The fund shorting MicroStrategy is now targeting the Ethereum treasury company.

Has the "flywheel" become a "death spiral"?

Original Title: "The Fund That Shorted MicroStrategy Sets Its Sights on Ethereum Treasury Companies"

Original Author: Eric, Foresight News

At 21:47 on October 8th, Beijing time (8:47 AM local time in New York, USA), short-selling firm Kerrisdale Capital publicly announced on X that it had shorted the stock BMNR of Ethereum treasury company BitMine. In its post, Kerrisdale stated that it is not bearish on Ethereum itself, but believes that the premium of BitMine’s stock price over its net asset value, brought by the treasury company model, is about to disappear. Kerrisdale is betting on a return to parity or even a discount.

This short on BMNR is not Kerrisdale Capital’s first attack on crypto concept stocks. In mid-2024, it had already shorted bitcoin mining company Riot and the pioneer of DAT companies, Strategy (formerly known as MicroStrategy). The stock prices of these companies dropped significantly after Kerrisdale’s short-selling news was released. This time, after Kerrisdale announced its short on BMNR, the stock price did not immediately drop significantly; last night’s sharp decline was more in line with the overall market. However, in terms of price, BMNR’s closing price on October 10th (US local time) was $52.47, more than 10% lower than the closing price of $60 on the 8th.

A close reading of the short report shows that Kerrisdale’s six reasons for shorting BitMine stock are all critical, and compared to its previous hedged shorting of Riot and Strategy (while going long bitcoin), this time’s naked short on BMNR reflects Kerrisdale’s extreme lack of confidence in BitMine.

The "Flywheel" Has Become a "Death Spiral"

Kerrisdale’s bearish view on BitMine is mainly based on six aspects:

1. Severe dilution of per-share Ethereum holdings: BMNR issued over 240 million shares through ATM (at-the-market) offerings in just three months, raising over $10 billions, with an average daily fundraising of about $170 millions, severely diluting the per-share Ethereum content;

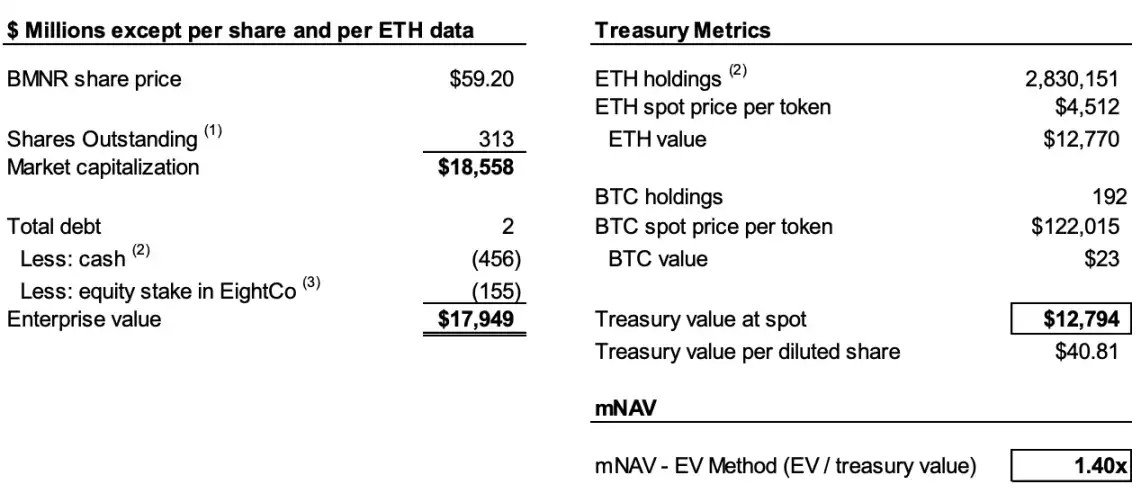

2. mNAV continues to decline: The premium of BMNR’s market cap over its net crypto asset value (mNAV) has dropped from 2.0x in August to 1.4x, with the trend continuing to worsen;

3. Using financial maneuvers to cover up cash-outs: The recent $365 millions "premium" fundraising was actually at a deep discount, with attached warrants greatly diluting the value of common shares;

4. Lack of transparency in disclosures: Since August 25, the company has stopped disclosing per-share NAV and total shares outstanding, making it impossible for investors to judge whether per-share Ethereum "content" is increasing;

5. Intensifying competition: There are already 154 companies in the US planning to raise nearly $100 billions for crypto treasury strategies, and the launch of ETFs will further weaken the scarcity of DATs;

6. The Strategy model is failing: The mNAV premium of Strategy (formerly MicroStrategy), the pioneer of DATs, has dropped from 2.5x to 1.4x, shaking market confidence in the model.

