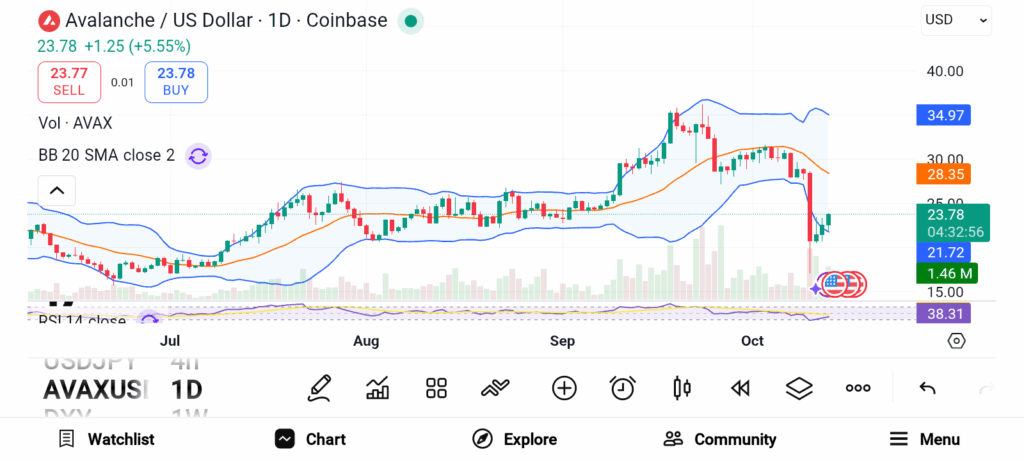

- Avalanche expands through subnets and stablecoin growth, attracting developers and institutional interest.

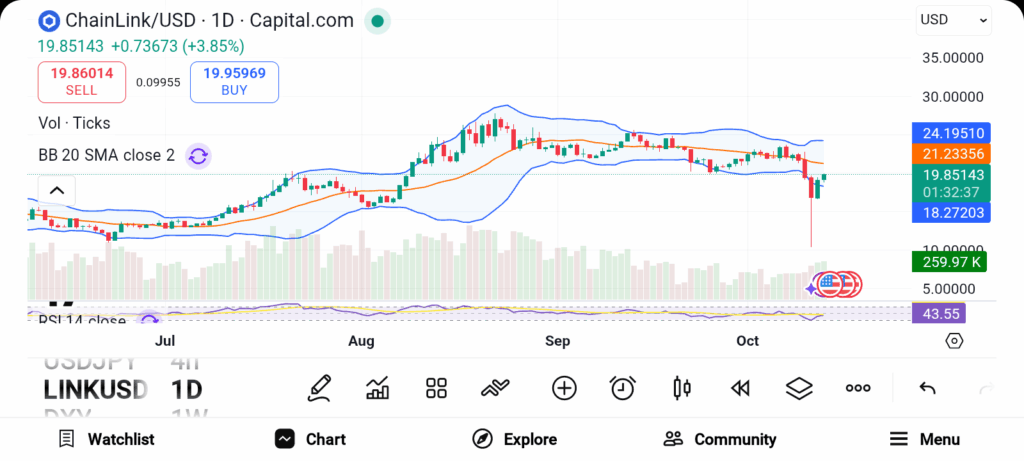

- Chainlink strengthens DeFi with oracles and CCIP, bridging traditional finance with blockchain systems.

