In the past few months, Hyperliquid has received a lot of attention. This article aims to inform everyone about the latest developments and future expectations. It serves as both an introduction to Hyperliquid and includes my nuanced insights into the overall ecosystem.

TL;DR

For readers who just want the highlights and key points:

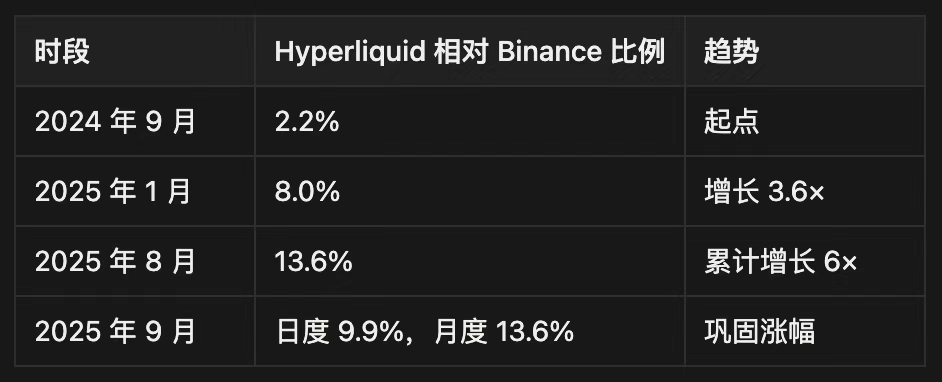

Hyperliquid has quietly captured 13.6% of Binance's monthly perpetual contract trading volume, generating $116 million in monthly revenue—yet most analyses overlook the subtle risk/reward dynamics that will determine whether it becomes a breakthrough infrastructure project in crypto or just another DeFi casualty.

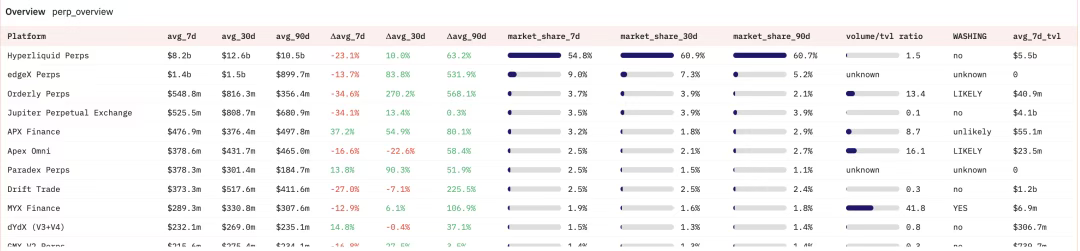

Market Position

· Accounts for 70% of decentralized perpetual contract trading volume, with daily trading volume at 9.9% of Binance's;

· 665,000 traders generate an average of $300,000 in trading volume per month per person (trading intensity is 65 times that of Binance retail users);

· $4.4 billion USDC on the platform accounts for 71% of Arbitrum's total USDC TVL.

Fundamentals

· $116 million in monthly revenue, of which 97% is returned to ecosystem participants;

· 38% of total token supply (388 million HYPE) is still reserved for future growth incentives;

· 24 validator nodes maintain network security vs. Ethereum's 1 million+ (a trade-off between centralization and performance).

Competitive Landscape

· Estimated 15–25% wash trading (better than industry standard but still worth monitoring);

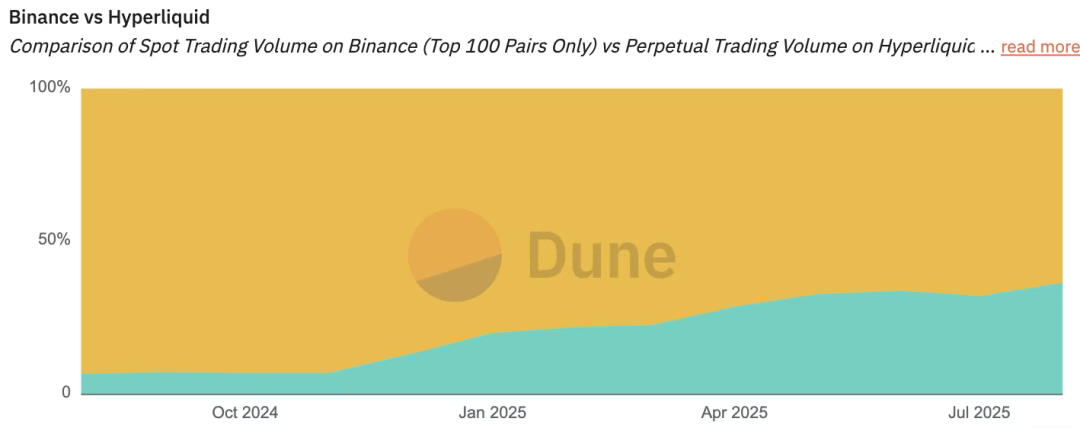

· Market share of Binance perpetual contracts grew from 2.2% to 13.6% in 12 months;

· Jupiter platform's $32 billion in 60-day perpetual contract trading volume shows intensifying on-chain competition.

While most people focus on token price appreciation, I analyze its underlying business sustainability through multiple market cycles (including bear market stress tests and competitive pressures).

· Token unlocks of 238 million starting at year-end will create an average daily sell pressure of $17 million—eight times current buyback capacity, a structural resistance most bulls ignore;

· $600 million in Nasdaq-listed treasury allocation and VanEck endorsement indicate non-retail demand that could absorb unlock pressure, but institutional adoption timeline remains uncertain;

· Zero gas fee trading + 0.2s latency + built-in order book create switching costs, but technical debt and consensus mechanism limitations may erode these advantages.

Hyperliquid may face user attrition due to token depreciation and yield compression, but its 97% fee return model and sustainable revenue generation make it a promising multi-cycle infrastructure project.

· Unlike traditional DeFi protocols that rely on token emissions or subsidized yields, Hyperliquid generates revenue from real economic activity and returns almost all of it—demonstrating resilience when unsustainable yield models collapse;

· Expect a 60–80% drawdown during the 2025–2027 unlock period, but business acumen and infrastructure advantages position it for a strong emergence during industry consolidation.

This article goes straight to the real keys to Hyperliquid's long-term success: a sustainable business model, competitive positioning, and the ability to survive multiple cycles during industry-wide existential crises.