To understand the logic behind the short, we first need to explain the core logic of how DAT companies operate. As Kerrisdale stated in its report, the core logic is: issue shares at a price higher than the book value of tokens → raise funds → buy more coins → increase per-share coin holdings → maintain the premium → issue more shares, forming a self-reinforcing cycle.

For example, if Company A has $1 billion worth of bitcoin on its books and 100 million shares outstanding, Company A issues new shares at a price higher than $10 per share. Investors, expecting that the company will use the raised funds to buy more bitcoin, thereby increasing the "content" of bitcoin per share and raising the stock price, are willing to buy the new shares at a premium. After fundraising, Company A continues to buy bitcoin, increasing the per-share bitcoin content and raising the stock price. Company A can continue this operation to keep pushing up the stock price.

But to maintain this cycle, two necessary conditions must be met: first, there must be a premium on mNAV in the initial stage or at least an expectation that a premium will arise; second, the premium and premium rate must be sustained. If the premium rate is zero or even negative, investors might as well buy the corresponding crypto assets directly.

Thus, we can combine points 1, 2, and 4 to explain the bearish reasons. According to the report, Kerrisdale estimates that as of October 6, BitMine had issued over 240 million shares, with total shares outstanding reaching 311.7 million. Although from July to August, BitMine used the flywheel to increase the content from 2.7 ETH per thousand shares to 7 ETH per thousand shares, Kerrisdale estimates that from August 25 to October 6, the company’s Ethereum holdings increased by 65%, but the per-share Ethereum content only increased by 17%.

In other words, Kerrisdale believes that dilution means the growth rate of per-share content will continue to lag behind the growth rate of Ethereum holdings. Coupled with the mNAV dropping from 2x in August to 1.4x, the decline in content growth and premium may lead to a vicious cycle, causing both numbers to keep falling and eventually reach parity or even a discount.

If the data still contains some speculation, BitMine’s decision to stop disclosing per-share NAV and total shares outstanding as of August 25 further solidified Kerrisdale’s judgment. As stated on X: "If per-share earnings had improved, they should be promoting it heavily."

"Premium Private Placement" Is Actually "Discounted Cash-Out"

On September 22, BitMine announced it had signed a securities purchase agreement with an institutional investor, directly issuing 5,217,715 common shares at $70 per share and granting warrants to subscribe for up to 10,435,430 common shares (exercise price $87.50 per share). Before deducting placement agent fees and other estimated offering expenses, the company expects total proceeds of about $365.24 millions from this offering.

This kind of news, which would normally push the stock price up, is seen by Kerrisdale as BitMine using financial maneuvers to cash out at a discount.

The report states that the $70 offering price is about 14% higher than the closing price of $61.29 on the day, but each share comes with two warrants (exercise price $87.5, term 1.5 years). Using Black-Scholes (vol 100%, rate 4%) and factoring in a 40% liquidity discount, each warrant is valued at about $14.

The Black-Scholes model, proposed by Fischer Black and Myron Scholes in 1973 (earning them the Nobel Prize in Economics), solves the problem of "how much a European option should be worth today under given conditions." The calculation involves several set parameters. Kerrisdale set volatility (vol) at 100% (since such stocks are highly volatile) and the risk-free rate at 4%, calculating that each warrant in BitMine’s September 22 offering was worth about $14.

Therefore, if the value of the two $14 warrants is excluded, BitMine’s actual fundraising is only $220 millions, making the effective per-share offering price just $42, about 31% lower than the closing price that day. Kerrisdale believes that while this deal may not be a loss for investors, if a DAT company needs to raise funds at an actual discount, one of the necessary conditions for the flywheel to turn has already failed, further indicating that BitMine’s model is showing signs of fatigue.