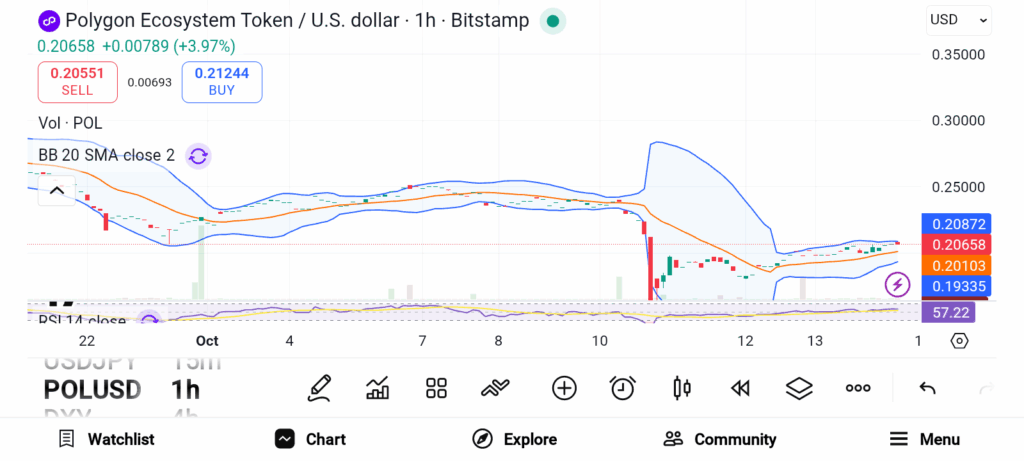

- Polygon advances Ethereum scaling through zkEVM technology and rising institutional adoption.

Bitcoin’s halving cycles have essentially determined the seasons of the crypto market for a long time, however, this time it seems different. With the market getting mature, there are now more and more projects with real utility and deep infrastructure gaining prominence. Investors are moving their attention away from hype to value, and these three altcoins—Avalanche, Chainlink, and Polygon—are at the forefront of this change. They each provide robust fundamentals, gradual development, and a far-reaching vision which might last longer than the influence of the cycles of Bitcoin.

Avalanche (AVAX)

Source: Trading View

Source: Trading View

Avalanche still holds the position as one of the most powerful Layer 1 blockchains in the market. Even though it doesn’t get as much attention as Ethereum or Solana, its ecosystem keeps developing at a steady pace. To address issues of speed and scalability, Avalanche enables developers to create their own blockchains via subnets. This feature is attractive to businesses which want high performance without giving up decentralization.

Last year, Avalanche experienced an increase in stablecoin transactions and gaming projects. In addition, liquid staking partnerships have been broadened, thereby offering more use cases to token holders. These patterns point to the fact that Avalanche’s ecosystem is maturing and is getting serious developers. When the crypto market gains momentum, there is a possibility that infrastructure networks such as Avalanche will be the ones to go first.

Chainlink (LINK)

Source: Trading View

Source: Trading View

Chainlink is one of the most important pieces of crypto infrastructure. As a leading oracle network , it is the first to connect real-world data to smart contracts. The capability is the source of the power of DeFi platforms, lending systems, and even blockchain-based insurance products. While LINK’s price has been relatively slow compared to other large caps, the company’s fundamentals are still viable.

The team is continuing to facilitate integrations across various blockchains, thereby broadening the Cross-Chain Interoperability Protocol’s scope. These integrations are indispensable for the merging of traditional finance with blockchain-based systems. In addition, Chainlink, by collaborating with financial institutions, helps to connect on-chain and off-chain markets.

Polygon (POL)

Source: Trading View

Source: Trading View

Polygon has earned a reputation as Ethereum’s go-to scaling solution. The network delivers faster transactions and lower fees while staying closely connected to Ethereum’s ecosystem. This design has attracted partnerships with major companies, from blockchain startups to global corporations. Polygon’s focus has recently shifted toward zkEVM technology.

This upgrade aims to make Ethereum scaling more efficient and cost-effective. The move aligns perfectly with the market’s demand for real-world applications rather than speculation. Institutional adoption is also growing. Several payment firms and financial service providers have started using Polygon-based rails.

Avalanche offers unmatched flexibility and scalability for developers. Chainlink anchors the DeFi sector by connecting real data to smart contracts. Polygon strengthens Ethereum’s ecosystem through powerful scaling solutions.