I. What Happen?

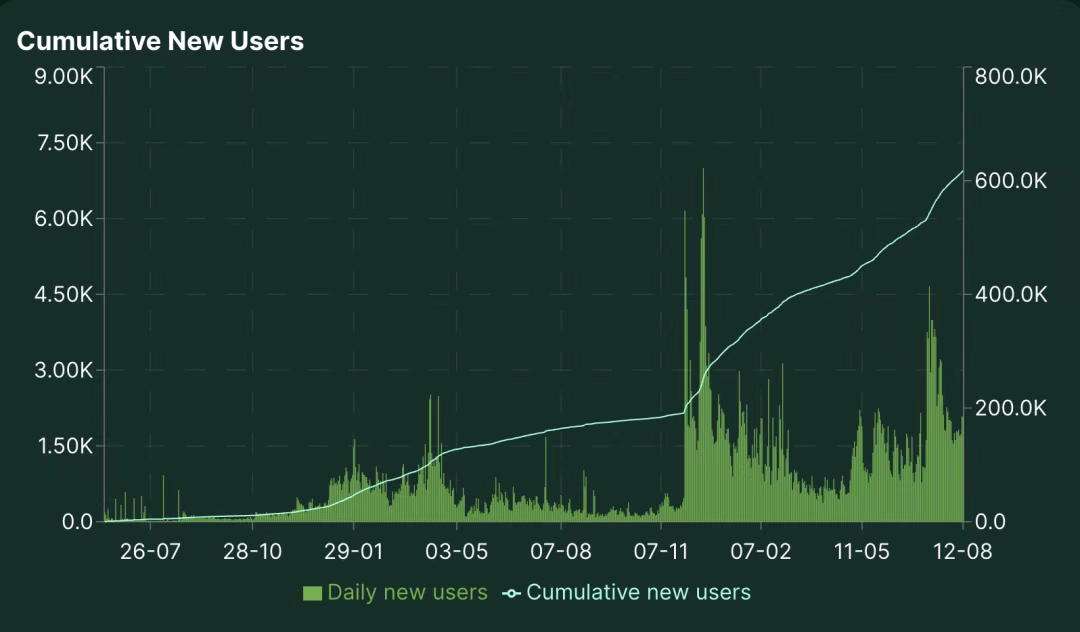

The well-known part—Hyperliquid is a leading decentralized perpetual contract exchange (Perpetual DEX) seeking vertical expansion. It accounts for 60% of the decentralized perpetual contract market's trading volume, driven by regulatory arbitrage opportunities, airdrop campaigns, excellent UI/UX, deep liquidity, and strong community consensus.

Early Growth

Users can use a perpetual contract exchange with seamless UI/UX without KYC (though still subject to regional regulations). This is thanks to:

# Zero gas fees and low trading costs, a unique order cancellation and post-only priority mechanism superior to other order types (such as IOC), which significantly reduces harmful HFT sniping (by more than 10x).

# Intuitive interface, one-click DeFi operations.

# Ultra-fast trading experience, 0.2s block time, achieving 20,000 TPS on-chain via a unique consensus model.

# Excellent market makers and liquidity provision, initially bootstrapped by the Hyperliquid core team.

In a crypto world where everyone in a bull market is eager for convenient leverage channels (e.g., meme coins, prediction markets, derivatives, altcoin beta, etc.), perpetual contracts have found their footing as the simplest way to access leverage, achieving product-market fit (PMF).

Airdrop

Subsequently, their airdrop began distribution—covering nearly 94,000 wallets, with each participant receiving an average of $45,000 to $50,000 worth of HYPE tokens:

· No insider sell pressure;

· Wide user ownership fosters loyalty and alignment of interests.

Notably, the Hypios community also provided extremely generous airdrops to its holders, and even meme coins on Hyperliquid (such as $BUDDY, $PURR) maintained low sell pressure and strong holders.

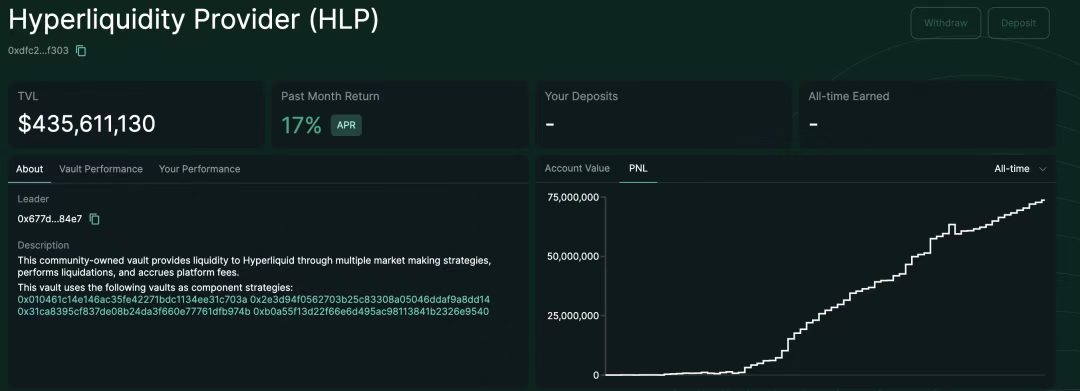

Since traders/DeFi power users received tokens, many chose to stake (to reduce trading fees) and deposit into the HLP vault, enhancing the trading experience and kickstarting a strong flywheel effect.

Heavy users, empowered by newfound wealth, continued to actively use the platform—fee revenue is used to buy back tokens—reinforcing product and market influence—attracting more users and trading volume to Hyperliquid.

As a result, this mass distribution helped HYPE avoid the common post-airdrop price drop. In fact, in the following months, HYPE's price soared by 1,179%—from $3.90 at its November 2024 launch to $47 in August 2025.

