Cathie Wood Interview: Why Focus on BTC, ETH, SOL, and HYPE

Chainfeeds Guide:

Cathie Wood is the founder and CEO of Ark Invest. She shares why she firmly believes bitcoin will become the leading cryptocurrency and explains in detail the important role of stablecoins in the crypto ecosystem. She also mentions her friendly disagreement with Tom Lee of Fundstrat. Although she does not believe ethereum will surpass bitcoin, her attitude towards ethereum has changed, and she recently invested in BitMine.

Source:

Author:

Cathie Wood

Opinion:

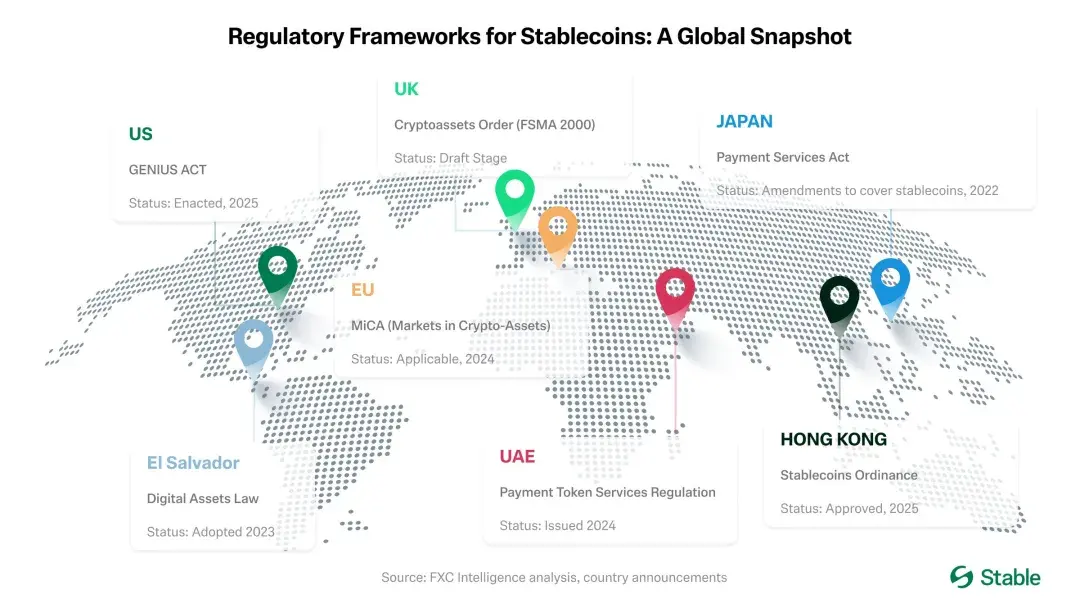

Cathie Wood: We do not believe that all cryptocurrencies have development potential. In fact, we think that there are not many cryptocurrencies with real prospects. In the realm of pure cryptocurrencies, bitcoin holds a dominant position. In addition, there are stablecoins, which are also cryptocurrencies, but mainly pegged to the US dollar, as they are usually backed by government bonds. Therefore, we believe that bitcoin is the only true cryptocurrency in the real sense, and it will become the largest one in the market. Bitcoin is a rules-based monetary system, and its rules follow the quantity theory of money. The total supply of bitcoin is capped at 21 million, with about 20 million currently in circulation. This is the so-called quantity theory. Stablecoins, on the other hand, are digital assets based on the US dollar. If you can find ways to use stablecoins, such as in DeFi, you can also earn yields. Just last week, Coinbase launched a product that allows users to lend USDC to others in the DeFi ecosystem. Although, due to regulatory reasons, these loans cannot receive traditional interest payments, users can still earn yields of up to 10.4%. Tether mainly circulates outside the US and Europe, while Circle is more compliant with regulations in the US. In addition, Circle has launched a euro-based USDC stablecoin, but it has not yet been widely adopted. In Europe, with the implementation of Mica (the crypto asset market regulatory framework), Tether and Circle have captured 90% of the stablecoin market share. So, why do people in developed countries also need stablecoins? We understand the demand in emerging markets, such as in countries with unstable economies, where people can protect their wealth through stablecoins. We once thought bitcoin would take on this role, but the emergence of stablecoins has indeed taken away part of bitcoin's market, which we did not anticipate in our initial analysis. In the world of blockchain technology, we are gradually eliminating intermediaries in financial services. These intermediaries, which I have jokingly called toll booths, exist to reduce transaction risk and protect the security of transactions between financial institutions. However, in the peer-to-peer transaction model of blockchain, these intermediaries will be completely replaced. Simply put, traditional credit cards usually charge a 2.5% fee per transaction, which is the cost brought by intermediaries. Blockchain-based transaction fees can be significantly reduced. In developed countries, these fees may drop from 2%-4% to below 1%, while in emerging markets, such as remittance fees in Nigeria that can be as high as 25%, these costs are also expected to decrease significantly. Ultimately, blockchain technology will compress global transaction costs to extremely low levels. These changes will take time to realize. For example, in the USDC case I just mentioned, someone said: "I can lend funds at a 10.4% interest rate, right? Such a rate is not available elsewhere." This is a high-yield savings method for depositors. And those who borrow at a 10.4% rate are usually too small in scale to obtain loans from banks. DeFi is changing this situation, giving those who previously had difficulty obtaining loans an opportunity, while also providing higher yields for depositors. The on-chain ecosystem is very transparent, and many loans are over-collateralized. We learned this from crypto collapses such as 3AC and Luna. On the blockchain, anyone's collateral will be automatically liquidated if its value is insufficient, which means financial institutions can quickly recover funds. In opaque and highly centralized systems like FTX, funds can be completely lost. Therefore, from a security perspective, the transparent mechanisms on-chain are actually more reliable than FTX, which was clearly a fraudulent company.

Source of ContentDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

IOSG: Understanding Stablecoin Public Chains in One Article

Public blockchains centered on stablecoins have already achieved the necessary scale and stability. To become everyday currencies, they still need: a consumer-grade user experience, programmable compliance, and transactions with imperceptible fees.

Trading stocks is better than trading crypto? A global wave of "virtual asset reserves" emerges, with the DAT strategy of listed companies becoming a new investment trend

Enterprises are increasing their investments in bitcoin and ethereum, with DAT strategies setting a new paradigm in the capital market.

Tether’s Next Chapter: From Offshore Issuance to Ambitions for Global Compliance Infrastructure

Can Tether evolve from an offshore issuer to a multi-chain, compliant infrastructure provider without compromising its core advantages in liquidity and distribution?

What will be the peak of Ethereum?

Based on multiple historical and on-chain indicators, the article's author Michael Nadeau conducts a scenario analysis of the potential peak price of Ethereum in the current bull market, aiming to provide a quantitative reference for Tom Lee's "supercycle" hypothesis. By tracking the 200-week moving average, price-to-realized price ratio, MVRV Z-score, Ethereum-to-Bitcoin market cap ratio, and its ratio to the Nasdaq Index, the article presents a range of specific potential price targets, mainly concentrated in the $7,000 to $13,500 range.