DATs Are No Longer Scarce

The report states that when MicroStrategy launched its bitcoin treasury strategy in 2020, the market lacked compliant and convenient crypto asset investment tools, so DATs became a "leveraged alternative." But today, more than 150 companies in the US have announced similar strategies, planning to raise nearly $100 billions. Meanwhile, the SEC has simplified ETF approval processes, and an "ETF tsunami" is expected, with lower-cost, higher-liquidity Ethereum investment channels likely to quickly capture the market.

Kerrisdale notes that even the oldest Strategy’s mNAV premium has dropped from a yearly high of 2.5x to 1.4x, indicating that market confidence in the DAT model has been shaken. Even Strategy itself suddenly canceled its promise in August to only issue new shares at a 2.5x premium. Once this trust and discipline collapses, it is hard to restore. Therefore, if the market—and even Strategy itself—lacks confidence, imitators will inevitably collapse first.

Kerrisdale already gave the best summary at the beginning of its report: "We are not shorting Ethereum, but the notion that investors should still pay a premium for ETH." If you want to hold ETH, just buy, stake, or buy an ETF. BMNR’s selling point is "worth more than ETH itself," but its strategy is mediocre, competition is fierce, disclosures are opaque, per-share ETH growth is slowing, and so-called "premium fundraising" is actually dilution (plus there is no scarcity). Against this backdrop, BMNR’s premium is bound to continue to decline.

Kerrisdale’s "Love" for Shorting and the Controversial DAT

Kerrisdale Capital is one of Wall Street’s most active "long-short hedge + event-driven" funds, known for its high-profile public shorting. In recent years, it has focused its firepower on "valuation disconnected from reality" sectors such as crypto concepts, quantum technology, and SPACs. From late 2023 to early 2024, Kerrisdale targeted Marathon Digital and Cipher Mining, causing single-day drops of 5% to 8%. In addition to crypto-related stocks, Kerrisdale shorted quantum computing stocks IonQ and D-Wave Quantum in the first half of the year, but both only saw small drops on the day of the short report and then rallied significantly.

Kerrisdale Capital founder and CIO Sahm Adrangi began his career at Deutsche Bank working on high-yield bonds and leveraged loan debt financing, and served as a bankruptcy and out-of-court restructuring advisor to creditor committees at Chanin Capital Partners. He later worked as an analyst at Longacre Management, a $2 billions distressed debt hedge fund.

Sahm Adrangi became famous for shorting and exposing fraudulent Chinese companies in 2010 and 2011, including China Marine Food Group, China-Biotics, and Lihua International. His short targets China Education Alliance and ChinaCast Education Corp were later investigated and penalized by the SEC.

Kerrisdale is not a fund company that only shorts and never goes long, but recently its main focus has been on overvalued companies, with DATs as the latest target. As mentioned at the beginning, such a confident naked short must have found a fundamental logical flaw. Kerrisdale’s shorting record this year has not been outstanding—most companies it shorted rebounded after a brief drop—but we still cannot ignore its unique insights into the DAT company model.

This year, although many US-listed companies have begun experimenting with the DAT company model for bitcoin, Ethereum, and even other altcoins, and well-known investors have cheered them on, even Web3 industry figures like Vitalik have expressed concerns. In retrospect, these concerns are not unfounded. In a hot market with ample liquidity, DAT company stock prices can indeed soar, but such bubble-driven rises are ultimately unsustainable.

We do not deny that when the overall market is strong, DAT companies can add fuel to the fire, but when the bubble bursts, whose eyes will be clouded by the ashes of this already-charred firewood?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Catch a Glimpse of Aster’s Remarkable Recovery in the Crypto Market

In Brief Aster token shows recovery signs, increasing 13% in 24 hours. Delays and trust issues still challenge long-term sustainability in DeFi. Investors are eager to seize short-term opportunities despite market uncertainties.

XRP Holds $2.37 Support as Price Rises 6.2% Amid Strong Momentum

Shiba Inu (SHIB) Rebounds 1.7% — Buyers Eye $0.00001097 Resistance After Sharp Weekly Drop

SUI Plunges 85% to $0.56 Before Whales Set Eyes on $10 Comeback