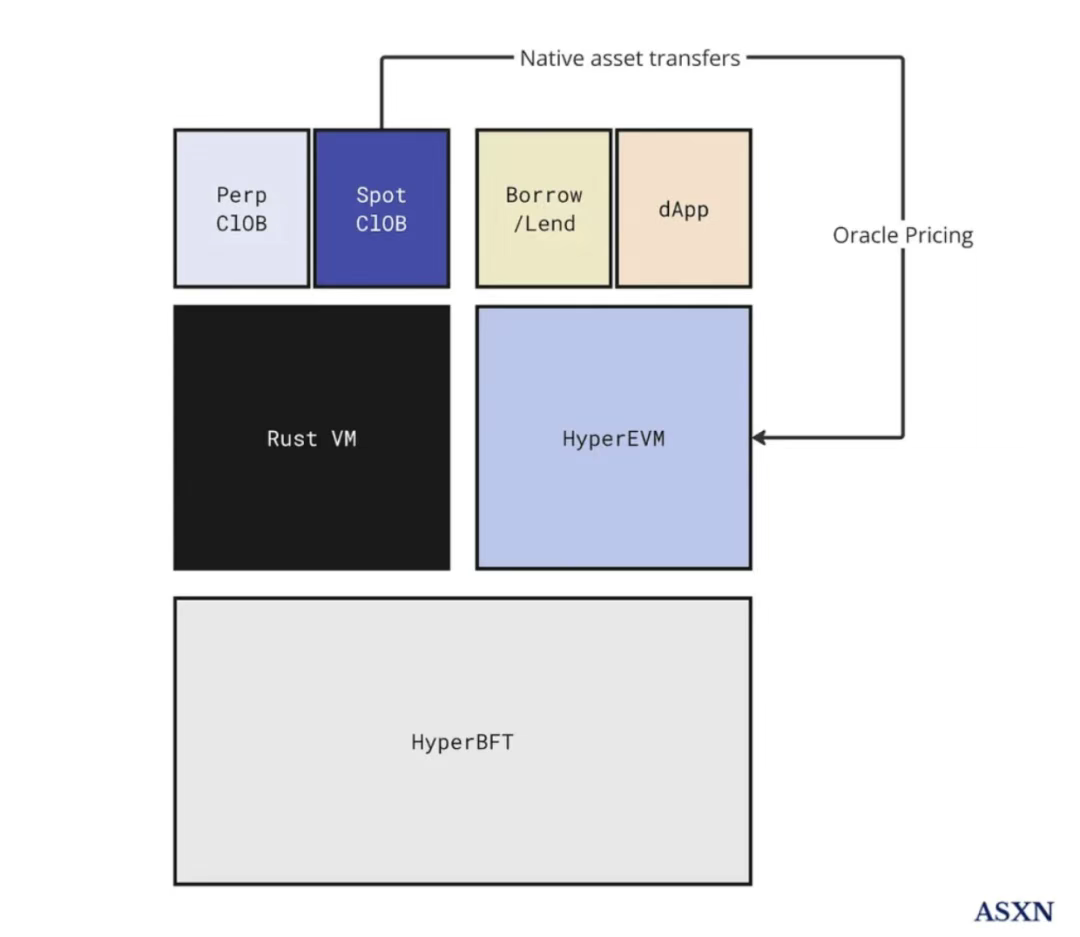

The HyperEVM

On February 18, HyperEVM was officially launched.

▲ Source: ASXN

It is not a standalone chain, but is secured by the same HyperBFT consensus mechanism as HyperCore. Both share state and essentially use a Cancun hard fork version without Blob.

Developers can now access a mature, highly liquid, and high-performance on-chain order book. For example, a project can deploy an ERC20 contract on HyperEVM using standard EVM development tools and permissionlessly deploy the corresponding spot asset in HyperCore's spot auction. Once linked, users can use the token in HyperEVM applications and trade it on the same order book.

This empowers developers and the community by supporting a broader range of use cases. It allows the vast user base and liquidity aligned with Hyperliquid to further leave their mark on the ecosystem. It also improves liquidity by providing a composable, programmable layer, opening another avenue for Hyperliquid usage to flow back to participants.

Notably, this also provides a pathway for projects outside the Hyperliquid ecosystem to join. For example, Pendle is now integrated with HyperBeat, as well as Kinetiq's LST and LoopedHYPE's WHLP LHYPE. EtherFi and HyperBeat are launching preHYPE. Morpho offers vaults on HyperBeat, with top curators including MEV Capital, Gauntlet, Re7 labs, and more.

The network effect of HyperEVM is not about cloning or EVM compatibility; its core is to create a programmable financial operating system where code, liquidity, and incentives are natively aligned and instantly accessible. Liquidity is not fragmented; instead, as more use cases, yield sources, and protocols are integrated, liquidity multiplies. As the entire tech stack enriches, both users and developers benefit, making the Hyperliquid ecosystem the "center of gravity" for future DeFi.

II. What Now?

Hyperliquid, in an ecosystem full of financialized individuals—farmers, quant traders, developers, and traders of all kinds—already has all the liquidity and infrastructure it needs. So, how to expand outward from here?

Builder Codes

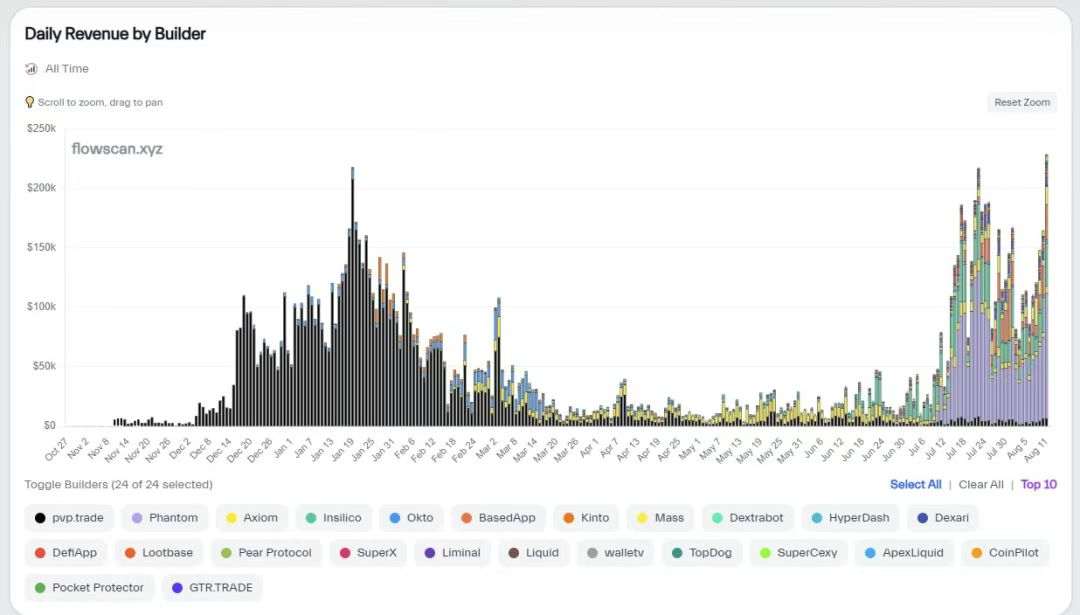

Hyperliquid launched Builder Codes, allowing the platform to be integrated into any distribution channel and letting integrators earn a share of the fees. For the Phantom wallet with 17 million users, this is undoubtedly an excellent opportunity to expand wallet use cases and increase revenue.

