Sol Strategies rings the 'STKE' listing bell: Solana's Wall Street debut

Source: Token Dispatch

Author: Prathik Desai

Compiled and organized by: BitpushNews

September 9, 2024

Sol Strategies, then still operating under its original name Cypherpunk Holdings, had not yet undergone its rebranding.

It was still trading on the Canadian Securities Exchange, a market typically reserved for small and micro-cap companies. Just a few months prior, the company had hired Leah Wald, former CEO of Valkyrie, as its new CEO. At that time, Cypherpunk was still obscure, with little attention from investors.

Meanwhile, Upexi was focused on driving consumer product sales for DTC brands, mainly targeting Amazon niches such as pet care and energy solutions, competing fiercely for traffic; DeFi Development Corp (DFDV, then still known as Janover) was preparing to launch a platform connecting real estate syndicators and investors; and Sharps Technology was manufacturing medical-grade syringes—a highly niche medical tech asset that struggled to attract investor attention.

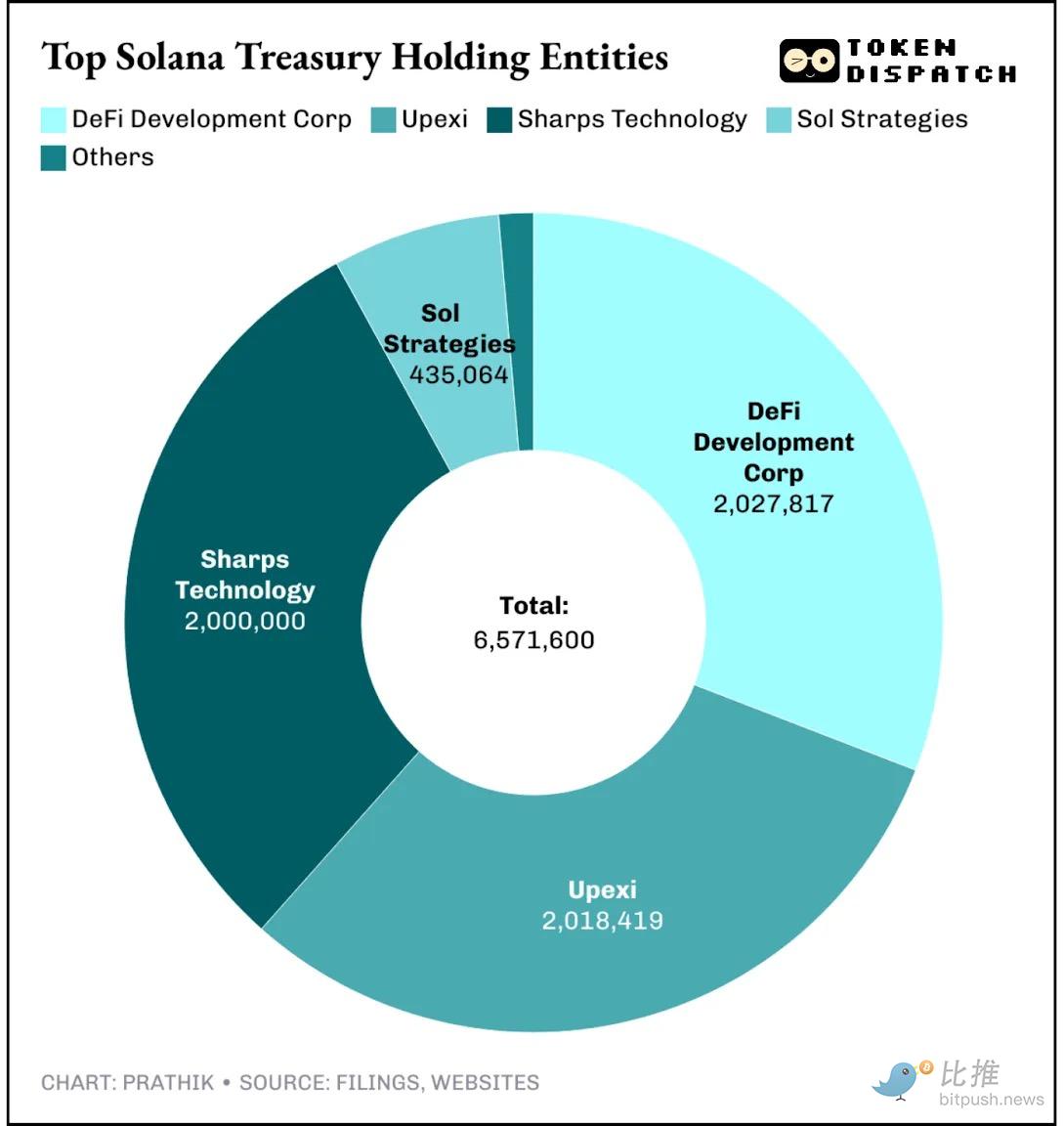

These companies, at the time, were all small—in both scale and ambition. Together, they held less than $50 million worth of Solana (SOL).

Fast forward a year, and the situation has changed dramatically.

Today, they proudly stand on Nasdaq—the world’s second-largest stock exchange—holding over 6 million SOL, with a valuation as high as $1.5 billion. The value of their Solana holdings has surged 30-fold in just one year.

From the Margins to the Center: Nasdaq’s Recognition

This Tuesday, the opening bell at New York’s Nasdaq not only marked Sol Strategies’ official listing, but also resonated on-chain: users could participate in a “virtual bell-ringing” by sending Solana transactions via stke.community, permanently recording this historic moment.

For Sol Strategies, which previously traded on the Canadian Securities Exchange (ticker HODL) and the OTCQB market (ticker CYFRF), this was a true “graduation ceremony”—making it onto the Nasdaq Global Select Market is no easy feat. This market is known for its strict standards and typically only admits blue-chip companies. This listing has earned Sol Strategies a legitimacy that most crypto companies can only dream of.

