Institutions: Trade deadlock and rising expectations of interest rate cuts drive safe-haven demand, gold price stands above $4,200

Jinse Finance reported that the spot gold price has surpassed $4,200 per ounce, reaching a new high. Institutional analysis indicates that the trade deadlock and rising market expectations for further interest rate cuts have driven safe-haven buying in precious metals. Amid ongoing trade tensions and the prolonged U.S. government shutdown, investors are flocking to gold to hedge against geopolitical uncertainty. Meanwhile, a speech by Federal Reserve Chairman Powell overnight reinforced market bets on rate cuts, putting pressure on the U.S. dollar and further supporting gold prices. In addition, silver futures have also been boosted by safe-haven demand and tightening liquidity in the London market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

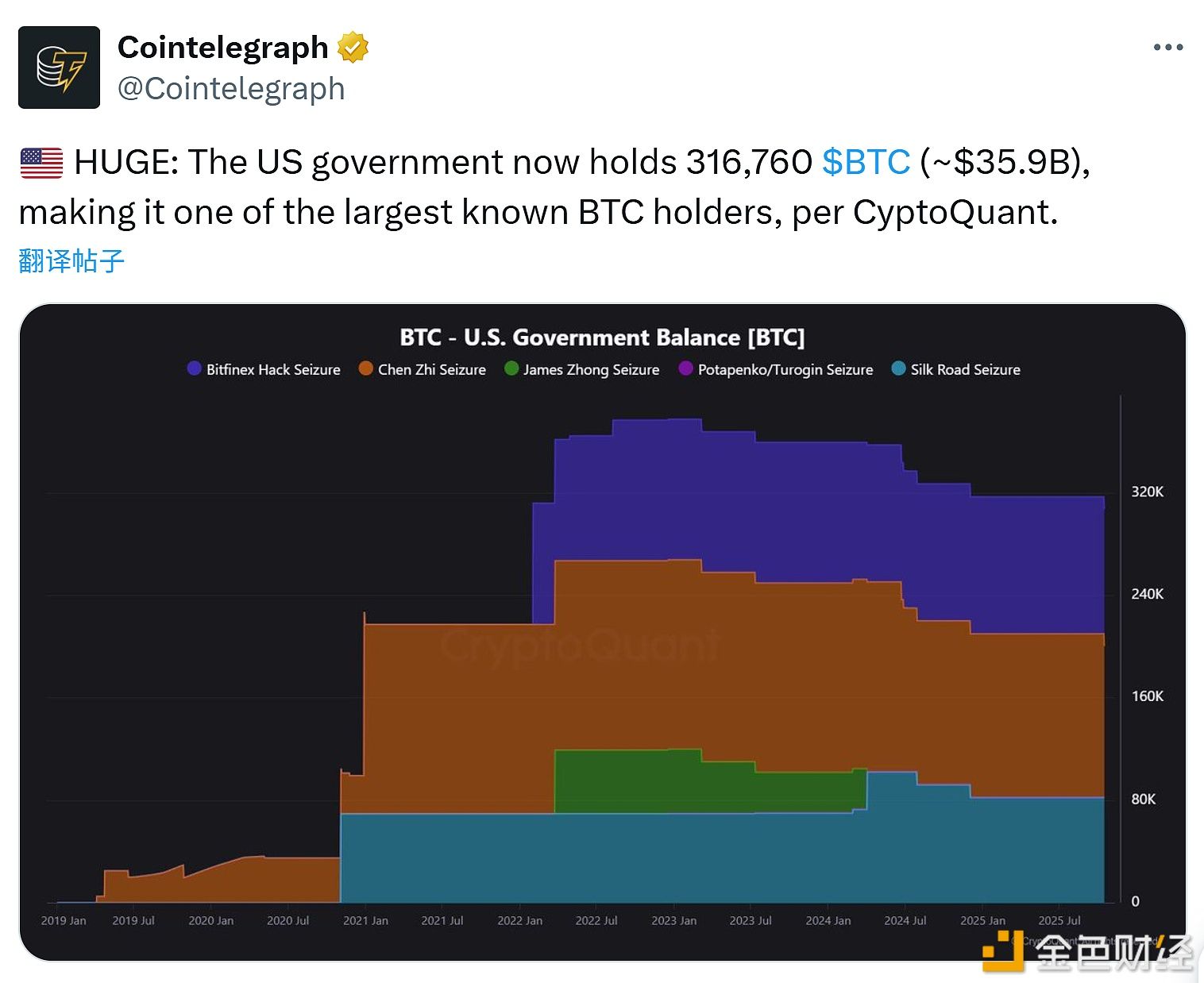

CryptoQuant: The U.S. government currently holds 316,760 BTC

Over $127 million in liquidations in the past hour, mainly long positions

Data: Two newly created addresses accumulate 1,465 BTC, worth over $160 million