HIP Proposal Overview

Moreover, Hyperliquid Improvement Proposals (HIP1, 2, 3) have further deepened the tech stack vertically.

· HIP-1 is a standard for deploying native tokens and on-chain spot order books.

· HIP-2 is dedicated to permanently injecting liquidity into HIP-1 token spot order books.

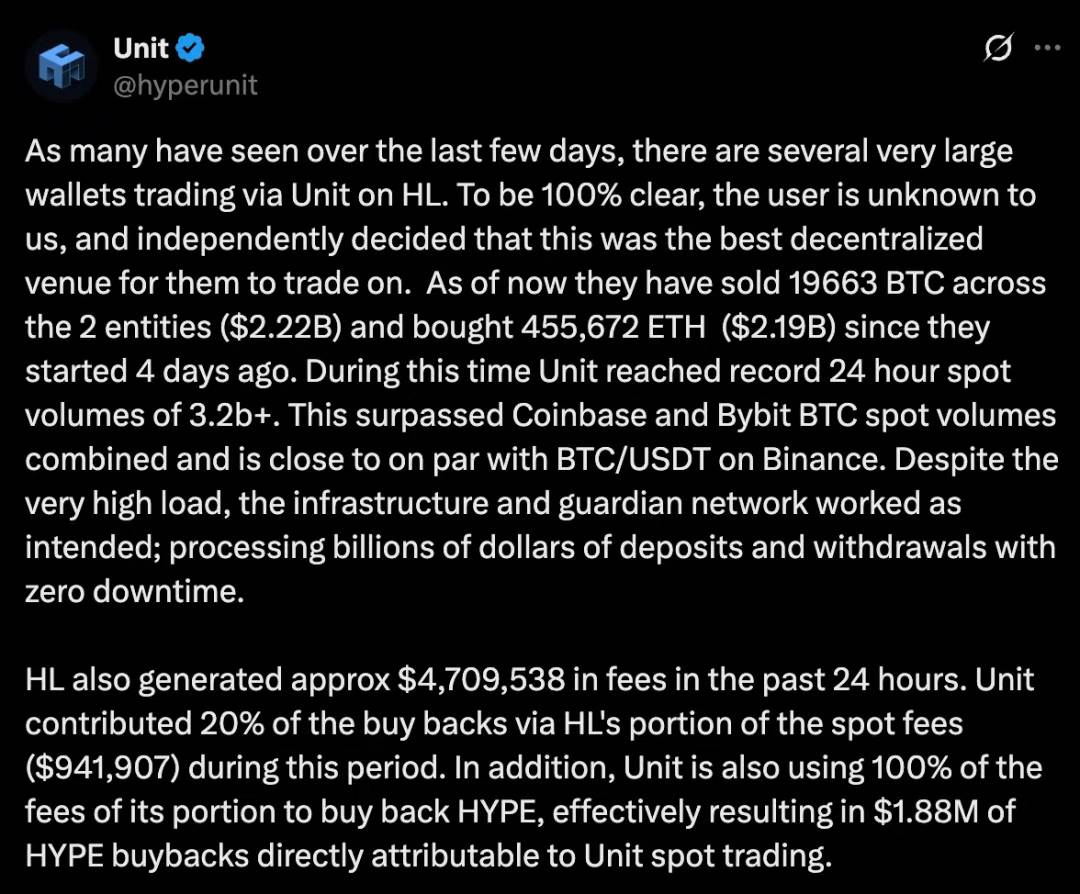

The Unit project has strongly promoted HIP-2 adoption by providing a more native spot trading experience. Essentially, Unit is a multisig wallet that allows traders to index native chains and trade permissionlessly on Hyperliquid.

But arguably the most impactful update is HIP-3, which introduces permissionless, developer-deployed perpetual contract markets to the core infrastructure. Before HIP-3, only the core team could launch perpetual contract markets, but now anyone staking 1 million HYPE can deploy their own market directly on-chain.

The process is as follows:

1. Stake 1 million HYPE.

2. Define market details: market name and code (still need to be purchased via auction, similar to spot), choose collateral type, oracle source and backup logic, leverage and margin parameters, contract specs, and funding mechanism.

3. Set fee structure (set base trading fee and any additional custom fees), decide the fee share for market deployers (up to 50%). Similar to the revenue-sharing relationship between Binance and Circle.

4. Deploy the market

Market operators need to bootstrap liquidity themselves, while Hyperliquid receives the other 50% of fees (which will flow back to HYPE tokens). Note that these markets will not appear directly on the Hyperliquid main interface, but anyone can choose which markets to connect to. This shifts Hyperliquid's role from just a launch platform to more of an asset provider.

So far, Hyperliquid has successfully tackled the following core areas:

· High-performance trading engine: Provides a trading experience for spot and perpetual contracts that effectively mimics centralized exchange performance. This includes leverage trading and spot transfer functions. Combined with consumer-grade UX through distribution channels.

· EVM as a programmable execution layer: Built a programmable layer (HyperEVM) closely connected to the user experience and liquidity hub.

· Stablecoin infrastructure: Successfully attracted $5.6 billion worth of USDH into its ecosystem.

For Hyperliquid itself or other projects in its ecosystem (based on HyperEVM), there are still broad opportunities to explore in the future:

· Native fiat on/off ramps: Build more convenient, low-cost bridges between fiat and crypto.

· Payment solutions: Develop new payment applications leveraging its high-speed, low-cost network.

· Web2-level consumer applications: Develop complex decentralized products with experiences comparable to traditional Web2 apps to attract a broader user base.

· Risk management engine: Create better risk management and hedging tools for institutions and advanced traders.