This is also why Sol Strategies’ listing is so significant, even though institutions seeking Solana exposure on Wall Street could already invest in Upexi and DeFi Development Corp.

Unlike Upexi and DeFi Dev Corp (both of which were already public companies before pivoting to holding over 2 million SOL each in their Solana treasuries), Sol Strategies chose the slow route. It built validator operations, secured institutional delegations such as ARK’s 3.6 million SOL, passed a SOC 2 audit, and strategically positioned itself on the Nasdaq Global Select Market—the exchange’s top tier.

While other companies merely hold SOL, Sol Strategies is actively running the infrastructure that supports it, turning these holdings into a viable business.

Diving into the Financials: Staking as Revenue, Cash Flow Turns Positive

I took a deep dive into Sol Strategies’ balance sheet to understand the story behind the numbers.

In the quarter ending June 30, Sol Strategies reported revenue of 2.53 million CAD (about $1.83 million). While this number may seem modest on its own, the real story lies in the details. This revenue came entirely from staking about 400,000 SOL and operating validators that secure the Solana network—not from selling traditional products. Upexi is weighed down by a non-crypto e-commerce business, while DFDV is heavily reliant on ongoing financing to drive growth, with 40% of its revenue still coming from its non-crypto real estate business.

By offering validator-as-a-service, Sol Strategies has carved out a new revenue stream from its Solana treasury business. This approach provides recurring income without the burden of ever-increasing debt or traditional overhead costs.

Sol Strategies represents institutional clients who delegate SOL, including the 3.6 million SOL delegation from Cathie Wood’s ARK Invest in July. The commissions from these delegations generate a stable revenue stream. Call it yield, call it fees, but in accounting terms, it’s revenue—something many crypto treasuries cannot demonstrate.

A typical Solana validator charges about 5%–7% commission on staking rewards. The base staking yield hovers around 7%, so these delegated tokens generate about 0.35%–0.5% of their nominal value annually for the validator.

