BlackRock Bitcoin Purchase of $426.2M Signals Market Confidence

BlackRock, the world’s largest asset manager, has purchased $426.2 million worth of Bitcoin (BTC). According to Whale Insider, this shows growing confidence from large institutions in the cryptocurrency market. The move also highlights how BlackRock’s focus is on expanding its presence in digital assets.

JUST IN: BlackRock buys $426.2 million worth of $BTC . pic.twitter.com/mjcWvmRXkK

— Whale Insider (@WhaleInsider) October 9, 2025

How BlackRock Made the Investment

BlackRock bought Bitcoin through its iShares Bitcoin Trust (IBIT). This fund lets the investors gain exposure to Bitcoin without holding the coins directly. The $426.2 million purchase is one of the largest single-day inflows into IBIT.

This investment fits BlackRock’s strategy to diversify its portfolio. The company has expressed optimism about digital assets before, seeing them as an important part of the financial future.

What This Means for the Market

BlackRock’s move could affect the market in a lot of ways:

- Boosting Confidence: Other institutions may follow BlackRock’s lead. Its investment sends a strong message that large financial firms trust Bitcoin.

- Price Impact: Huge purchases can push Bitcoin’s price higher. Demand from big investors can create an upward momentum.

- Regulatory Attention: Regulators may take note of these big trades. This could lead to clearer rules for cryptocurrencies.

Together, these factors could make the cryptocurrency market stronger and attract more investment.

Growing Trend of Institutional Adoption

BlackRock is not alone. A lot more financial institutions are entering the crypto space. They see Bitcoin and other digital assets as a way to diversify investments and seek higher returns.

Institutional participation also brings credibility. Large firms help to stabilize the market and encourage innovation. They also create new financial products designed for professional investors.

How BlackRock’s Move Affects Bitcoin

Investors will watch closely to see how BlackRock’s purchase affects the market. If Bitcoin continues to grow and regulations become clearer, more institutions may enter.

For retail investors, this could mean more options and potentially even higher prices. However, crypto still remains risky. Prices can change quickly, and investors should only invest what they can afford to lose.

BlackRock’s $426.2 million investment shows that huge institutions are taking cryptocurrencies seriously. Its actions could influence other companies too and reshape the market.

What Comes Next for Bitcoin?

BlackRock’s purchase marks an important milestone for Bitcoin. It reflects a broader trend of institutional interest in cryptocurrencies. With strong demand from big investors, Bitcoin may see more growth.

This move also shows the growing integration of traditional finance with digital assets. Investors, both retail and institutional, now have a reason to watch the market closely. The coming weeks could be important for Bitcoin’s price and adoption.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

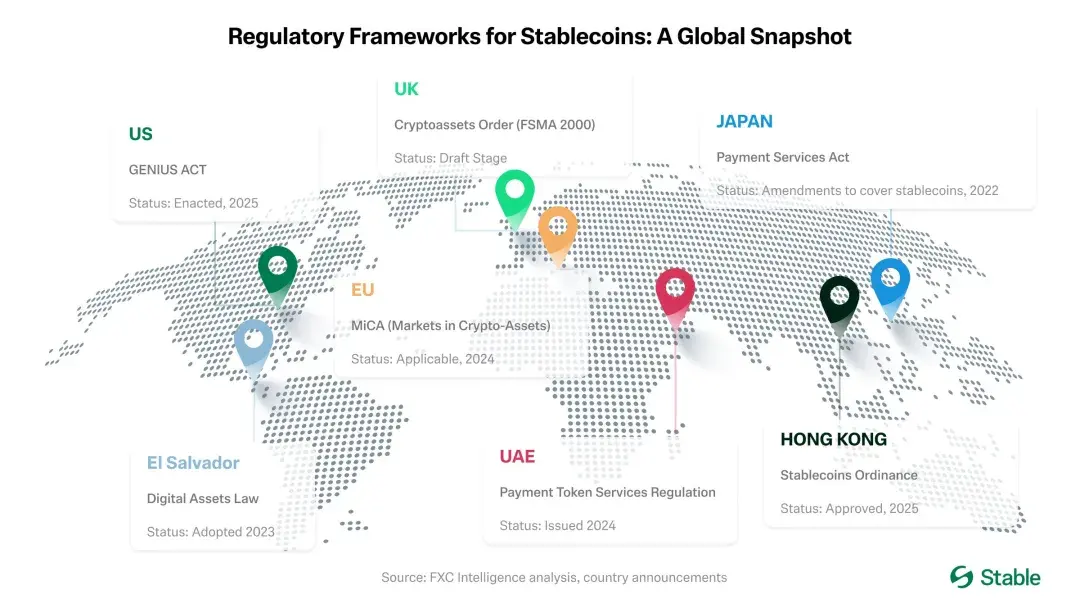

Opinion: The Era of the Stablecoin Duopoly Is Coming to an End

The article analyzes the underlying reasons why the duopoly of Circle (USDC) and Tether (USDT), which still dominate about 85% of the stablecoin market, is beginning to break down. It points out that various structural changes are driving the stablecoin market toward "substitutability," challenging the core advantages of the existing giants.

IOSG: Understanding Stablecoin Public Chains in One Article

Public blockchains centered on stablecoins have already achieved the necessary scale and stability. To become everyday currencies, they still need: a consumer-grade user experience, programmable compliance, and transactions with imperceptible fees.

Trading stocks is better than trading crypto? A global wave of "virtual asset reserves" emerges, with the DAT strategy of listed companies becoming a new investment trend

Enterprises are increasing their investments in bitcoin and ethereum, with DAT strategies setting a new paradigm in the capital market.

Tether’s Next Chapter: From Offshore Issuance to Ambitions for Global Compliance Infrastructure

Can Tether evolve from an offshore issuer to a multi-chain, compliant infrastructure provider without compromising its core advantages in liquidity and distribution?