Steve Jobs' Bold Presentation Changed Smartphone Displays for Good

- Steve Jobs pressured Corning to produce the first iPhone screen in 2007, accusing its leaders of fearing risk despite initial reluctance. - This collaboration led to Gorilla Glass becoming the smartphone industry standard, reshaping mobile device design and durability. - Apple's $2.5B U.S. glass production investment triples Corning's Kentucky factory capacity, aligning with its China diversification strategy. - Legal challenges persist as Apple appeals Epic Games' App Store ruling, with potential $10B a

Apple's groundbreaking partnership with

Back then, Corning was reluctant to sign on to manufacture the iPhone’s glass screen, with internal voices suggesting the deal should be declined. Jobs, however, used his reputation for relentless standards and boldness to persuade Weeks. "Do you know what your problem is? You're afraid. You know, you're afraid I'm going to launch the biggest product in history, and I'm not going to be able to do it because you failed, and I'm going to eviscerate you," Jobs reportedly told Weeks, according to AppleInsider. The conversation, described as a masterclass in persuasion, convinced Corning to take the leap, resulting in the creation of Gorilla Glass, which soon became the industry norm for smartphones.

The alliance has since progressed, with Corning now providing the advanced Ceramic Shield 2 for the iPhone 17.

At the same time, Apple continues to deal with legal disputes, including its appeal in the Epic Games App Store lawsuit. The company is trying to overturn a federal court order that prevents it from collecting commissions on purchases made outside the App Store, arguing that the decision imposes excessive financial burdens, according to

Investor outlook remains cautiously positive, with Loop Capital upgrading Apple to a "Buy" rating and increasing its price target to $315, citing strong demand for the iPhone 17 and expectations for sustained growth through 2027, according to a

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin News Today: Meme Coin Battle: Excitement Versus Practical Use in the Quest for Supremacy

- Meme coin investors shift focus to Layer Brett ($LBRETT), an Ethereum L2 project combining meme appeal with utility, as Dogecoin (DOGE) ETF delays stall its momentum. - Pepe Coin (PEPE) struggles to sustain engagement despite social media-driven surges, lacking infrastructure for long-term on-chain activity. - Layer Brett offers low fees, instant transactions, and 590% APY staking, attracting $4.4M in pre-sales amid DOGE's 17% three-month price drop. - Shiba Inu (SHIB) retains brand strength but faces sc

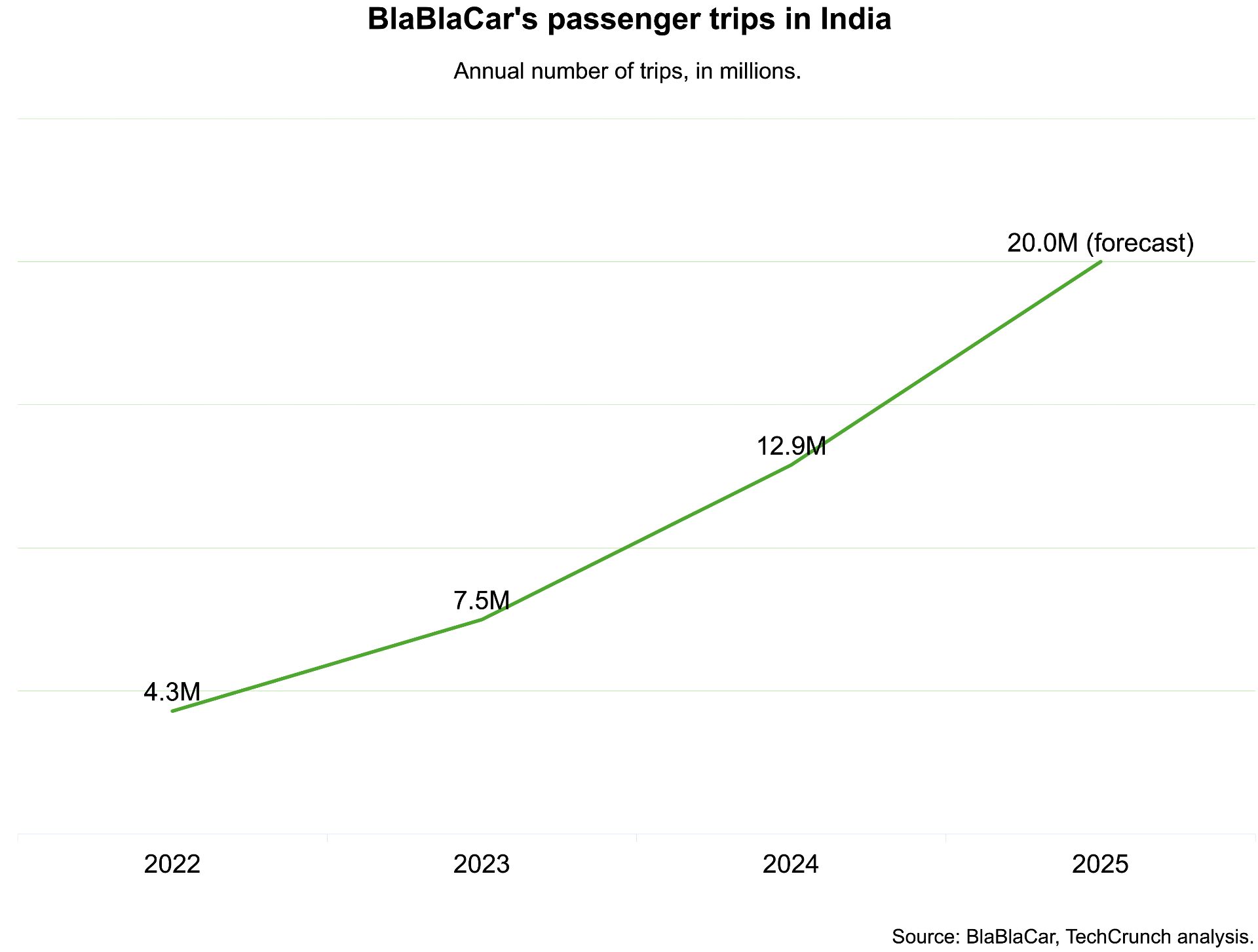

India, which BlaBlaCar previously exited, has now become its largest market

TechCrunch Mobility: The debate over the ‘robot army’