Ethereum price crash hit ETH hard but showed relative resilience: Ether dropped to roughly $3,510 during Friday’s liquidation event, rebounded above $3,800 after tapping the 200-day EMA, and faces mixed pressure from record exchange inflows and $10B in staking withdrawals.

-

ETH hit $3,510 low, then bounced above $3,800 after tapping the 200‑day EMA

-

Nearly 1.6 million traders liquidated; up to $20 billion wiped from the market in 24 hours

-

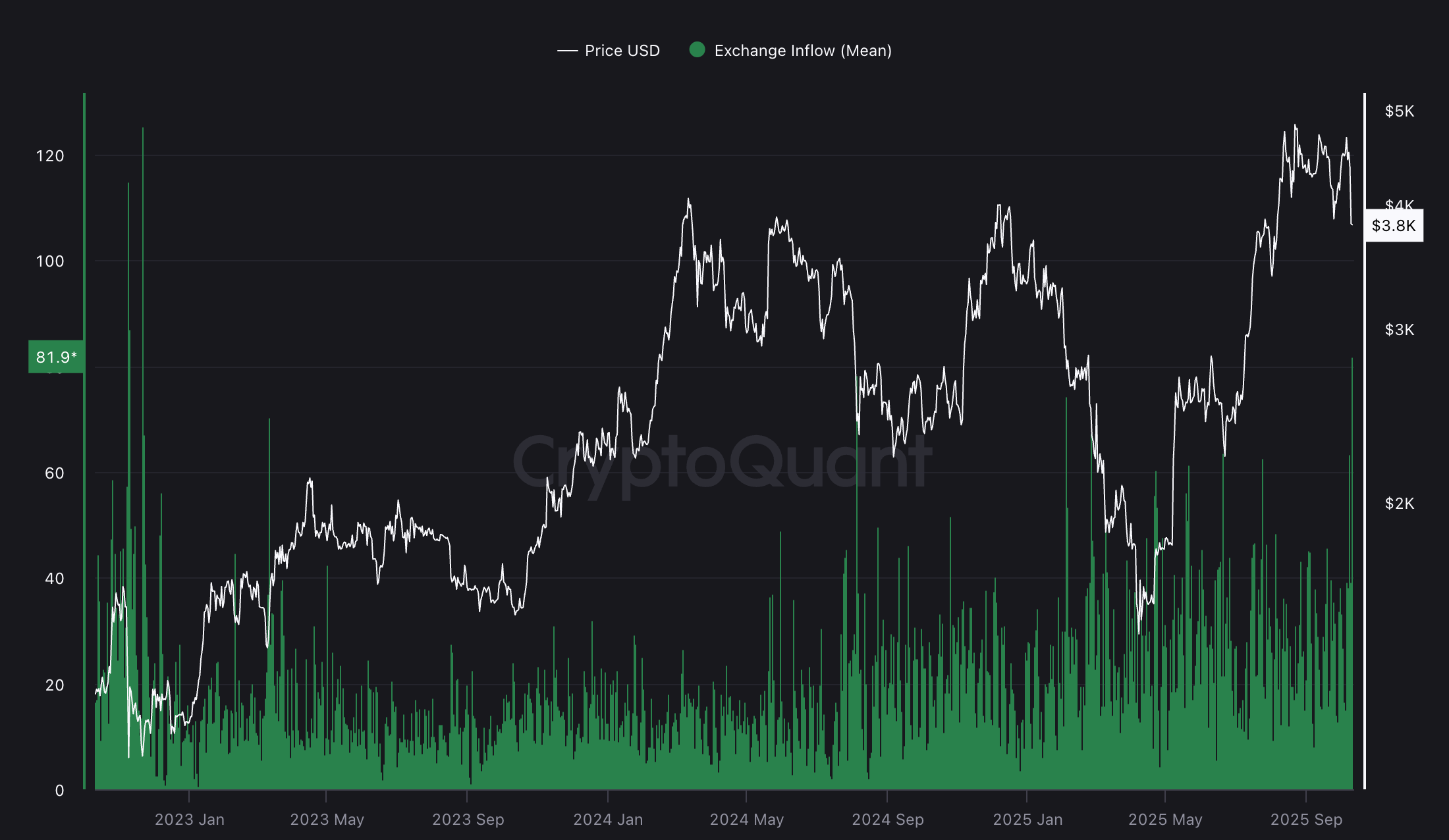

Exchange inflow mean reached 79 (CryptoQuant); staking queue withdrawals topped $10 billion (Nansen)

Ethereum price crash: ETH fell to $3,510 then rebounded above $3,800; assess outlook now — read analysis and key actions for traders.

