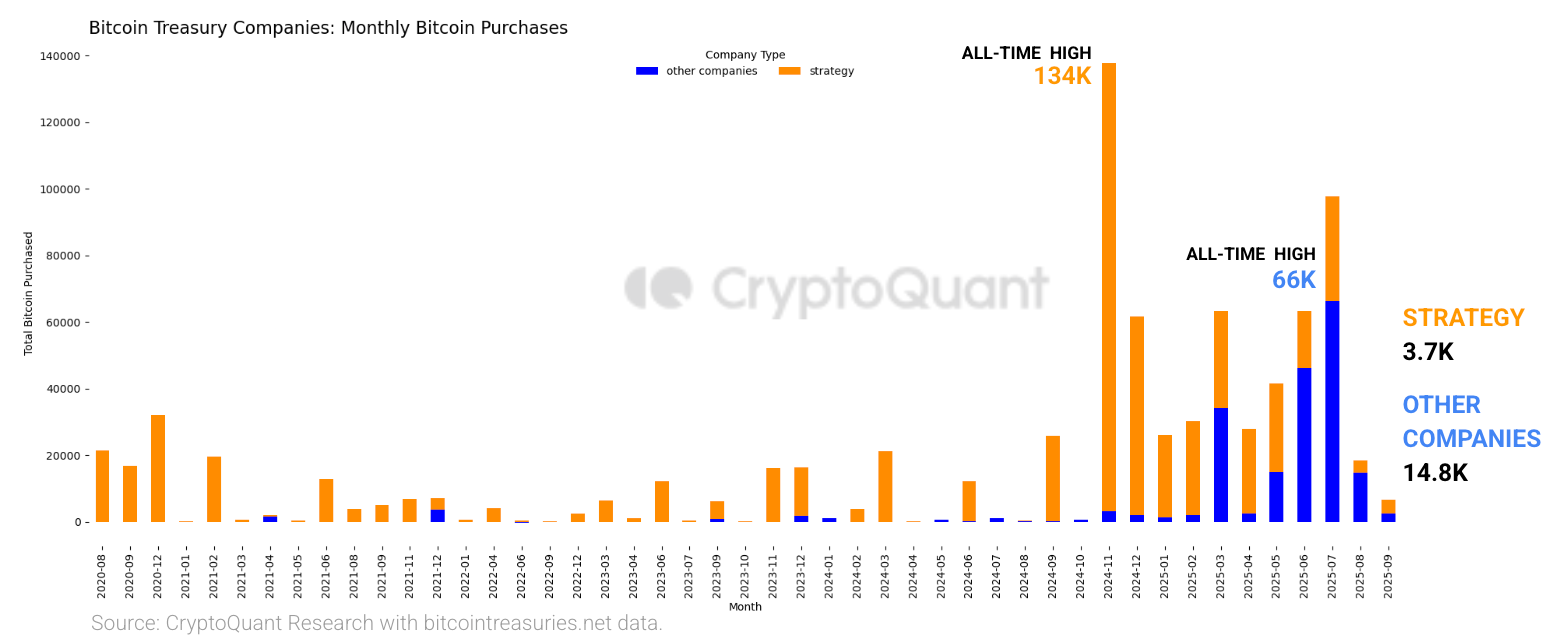

Monthly Bitcoin purchases by Strategy (orange) and other treasury companies (blue). Source: CryptoQuant

Monthly Bitcoin purchases by Strategy (orange) and other treasury companies (blue). Source: CryptoQuant

For example, Strategy’s average purchase size fell to 1,200 BTC in August compared to its 2025 peak of 14,000 BTC, while other companies purchased 86% less Bitcoin compared to their 2025 high of 2,400 BTC in March.

That’s led to a sudden slowdown in the growth of Bitcoin treasury holdings, with Strategy’s monthly growth rate dropping to 5% last month, compared to 44% at the end of 2024, while other companies saw an 8% growth in August compared to 163% in March.

Bitcoin has traded flat in the last 24 hours at around $111,200, and has fallen 10.5% from its over $124,000 peak in mid-August, according to CoinGecko.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is the biggest on-chain bull market about to break out? Are you ready?

The article believes that the crypto sector is experiencing the largest on-chain bull market in history. Bitcoin remains bullish in the long term, but its short-term risk-reward ratio is not high. There is a surge in demand for stablecoins, and regulatory policies will become a key catalyst. Summary generated by Mars AI. This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Solana CME futures open interest hits new high of $1.5B after launch of first US Solana staking ETF

JPMorgan expects September Fed rate cut despite CPI risks and warns of S&P 500 volatility

Ripple Expands Crypto Custody Partnership with BBVA in Spain

Quick Take Summary is AI generated, newsroom reviewed. Ripple and BBVA extend their partnership, offering digital asset custody services in Spain. The service supports compliance with Europe’s MiCA regulation. BBVA responds to growing customer demand for secure crypto solutions.References Ripple Official X Post Ripple Press Release