Spot Bitcoin ETFs Record $1 Billion Volume in 10 Minutes

- Spot Bitcoin ETFs achieve $1B in early trading volume.

- Highlights demand in the first 10 minutes.

- Indicative of strong institutional interest.

Spot Bitcoin ETF trading volume exceeded $1 billion within the first 10 minutes, showcasing substantial interest from institutional and retail investors.

This milestone underscores rising confidence in digital assets, potentially influencing Bitcoin’s market cap, and reflects a shifting landscape in cryptocurrency investment trends.

The trading volume for spot Bitcoin ETFs reached an impressive $1 billion within 10 minutes. This milestone showcases an exceptional level of interest from both institutional and retail investors, signaling the prominence of digital assets.

Major players including BlackRock , Fidelity , and VanEck are leading the charge in the Bitcoin ETF space. These firms are capitalizing on the evolving financial landscape, marking a significant shift towards digital assets. CEO Larry Fink’s involvement represents institutional support.

The historic inflows into spot Bitcoin ETFs demonstrate growing institutional conviction in digital assets. — Larry Fink, CEO, BlackRock

Immediate market reactions indicated robust enthusiasm. This volume surge may influence traditional financial sectors, pushing further institutional adoption of cryptocurrencies . The development underscores changing investment dynamics in favor of digital currencies.

The financial implications are substantial, with Bitcoin’s growing acceptance potentially reshaping asset portfolios. Key observers highlight digital assets as a core component, noting Bitcoin’s expanding role within formal investments. Institutional interest is experiencing a notable acceleration.

Analysts predict ongoing ETF inflows could stabilize and elevate Bitcoin’s market position. Observers credit institutional moves with initiating broader acceptance. Bitcoin’s transition from a speculative asset to an institutional mainstay is evident.

Potential outcomes include significant shifts in regulatory landscapes and technological adoption. Historical trends show Bitcoin ETFs influence crypto market perceptions, potentially encouraging more regulatory approvals. Data supports a trajectory towards widespread integration of digital assets in investment strategies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

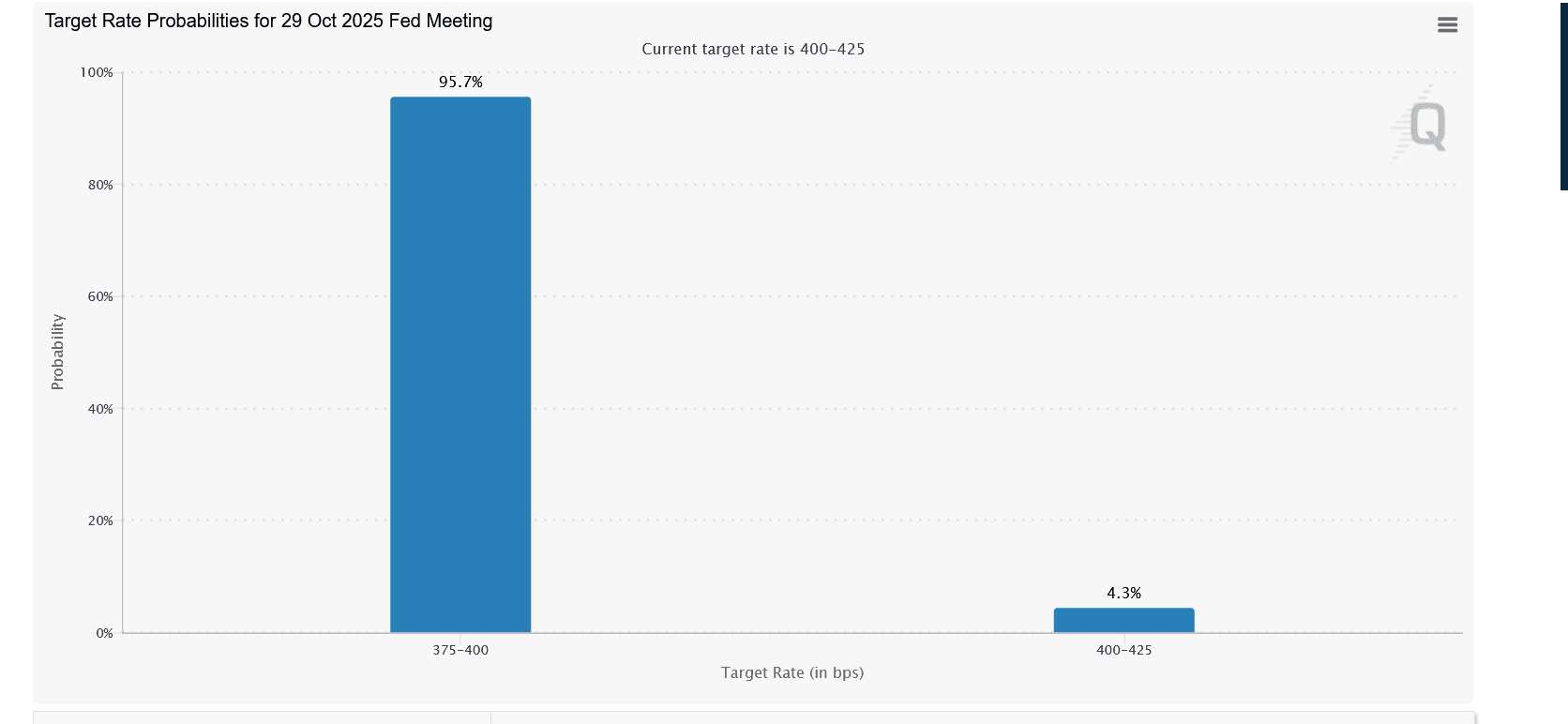

Is Cardano (ADA) About to Rebound as the Fed Turns Dovish?

Sorare CEO still bullish on Ethereum despite ‘upgrading’ to Solana

Base co-founder discusses token issuance again—what does Zora’s launch of live streaming at this moment signify?

The current $850 million FDV still has reasonable room for growth considering Zora's ecosystem status and growth potential.

The last mile of blockchain, the first mile of Megaeth: Taking over global assets

1. The blockchain project Megaeth has recently reached a critical milestone with its public sale, marking the official start of the project. Its goal is to build the world's fastest public chain to solve the "last mile" problem of blockchain's management of global assets. 2. Industry observations indicate that the crypto punk spirit has been weakening year by year, and the industry's focus is shifting towards high-performance infrastructure. Against this backdrop, Megaeth is advancing the implementation of its project, emphasizing that the blockchain industry has moved past the early exploratory phase, and high performance has become key to supporting the next stage of application scenarios. 3. Industry insiders believe that all infrastructure has a "late-mover advantage," and blockchain also needs to go through a process of performance upgrades to drive scenario expansion. High performance is seen as the key to unlocking larger-scale applications. 4. With multiple chains exploring performance pathways, Megaeth positions itself as aiming to be the "fastest public chain," attempting to solve the challenge of "trillions of transactions on-chain." The team believes that addressing real-world problems is the most effective path, regardless of whether it is Layer1 or Layer2. 5. Megaeth's public sale is seen as the beginning of its "first mile" journey. Although it may face technical challenges, the potential brought by its differentiated underlying architecture is highly regarded and is expected to give rise to new industry paradigms.