Some altcoins lost over 95% of their value during Friday’s crash, triggering one of the most rapid and severe liquidation events in crypto history and elevating market stress across spot and derivatives markets.

Ether (ETH), the native cryptocurrency of the layer‑1 Ethereum blockchain, is down about 6.7% in the past 24 hours after Friday’s market crash, showing greater price resilience than many altcoins that plunged as much as 95%.

The crash, intensified by global macro headlines, pushed ETH to a Friday low near $3,510, a drop exceeding 20% intraday. Price found dynamic support at the 200‑day exponential moving average (EMA) and recovered to above $3,800.

Ethereum price action and analysis. Source: TradingView

What triggered the Ethereum price crash?

Front-loaded macro news and rapid deleveraging triggered mass liquidations, which are the primary drivers of the Ethereum price crash. Nearly 1.6 million traders were liquidated, and the event erased up to $20 billion across crypto markets, amplifying downward momentum.

How severe were the liquidations and which metrics matter?

Liquidations reached historic highs, with nearly 1.6 million accounts closed out. Key metrics to watch: exchange inflows, derivatives open interest, and the RSI. The relative strength index (RSI) sits near 35, indicating near‑oversold conditions that could precede a technical bounce.

The market downturn also spurred sharp exchange activity. The Ethereum exchange inflow mean climbed to 79, the highest level recorded in 2025 per CryptoQuant, signaling potential selling pressure as coins move to exchanges.

Ether exchange inflow mean hits highest level recoded in 2025. Source: CryptoQuant

Will ETH recover to $5,500, or will sell pressure keep prices down?

Analysts from investment research firm Fundstrat project ETH could reach a new all‑time high near $5,550 after a capitulation and recovery phase. However, elevated exchange inflows and $10B in staking queue withdrawals create meaningful near‑term sell pressure risks.

Withdrawals from Ethereum’s staking queue recently hit a record $10 billion in October, according to market intelligence platform Nansen. While withdrawals indicate potential supply coming to market, they do not guarantee immediate sell orders.

What technical signals should traders watch?

- 200‑day EMA: Holding this level supports a technical recovery thesis.

- RSI: Near‑oversold (≈35) could allow a short‑term bounce.

- Exchange inflows: Elevated inflows often presage selling pressure.

The crash’s anecdotal commentary included investor Sassal noting that BTC and ETH outperformed the long tail of altcoins, many of which “nuked 70% or more, with some even going down 95% or more.” This underscores market concentration and flight to higher‑liquidity assets.

Frequently Asked Questions

How did the macro environment affect the crypto crash?

Macro headlines on tariffs and trade tensions drove risk‑off flows, pressuring crypto markets. Combined with high leverage and concentrated altcoin positions, the macro shock triggered rapid deleveraging and historic liquidation volumes.

Is the ETH sell‑off temporary or structural?

Current data show both transient and structural elements: technical oversold indicators suggest a temporary bounce, while record exchange inflows and large staking withdrawals imply persistent selling risk until inflows decline.

What should long‑term ETH holders consider now?

Long‑term holders should monitor exchange inflows, staking queue dynamics, on‑chain activity, and network adoption metrics. If inflows subside and on‑chain use remains strong, the recovery case strengthens.

Key Takeaways

- Market impact: The crash caused nearly 1.6 million liquidations and up to $20B lost in 24 hours.

- Technical outlook: ETH found support at the 200‑day EMA and shows RSI near oversold.

- Fundamental risks: Record exchange inflows (CryptoQuant) and $10B staking withdrawals (Nansen) could sustain selling pressure.

Conclusion

The Ethereum price crash was driven by macro shocks and extreme leverage, leaving ETH technically vulnerable yet relatively resilient versus many altcoins. Monitor exchange inflows, staking withdrawals, and the 200‑day EMA for signs of stabilization. Traders should balance short‑term risk management with long‑term fundamentals as market structure evolves.

![[Bitpush Weekend Key News Review] Strategy's portfolio value evaporated by over 8 billion USD this week, Michael Saylor says BTC will not be subject to tariffs; ARK launches AI-driven DAO governance framework, leading a new paradigm in DeFi governance; Crypto.com CEO calls on regulators to investigate exchanges involved in large-scale liquidations over the past 24 hours.](https://img.bgstatic.com/multiLang/image/social/77b88a878c12689fd91181f3994303bc1760253126852.png)