Solana price (SOL) is trading near $236, showing limited net change as volumes decline. Short-term momentum favors sideways action between $230–$240, while failure to hold $244.70 raises probability of a correction toward $220–$230 within days.

-

Current SOL range: $230–$240 (most likely short-term outcome)

-

Volume is falling, indicating low conviction from buyers or sellers.

-

Failure to fix above $244.70 increases risk of a pullback to $220–$230.

Solana price analysis — SOL price near $236; watch $244.70 resistance and $220–$230 support. Read the brief market outlook and trade considerations.

What is the current Solana price outlook?

Solana price is largely unchanged intraday, trading around $236 as of press time, with limited directional conviction. Volume contraction suggests a likely continuation of sideways trading between $230 and $240 unless buyers push a decisive close above $244.70 or sellers target $220 support.

How is SOL/USD reacting to resistance and support levels?

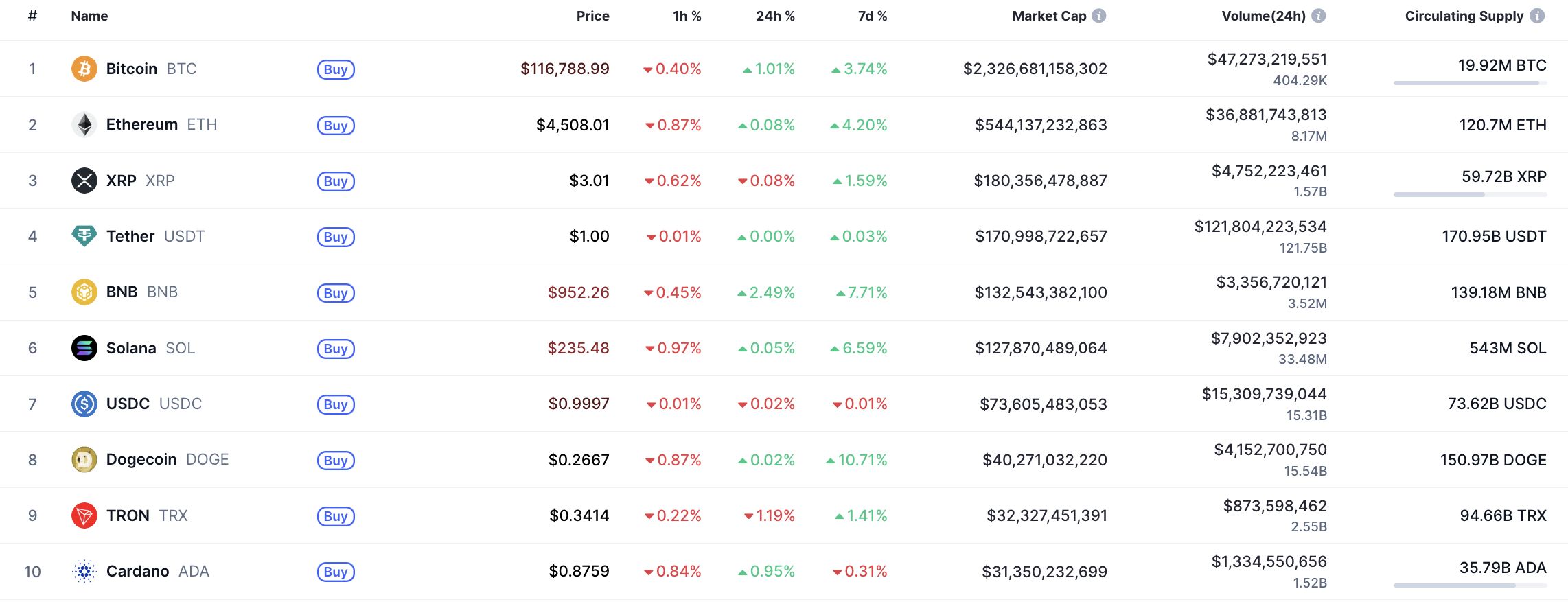

On the hourly chart, SOL fell after a false breakout above local resistance at $237.85. Short-term traders should watch $237.85 and $244.70 as key ceilings. A sustained drop would target $230, then the $220 zone. CoinMarketCap shows the broader market mostly rising, but individual coins like SOL can lag.

The market is mainly rising today, however, there are some exceptions to the rule, according to CoinMarketCap. Solana is among those showing muted movement versus the broader market.

Top coins by CoinMarketCap

Why did SOL fail to sustain the breakout?

Short-term technicals show a false breakout above $237.85 on the hourly timeframe. Declining volume accompanied the move, which often signals a lack of follow-through. Traders should interpret this as a cautionary sign: without higher volume, breakouts are vulnerable to reversal.

What does the longer time frame indicate for Solana?

On the daily and weekly charts, SOL remains away from major structural levels. Volume has been falling across sessions, indicating market indecision. This suggests neither bulls nor bears are ready to commit fully, increasing the odds of continued range-bound action through the near term.

Image by TradingView

On the hourly chart, the price of SOL is going down after a false breakout of the local resistance of $237.85. If the decline continues, one can expect a test of the support by the end of the day.

Image by TradingView

On the longer time frame, the rate of SOL is far from key levels. Thus, the volume is falling, which means none of the sides is ready to seize the initiative. In this case, sideways trading in the narrow range of $230–$240 is the most likely scenario.

Image by TradingView

From the midterm point of view, the price has once again failed to fix above the $244.70 level. Until it happens, traders may expect a correction to the $220–$230 zone. SOL is trading at $236 at press time.

Frequently Asked Questions

What are the immediate support and resistance levels for SOL?

Immediate resistance sits at $237.85 and $244.70. Immediate support is at $230, with the $220–$230 zone acting as a stronger corrective area if selling intensifies.

How should traders manage risk on SOL positions?

Use tight stop-losses just below the short-term support level, size positions to limit downside exposure, and avoid adding risk while volume remains low and price action is indecisive.

Key Takeaways

- Range-bound bias: SOL likely trades between $230–$240 until a clear breakout occurs.

- Volume matters: Falling volume signals low conviction; watch for volume spikes to confirm moves.

- Actionable levels: Monitor $244.70 for bullish confirmation and $220–$230 for potential support-based entries.

Conclusion

This Solana price update emphasizes a cautious, evidence-based outlook. SOL price is near $236 with contracting volume, favoring a sideways market in the immediate term. Traders should wait for a decisive close above $244.70 or increased selling momentum toward $220–$230 before shifting directional bias. For continued coverage, follow COINOTAG updates and market data from CoinMarketCap and charting on TradingView (plain text references).