Current State of Token/Liquidity

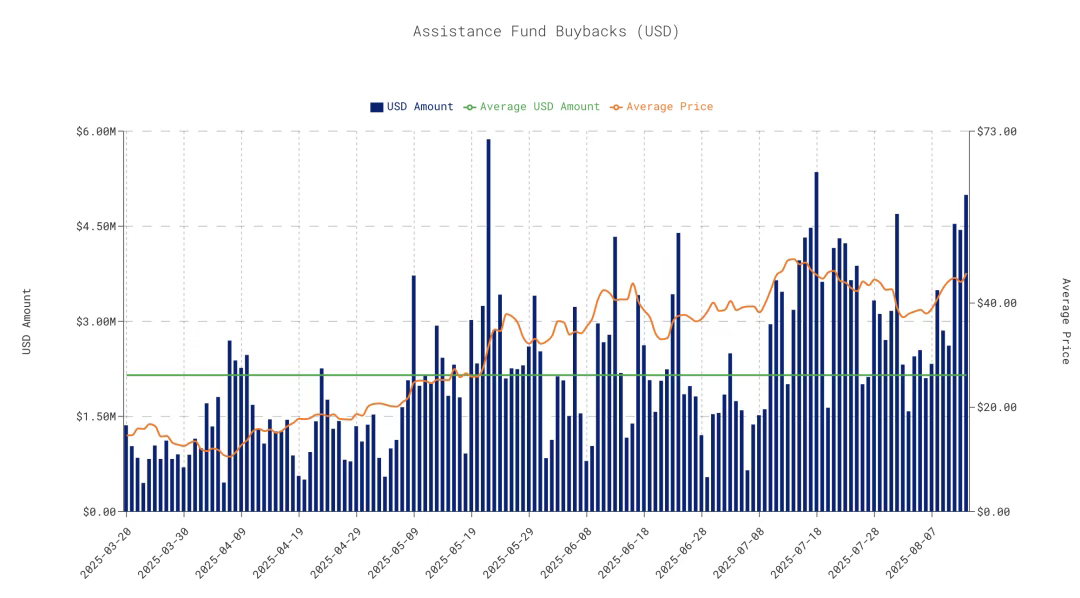

The buyback program led by the Assistance fund has so far accumulated 28 million HYPE bought back, funded by 54% of total revenue (46% of perpetual contract fees are allocated to HLP depositors, meaning 92–97% of total revenue is returned to users), with an average daily buyback amount of $2.15 million.

Currently, 38% of the total HYPE supply of 1 billion is still reserved for airdrops and incentives, which has the potential to further drive ecosystem usage. However, this is a double-edged sword, as such a large increase in circulating supply could create massive sell pressure far exceeding current buyback capacity.

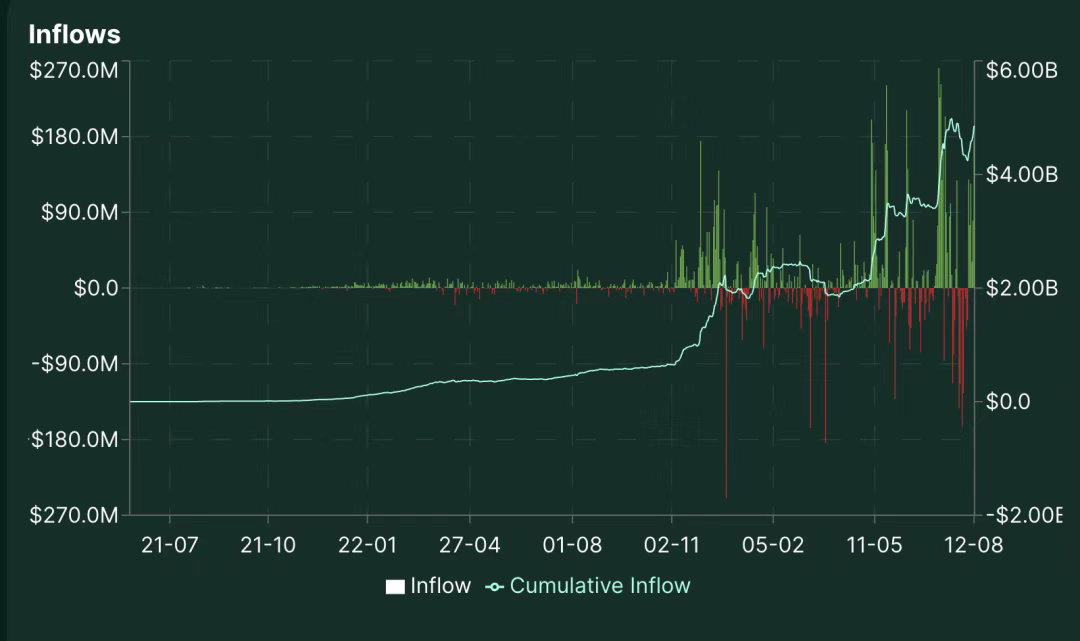

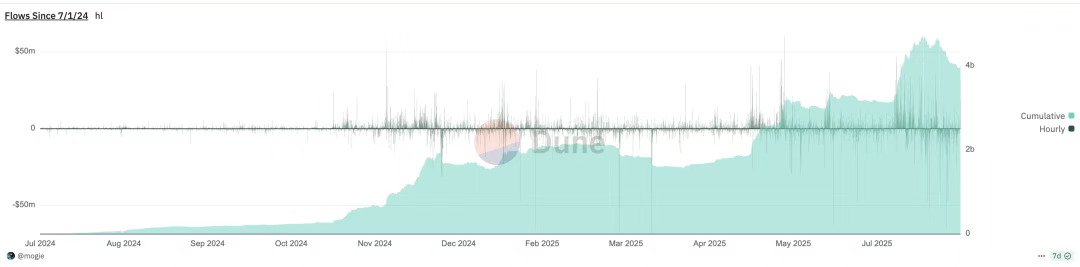

In terms of USDC inflows, Hyperliquid continues to grow, with a current balance of about $4.4 billion. Surprisingly, this accounts for 71.11% of Arbitrum's total USDC TVL, and these funds are being used in the Hyperliquid ecosystem.