With 3.6 million SOL (worth over $850 million at current prices), even if Sol Strategies’ own treasury saw no price appreciation or yield, this translates to over $3 million in annualized fee revenue. This is actually an additional revenue stream, more than half the staking yield from its own 400,000 SOL holdings, created entirely by external capital.

However, Sol Strategies’ third-quarter bottom line showed a net loss of 8.2 million CAD (about $5.9 million). But if you exclude one-time expenses such as amortization of acquired validator IP, stock-based compensation, and listing costs, the operations themselves are cash-flow positive.

Core Advantages

What truly sets Sol Strategies apart from its competitors is how it views Solana.

For the company, the product is not just the Solana token; it’s the Solana ecosystem. This unique perspective is both innovative and strategic, making Sol Strategies stand out among its peers in the field.

As more delegators join, the network becomes more secure, and the improved node reputation attracts even more delegations—creating a flywheel effect. Every user who delegates SOL to Sol Strategies is both a client and a co-creator of its revenue,turning community participation into a measurable driver of shareholder value.

This model gives it an edge even among competitors with much larger holdings. Currently, at least seven public companies collectively control 6.5 million SOL (worth $1.56 billion), accounting for 1.2% of SOL’s total supply.

In the race for Solana treasuries, each company is striving to become the preferred proxy for investors seeking Solana exposure.

Each company is slightly different: Upexi acquires SOL at a discount, DFDV bets on global expansion, while Sol Strategies is betting on diversified war chests.

The game is the same: accumulate SOL, stake it, and sell a wrapper to Wall Street.

The path for bitcoin’s adoption on Wall Street was paved by companies like MicroStrategy, which transformed from a software business into a leveraged BTC treasury company and through a highly successful spot ETF. Ethereum has followed a similar path, with companies like BitMine Immersion, Joe Lubin’s SharpLink Technologies, and the recent spot ETF.

For Solana, I foresee adoption happening mainly through operating companies within the network. These businesses not only hold assets, but also run validators, earn fees and staking rewards, and report quarterly earnings. This model is closer to an actively managed company than an ETF.

It is this combination of net asset value (NAV) appreciation and real cash flow that is likely to convince investors to invest via this route. If Sol Strategies can make all this work, it could become the BlackRock of the Solana space.

Risk Warning: Challenges of a New Phase

The future hints at a closer relationship between Wall Street and Solana.

Sol Strategies is already exploring tokenizing its equity and issuing it on-chain. Imagine STKE stock not only existing on Nasdaq, but also becoming a Solana on-chain token, tradable in DeFi pools and instantly settled with USDC—this “public equity + on-chain trading” bridge is something ETFs cannot cross. While still speculative, the trend is blurring the lines between public equity and crypto assets.

However, this is no easy feat. Listing on Nasdaq introduces new challenges, including greater responsibility for Sol Strategies.

-

Validator operation errors or governance missteps could trigger immediate investor feedback

-

Betting on the Solana ecosystem (rather than just the token) means higher risks and returns

-

The SOL network itself still faces risks of outages and competition from new public chains

-

If the stock price falls too far below NAV, arbitrageurs may ignore fundamentals and sell off

Nevertheless, Sol Strategies’ listing remains Solana’s best chance to seize a “front-row seat” on Wall Street. Can on-chain treasuries be packaged into wrapped investment products and integrated into Nasdaq? Sol Strategies has now taken up this challenge.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$2.4B in Shorts at Risk if Bitcoin Hits $120K

Over $2.4 billion in short positions could be wiped out if Bitcoin climbs to $120K.Why Short Sellers Should Be WorriedBullish Sentiment Continues to Build

Bitcoin Nears All-Time High with Just 7.4% to Go

Bitcoin is now only 7.4% away from hitting its all-time high, signaling strong market momentum.What’s Driving Bitcoin’s Momentum?Is a New ATH Coming Soon?

Shiba Inu Price Gains 10.6% as Resistance Nears $0.00001477 in Active Market

Compute belongs to everyone, decentralize it | Opinion