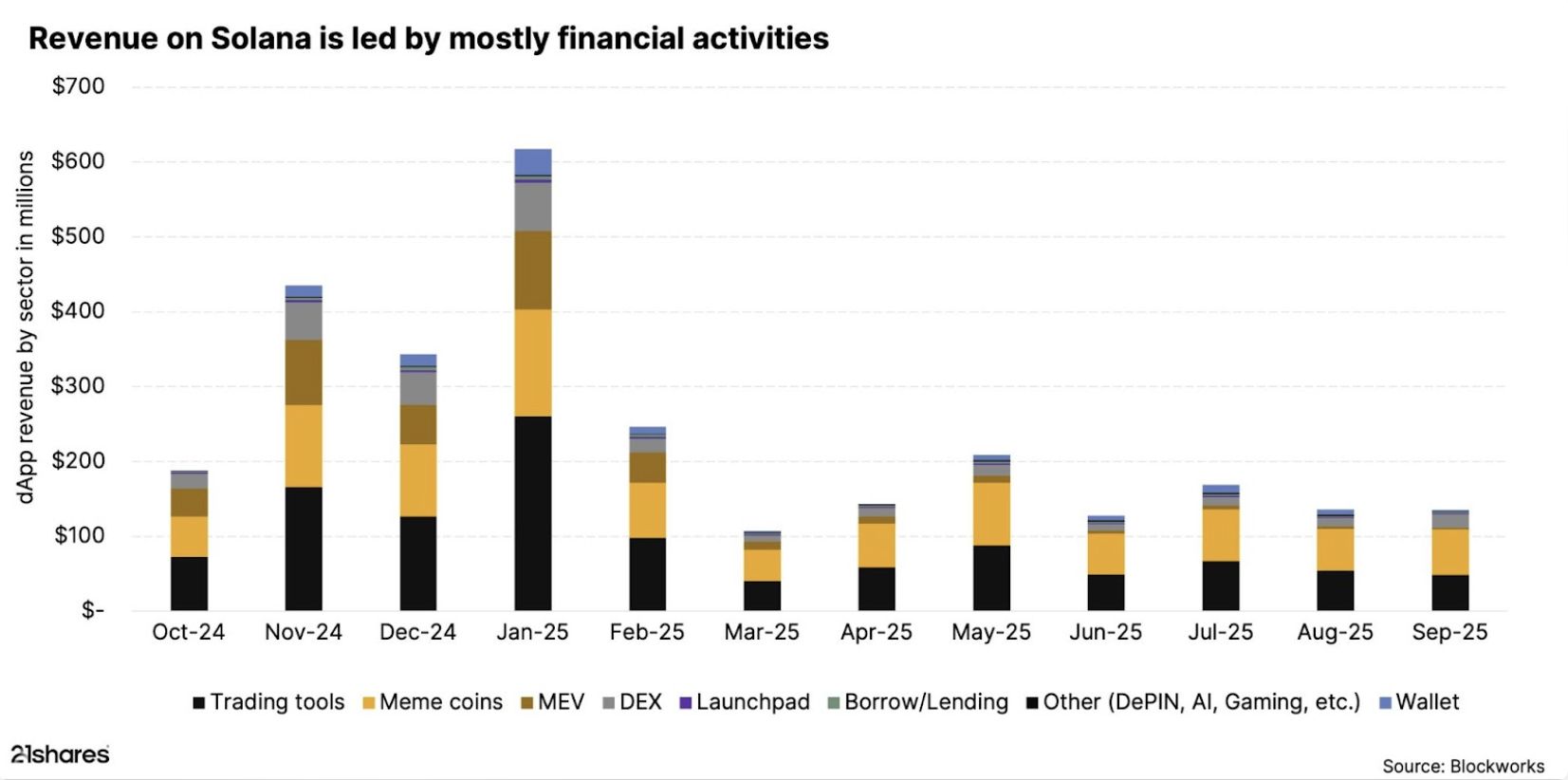

Solana revenue reached $2.85 billion over the past 12 months, driven primarily by trading platforms, memecoins and DeFi activity. This surge reflects monthly averages of ~$240M and peak months above $600M, signalling growing institutional and on‑chain adoption across the Solana network.