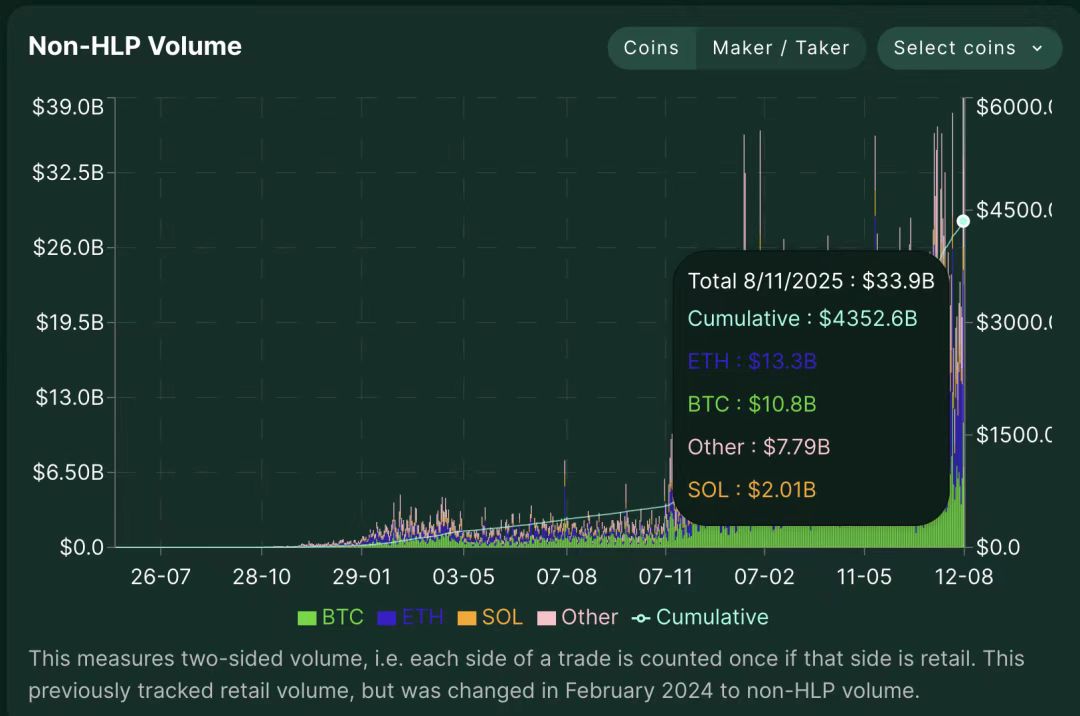

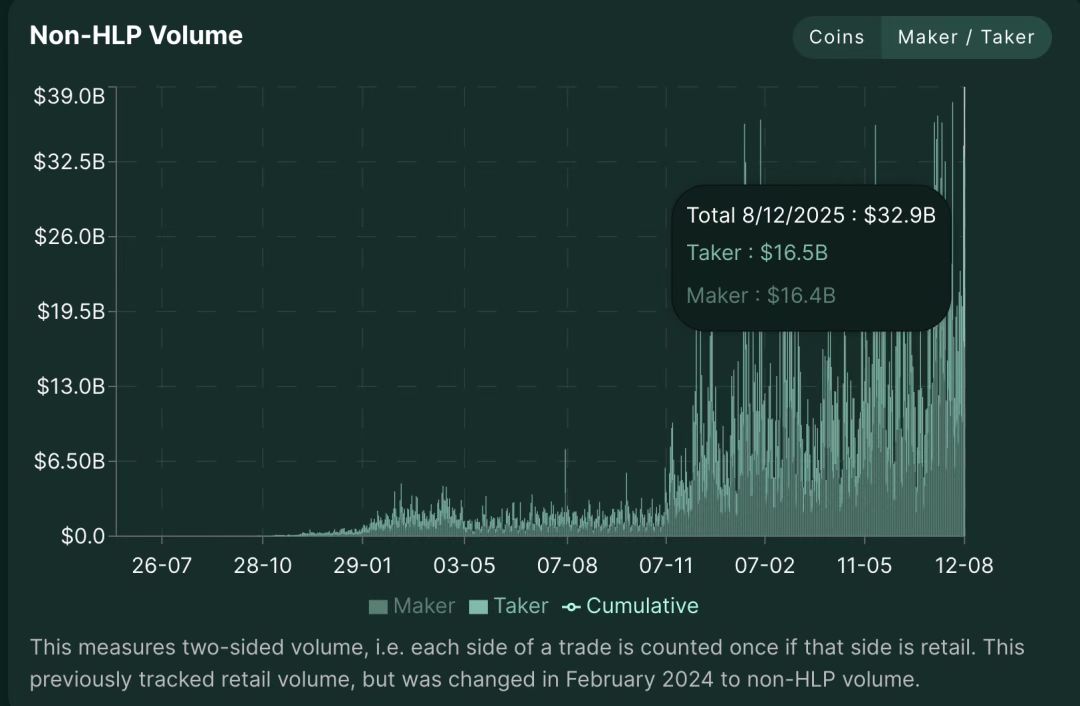

Using the non-HLP trading volume metric (cumulative $4.3 trillion) for analysis, since HLP is a passive liquidity provider/platform pool responsible for internalizing order flow and hedging risk, non-HLP trading volume represents peer-to-peer trading flow. Note that this peer-to-peer trading flow still includes:

· Market makers;

· About 20% regular trading mining accounts and systematic strategy vaults.

For an exchange, more market makers is a "sweet problem." In fact, Jeff once mentioned that there are already "too many" market makers.

