This is not the end, but a bear market trap: Cycle psychology and the prelude to the next bull run

The recent market performance has left many investors confused. Bitcoin remains stagnant, Ethereum has entered a consolidation phase after a brief rise, and altcoins lack sustained liquidity. For many, this seems like a signal of the "end of the bull market," but in reality, this is a classic Bear Trap.

1. Historical Bear Traps

Every crypto cycle has similar moments:

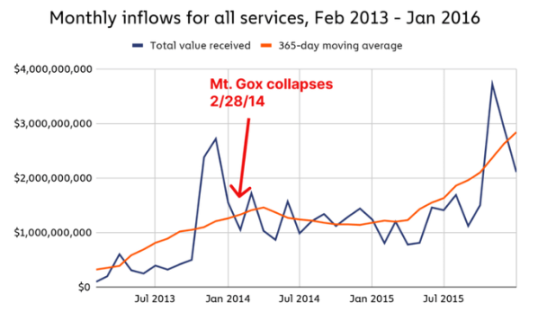

2011 and 2013: The Mt.Gox collapse triggered massive panic;

2017: Bitcoin’s first sharp drop caused a large number of investors to exit the market;

2021: As cryptocurrencies entered the mainstream, the fear triggered by market declines became even more intense.

These phases are often accompanied by 50%-80% pullbacks, each time being considered the "end" of crypto, but in fact, they have proven to be merely the prelude to a new round of surges.

2. The Market’s Psychological Cycle

The market operates according to a fixed psychological sequence:

Euphoria

Sharp Correction

Panic

Exit of Weak Hands

Final Impulse

This pattern is almost unchanged, whether in crypto or traditional financial markets.

3. Current Market Signals

Although short-term sentiment is sluggish, data shows the market has not lost its vitality:

ETF inflows remain stable, indicating institutional interest has not waned;

The Altseason Index is climbing;

The M2 liquidity index is rising;

**BTC.D (Bitcoin Dominance)** is slightly declining, which means funds are gradually preparing to flow into altcoins.

This is more like an "endurance race," where whales create fear and exhaustion to force retail investors to sell, thus accumulating at lower prices.

4. How Should Investors Respond?

At times like this, emotions are often the biggest enemy. The correct approach is to:

Stay calm and not be swayed by short-term fluctuations;

Develop and stick to a clear trading plan;

Focus on core assets: BTC, ETH, SOL (SOL’s performance is often a precursor to altcoin rotations);

Track macro data and key market indicators.

Conclusion

The current market is not the end of the bull market, but a classic Bear Trap within the cycle. Its essence is to drive out impatient investors through fear and exhaustion, while the real rally often erupts after this cleansing.

For rational investors, now is:

The stage to accumulate at low levels, not panic sell;

A time to test patience and discipline;

An opportunity to build up for the final strong rally.

The real winners are not those who go with the emotional flow, but those who can endure fear, resonate with the market, and reap the rewards in the final celebration.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The "Singularity Moment" of Perp DEX: Why Can Hyperliquid Kick Open the Door to On-Chain Derivatives?

The story of Perp DEX is far from over—Hyperliquid may be just the beginning.

Huma Finance Unveils Project Flywheel to Power Solana PayFi

Quick Take Summary is AI generated, newsroom reviewed. Project Flywheel combines yield amplification, risk protection, and token demand on Solana. Looping strategy uses $PST collateral for structured borrowing and reinvestment to amplify stable APY returns. The Huma PayFi Reserve acts as a backstop using staked SOL (HumaSOL) to secure assets and mitigate risk. Huma Vault automates yield strategies to drive $HUMA token demand and increase staking participation.References Introducing Project Flywheel

Altcoin ETF Wave Grows as SEC Reviews XRP, DOGE and LTC

Quick Take Summary is AI generated, newsroom reviewed. The SEC is reviewing ETF filings for major altcoins like XRP, DOGE, and LTC. New listing rules could fast-track altcoin ETF approvals within 75 days. Over 90 crypto ETF proposals are now awaiting review under the new system. Analysts predict an altcoin ETF boom could reshape the crypto market by year-end.References The SEC is reviewing ETF filings for $XRP, $DOGE, and $LTC and several others, hinting at an upcoming altcoin ETF boom!

Interview with Cathie Wood: Ark Invest's Three Main Directions, Bitcoin, Ethereum, and Solana Are the Final Choices

Cathie Wood also mentioned Hyperliquid, saying that the project is reminiscent of Solana's early development stage.