-

Annual revenue: $2.85 billion from Oct 2024–Sep 2025

-

Trading platforms generated 39% of revenue (~$1.12B); memecoins and DeFi contributed significant fee volume.

-

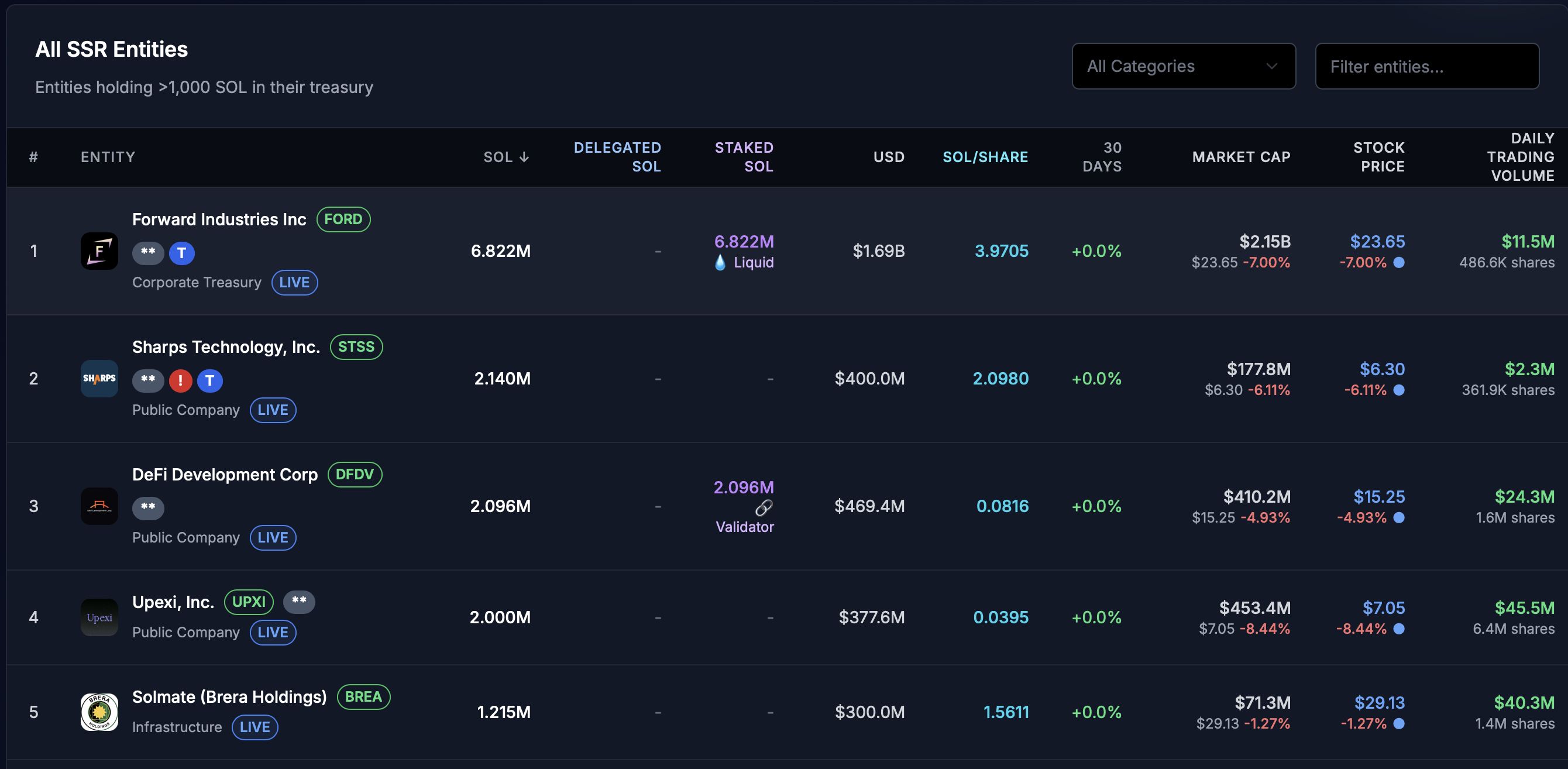

Nearly 17.8M SOL held by 18 public treasuries; Forward Industries leads with 6.822M SOL.

Solana revenue surged to $2.85B across DeFi, memecoins and trading apps — read the report for implications and next steps. Learn more with COINOTAG.

What is Solana’s annual revenue and why does it matter?

Solana revenue totaled $2.85 billion from October 2024 to September 2025, led by trading platforms, memecoin activity and DeFi. This level of fee generation shows the network’s increased transaction throughput and institutional interest, positioning Solana as a major payments-and-trading layer in crypto markets.

How did Solana generate $2.85 billion in one year?

Monthly averages were about $240 million, peaking at $616 million in January 2025 during a memecoin surge featuring tokens like Official Trump (TRUMP). Validators captured fees from decentralized exchanges, DeFi protocols, memecoins, AI apps, DePIN and launchpads.

Trading platforms were the single largest revenue source, accounting for 39% (~$1.12 billion), with notable contribution from apps such as Photon and Axiom. The diversity of fee sources underscores a broadening on‑chain economy.

Solana’s 12-month revenue by sector. Source: 21Shares

Why are Solana treasuries and ETFs important now?

Corporate treasuries and potential spot ETFs can concentrate SOL holdings and provide regulated market access. Nearly $4 billion in SOL is reported on public company balance sheets after multiple rebrands to Solana-focused treasuries.

Companies tracked include Forward Industries (6.822M SOL) and Sharps Technology (2.14M SOL), among 18 entities holding a combined 17.8 million SOL, per StrategicSolanaReserve.org data cited in recent reporting.

Solana treasury companies’ holdings. Source: StrategicSolanaReserve.org