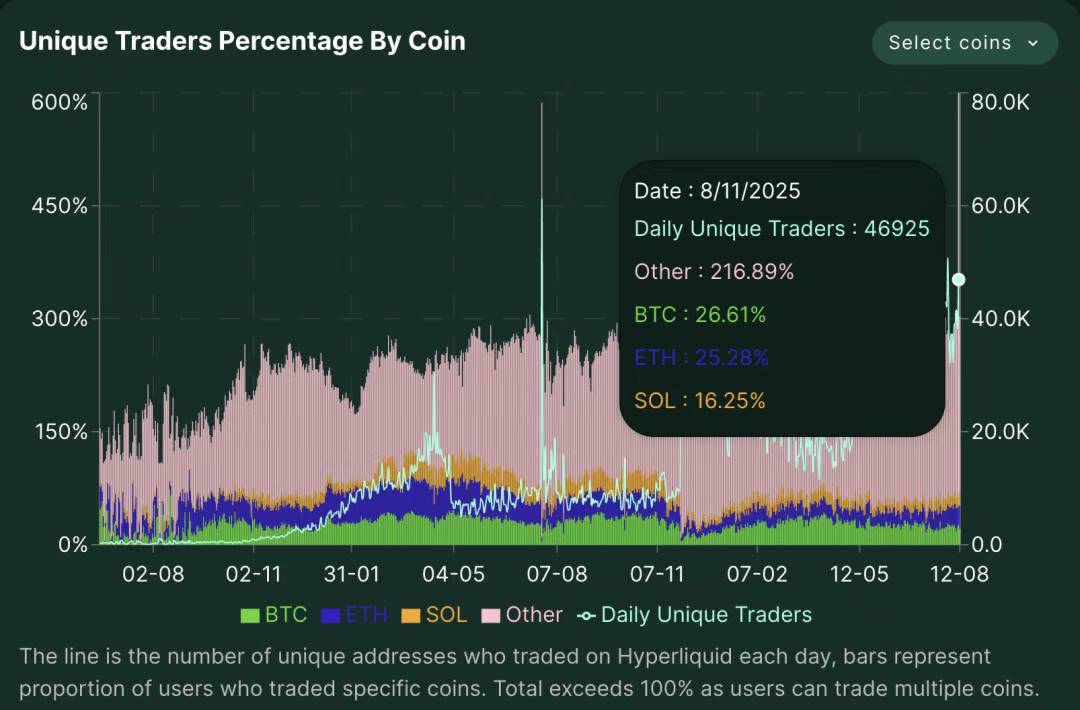

As of the analysis date, the number of daily independent traders was 46,925. Statistics show that the sum of the percentage of coins traded by users exceeds 100%, as one address may trade multiple assets. This multi-coin overlapping trading means Hyperliquid is not just a single-asset trading venue—traders interact with multiple assets per session, indicating extremely high platform stickiness and cross-coin speculation. Meanwhile, the number of traders on Hyperliquid is growing steadily.

So, what does this mean?

For now, all aspects seem highly dependent on bringing users into the HyperCore infrastructure and then somehow returning value to the ecosystem:

· HyperEVM will bring more trading volume to hyperliquid + a stable financialization layer.

· Builder Codes help expand hyperliquid's distribution channels, bringing fees back to HYPE tokens.

· HIP-3 will enable permissionless market creation and share fees with HYPE tokens.

· HYPE token inflation will benefit stakers and generally bring higher yields to HyperEVM.

With the HYPE token as the perfect marketing tool and the best way to coordinate community development, Hyperliquid has formed its own tightly-knit, almost cult-like community. Ultimately, if leveraged trading is a valuable experience for consumers, Hyperliquid's flywheel will keep spinning.

III. What Next?

Bearish Case

# Potential for Regulatory Tightening

Perpetual contracts provide end users with access to leveraged markets. Without robust KYC/AML measures, there is a risk of money laundering. The platform may be forced to implement stricter compliance systems and report large transactions. Like Polymarket, US users may eventually need to go through KYC to use the platform.

# Token Unlocks

If mishandled, locked airdrop supply could trigger massive sell pressure.

· 238 million core contributor tokens (23.8% of total supply) will begin linear unlocking on November 29, 2025.

· At current prices, an estimated $17.3 million in equivalent daily sell pressure will be generated during 2027–2028.

· Insider holdings will surge from the current 15.9% to a fully diluted 45.8%.

Why this matters:

· Current buyback capacity of the assistance fund is only about $2 million per day;

· Creates sell pressure 8.6 times buyback capacity;

· Timing overlaps with the post-2027–2028 Bitcoin halving downcycle;

· Maintaining price equilibrium would require 6–7x revenue growth.

# Liquidity Drain Risk

With many new distribution forms (such as Builder Codes and HIP-3-created markets) emerging on Hyperliquid L1, there is a risk of trading volume flowing to other markets. Although fees will ultimately flow back to HYPE tokens (albeit possibly at a discount), and Hyperliquid controls core markets and distribution channels, this risk remains.

# Diminishing Marginal Effect of Buybacks & Flywheel Break Risk

The price-boosting effect of buybacks has diminishing marginal returns. If Hyperliquid's adoption and product-generated revenue cannot match market growth expectations or the opportunity cost of holding other tokens, the growth flywheel may break (macro trends may also suppress price, as seen in April 2025). The mitigating factor is economic game theory: if the price falls to a low enough market cap, buybacks will consolidate and push the price back up. But the core risk is: how many users are solely using the platform because of the HYPE token.

# Security and Trust Comparison

Retail users love Hyperliquid's UX, but still prefer Ethereum as an asset storage base—because it has a stronger validator set (800,000 vs. HL's mere 16), a longer security record, and harsher penalty mechanisms (HL's consensus design is secure but more centralized, with more concentrated penalty risk). Incidents like $JELLYJELLY have also raised community concerns about security and management.

# Lack of Development Funding

97% of fees go to buybacks, meaning zero budget for growth, marketing, or security incentives. Any governance proposal to divert funds for development would be doubly negative for token holders. Competitors actively fund ecosystem growth, while Hyperliquid keeps itself "hungry."

Bullish Case

# Growth Drivers

· Attracting massive capital inflows through EVM integration and better interoperability;

· HIP3 markets bring in institutional and retail TradFi capital;

· Continued increase in the number of main site perpetual contract markets;

· 38.8% of tokens reserved for airdrops provide growth ammunition.

# USDH Yield Potential

About $5 billion in USD deposits on the platform; after USDH introduction, based on current US Treasury rates, can generate $150–200 million in annual yield. If this income, previously retained by Circle, can be redirected to HYPE buybacks, it would be extremely beneficial for the ecosystem.

# Cross-chain Expansion

One-click deposit from any LayerZero chain via LayerZero, with initial assets including USDT0, USDe, PLUME, COOK. Breaks the single-chain ceiling, preemptively captures L2 order flow.

# Fee Advantage

· Current fee rate is about 2.8 bps, competitors about 1 bps;

· Zero gas orders + on-chain matching provide a sustainable profit model;

· Can remain profitable even if fees are halved.

# CEX Trust Crisis Opportunity

Incidents at centralized exchanges (like FTX) have damaged their image. Hyperliquid, as a semi-trusted neutral infrastructure, promotes blockchain ideals with a CEX-like experience, narrowing the gap in custody decentralization, operating costs, and regulatory arbitrage.

