Euler plans to launch a synthetic dollar product in the coming weeks

Jinse Finance reported that Euler plans to launch a synthetic dollar product "within a few weeks." The startup stated that this move will complete its three major product offerings: lending, swapping, and USD-denominated assets. Co-founder Michael Bentley described the new product as a "USD synthetic token," adding that Euler is now "not just a lending protocol" but also a decentralized exchange (DEX). Bentley positioned the synthetic dollar as a strategic complement to Euler's credit market and protocol swaps, emphasizing tight integration rather than relying on external liquidity incentives.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

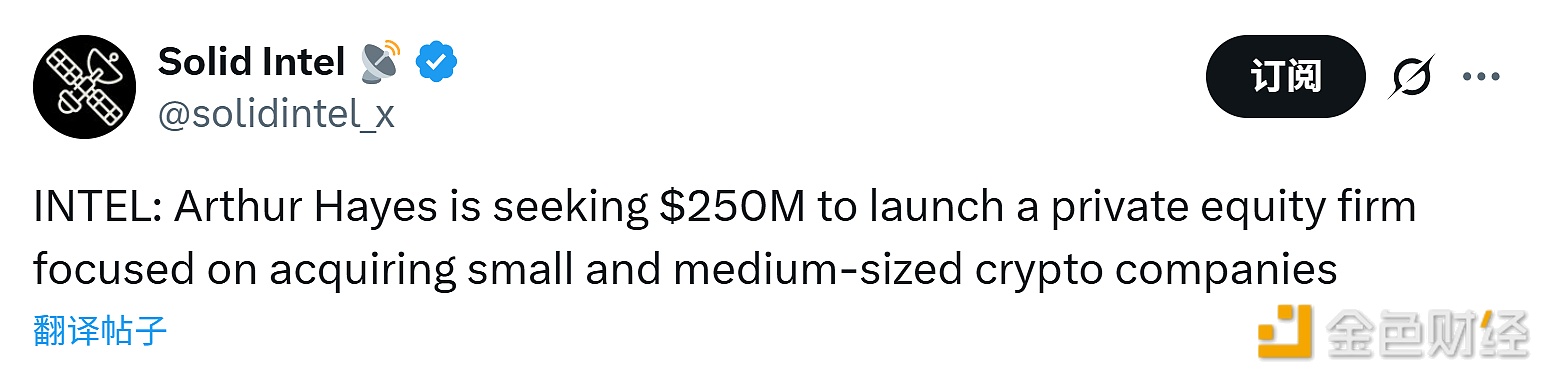

Arthur Hayes seeks to raise $250 million to establish a private equity firm

Dow Jones and S&P 500 futures turn higher, Nasdaq futures fall 0.1%

Sun Wukong surpasses 2 billions USDT in trading volume within one week of launch, with liquidity depth tripling

UBS upgrades its rating on the US stock market to "attractive"