When could a spot Solana ETF affect markets?

Spot Solana ETF filings from multiple asset managers are under regulatory review, with several deadlines in October 2025. If approved, spot ETFs could increase institutional custody demand and liquidity for SOL, with implications for price discovery and treasury management.

Market sentiment indicators such as Polymarket showed high odds of approval by year-end at the time of reporting, reflecting participant expectations. Regulatory timing remains the primary variable.

Top five Solana treasury companies. Source: StrategicSolanaReserve.org

Frequently Asked Questions

How sustainable is Solana’s fee revenue?

Solana’s fee revenue is supported by high throughput and low costs that attract trading platforms and new app types. Sustainability depends on persistent user demand and continued innovation from validators and apps; diversification across DeFi, memecoins and AI reduces single-source risk.

How much SOL do treasury companies hold?

Publicly tracked entities hold roughly 17.8 million SOL across 18 companies, led by Forward Industries with 6.822 million SOL and Sharps Technology with 2.14 million SOL. These holdings concentrate supply on corporate balance sheets.

Key Takeaways

- Revenue scale: Solana generated $2.85B in 12 months, showing rapid fee growth versus early-stage Ethereum.

- Revenue mix: Trading platforms drove 39% of earnings, with memecoins and DeFi as major contributors.

- ETF & treasury risk: Corporate SOL treasuries and potential spot ETFs could materially affect liquidity and institutional demand—monitor filings and on‑chain metrics.

Conclusion

Solana’s $2.85 billion annual revenue highlights a maturing on‑chain economy anchored by trading platforms, memecoins and DeFi. With sizable corporate treasuries and pending spot ETF filings, market structure may shift toward greater institutional participation. Readers should monitor regulatory timelines, treasury disclosures and on‑chain indicators to assess future impact.