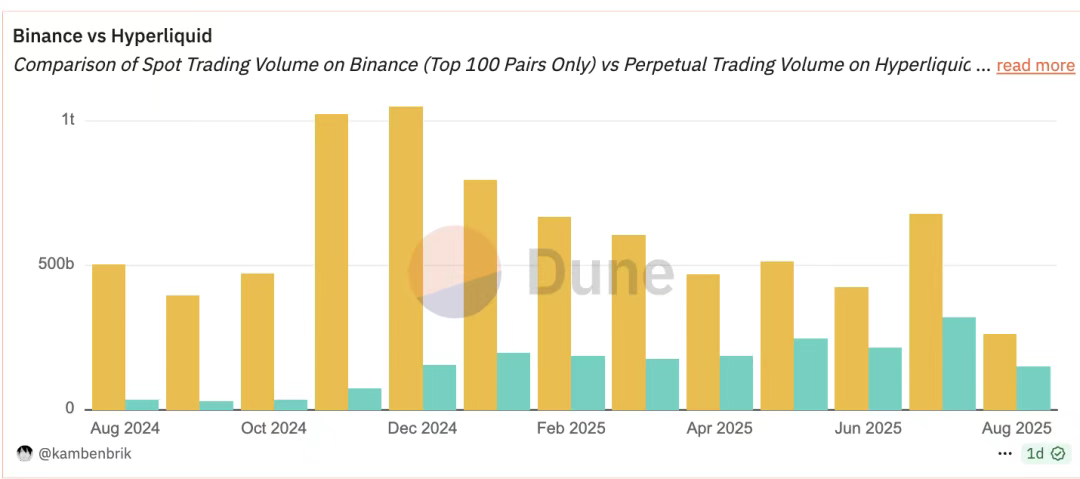

However, directly comparing spot trading volume to perpetual contract trading volume is like comparing apples to oranges. If we want to clearly distinguish Binance and Hyperliquid (HL) in terms of actual spot and perpetual contract market share, we see the following:

Daily trading volume (September 9, 2025)

30-day trading volume, estimated based on Messari's $73 billion monthly total and daily ratios messari

The two have completely different market positioning. One mainly serves off-chain users, while the other targets on-chain users. The chart below shows their dominance in their respective fields.

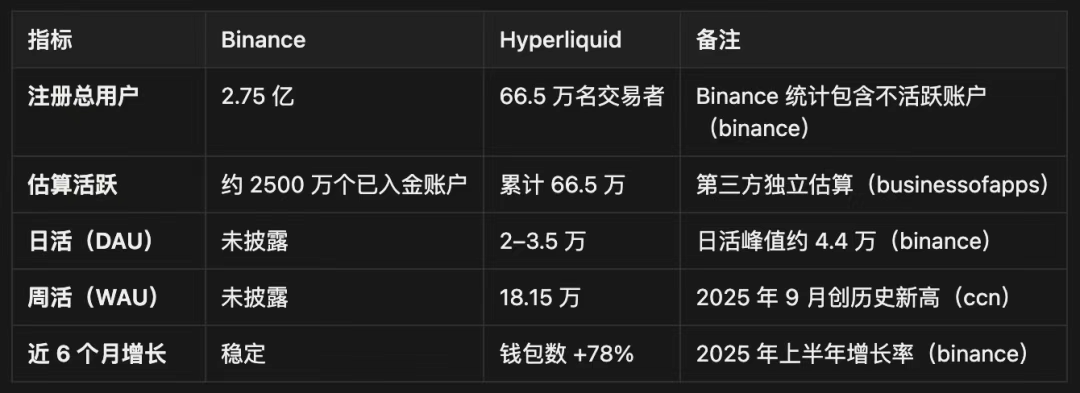

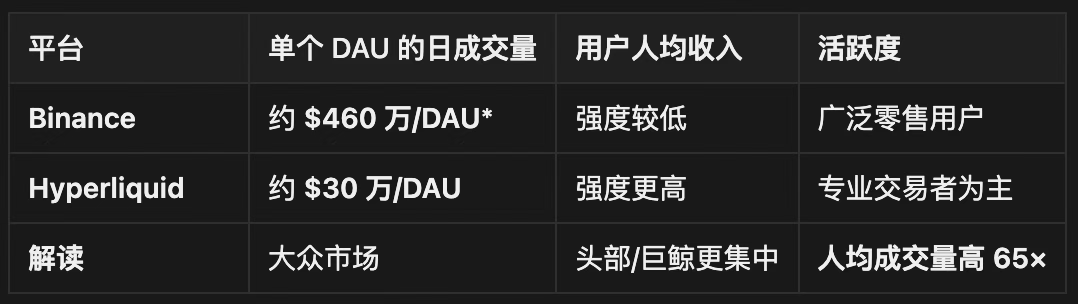

User Base Analysis

Trading Intensity, rough estimate based on 25 million active users

Market Share

So far, every builder I've interacted with in the Hyperliquid ecosystem is a heads-down, value-creating, community-driven team. This atmosphere is largely due to the way the ecosystem guides everything from product to airdrop and everything in between.

To bring crypto to the masses, the space needs to create new value and better experiences for potential retail newcomers. Fundamentally, I believe Hyperliquid can provide a lot of such products.

For example:

· Excellent trading interface (on-chain Robinhood): Can access on-chain liquidity while providing a seamless financial experience. If the crypto market wants to create a better financial structure, we also need a better interaction portal to abstract away confusing UI/UX.

· Pre-IPO products: With $PUMP's ICO/TGE (Token Generation Event), we see pre-markets facilitated on perpetual contract exchanges allowing users to speculate, while also providing better price discovery for underlying assets. If this is replicated for Pre-IPO assets, it would be an intuitive way to provide real value arbitrage.

· Addressing fragmentation: With many new markets (HIP3, other CLOBs, etc.) emerging, we see liquidity and user experience may gradually become fragmented. Projects like this provide a good solution, just as 1inch did for DEXs, Jumper for bridges, and Beefy for yield farming.

· Real World Assets (RWA): HIP3 provides a way for off-chain assets like SPX to be accounted for on-chain. Other forms of RWA will provide more sustainable, income-backed yields and financial activities, helping to drive ecosystem development.

In summary, Hyperliquid takes a user-centric approach. From the core team's product decisions to thousands of builders aligned with the vision, the entire ecosystem is designed so that the ultimate winners are those who create value, not extract it. Newcomers now have an equal opportunity to prove their insight without being troubled by bad actors and can access a rich and mature ecosystem. Whether any product can survive a bear market cycle is a mystery to anyone, but personally, I am very hopeful about their ability to rebound and continue attracting more builders.

This is not a bet on HYPE price appreciation or sustained high yields—but a bet that building real businesses with real users and real revenue will ultimately win, even if the road includes significant volatility and user attrition.

The market will likely give you multiple opportunities to accumulate this thematic asset at distressed prices. The question is, do you believe that in the long-term evolution of crypto, business acumen and sustainable revenue models ultimately matter more than short-term token games.

The room for growth is huge, but like any venture investment, I believe it is in the right hands.