Limitless surprise TGE: Secret launch to avoid sniping, but unavoidable market doubts

The secretive launch did allow Limitless to avoid technical sniping, but it also made it more difficult for outsiders to trace the early flow of funds.

Original Title: "Behind the Limitless TGE: A Secretive Launch to Avoid Sniping, Unavoidable Market Doubts"

Original Author: Ethan, Odaily

At 7:30 PM on October 22, the prediction platform Limitless suddenly posted: "Shall we TGE today?"

This unexpected question instantly caused a stir in the community. Most people thought it was another intern "accidentally posting," and the comments were full of jokes. Even project CEO CJ (@cjhtech) quickly commented: "intern wtf??" "who gave you this button".

For a moment, netizens speculated that this was a joke or a "scripted" marketing stunt. However, just an hour later, the plot took a turn—Limitless officially announced the launch of TGE and simultaneously opened LMTS token airdrop claims.

This series of "unexpected official announcements" shifted the community from "joke mode" to "attention mode" in an instant, and the story behind the TGE gradually revealed itself to be more complex.

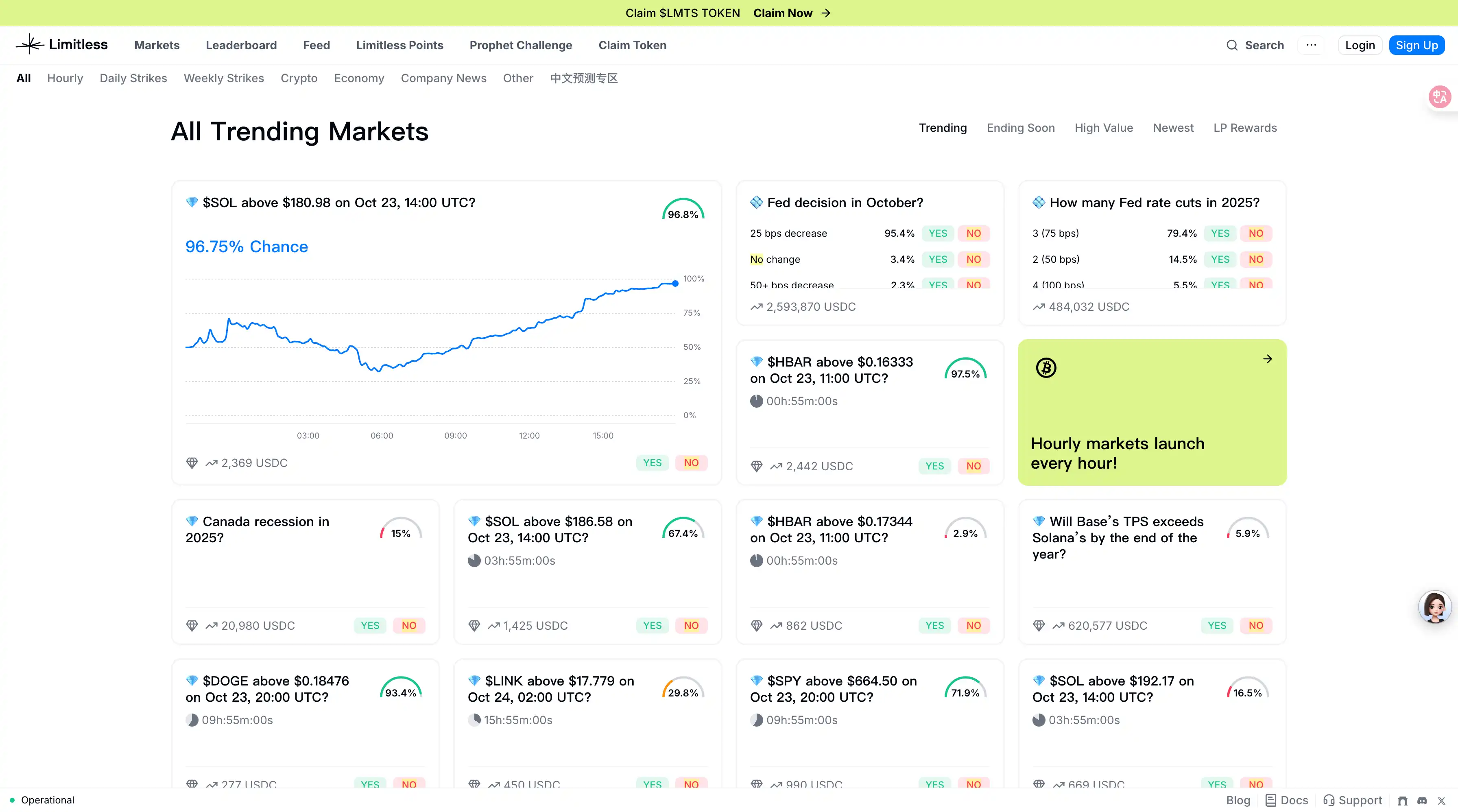

Who is Limitless?

Limitless is a Base chain-based, socially oriented prediction market protocol that allows users to create and participate in prediction markets across crypto assets, stocks, sports, social culture, and more. The project has completed three rounds of financing, raising a total of $17 million, with investors including Coinbase Ventures, 1confirmation, Maelstrom, and other crypto investment institutions.

In terms of mechanism, Limitless is similar to Polymarket: Users participate in predictions by buying shares of specific event outcomes (usually "yes" or "no"). Winning shares are settled at $1 upon expiration, while losing shares become void.

According to the project's whitepaper, before the outcome is determined, one "yes" share and one "no" share in the same market can be redeemed together for one collateral token (usually USDC or Wrapped ETH), which is locked by an on-chain smart contract as the underlying collateral for issuing shares.

Unlike Polymarket, Limitless is attempting to add social scenarios and a "short-term quick game" mechanism on top of the prediction market, making speculation lighter, faster, and more shareable.

This TGE officially brings it into the "public spotlight" stage.

TGE: From a Dream Chart Opening to a Trust Rift

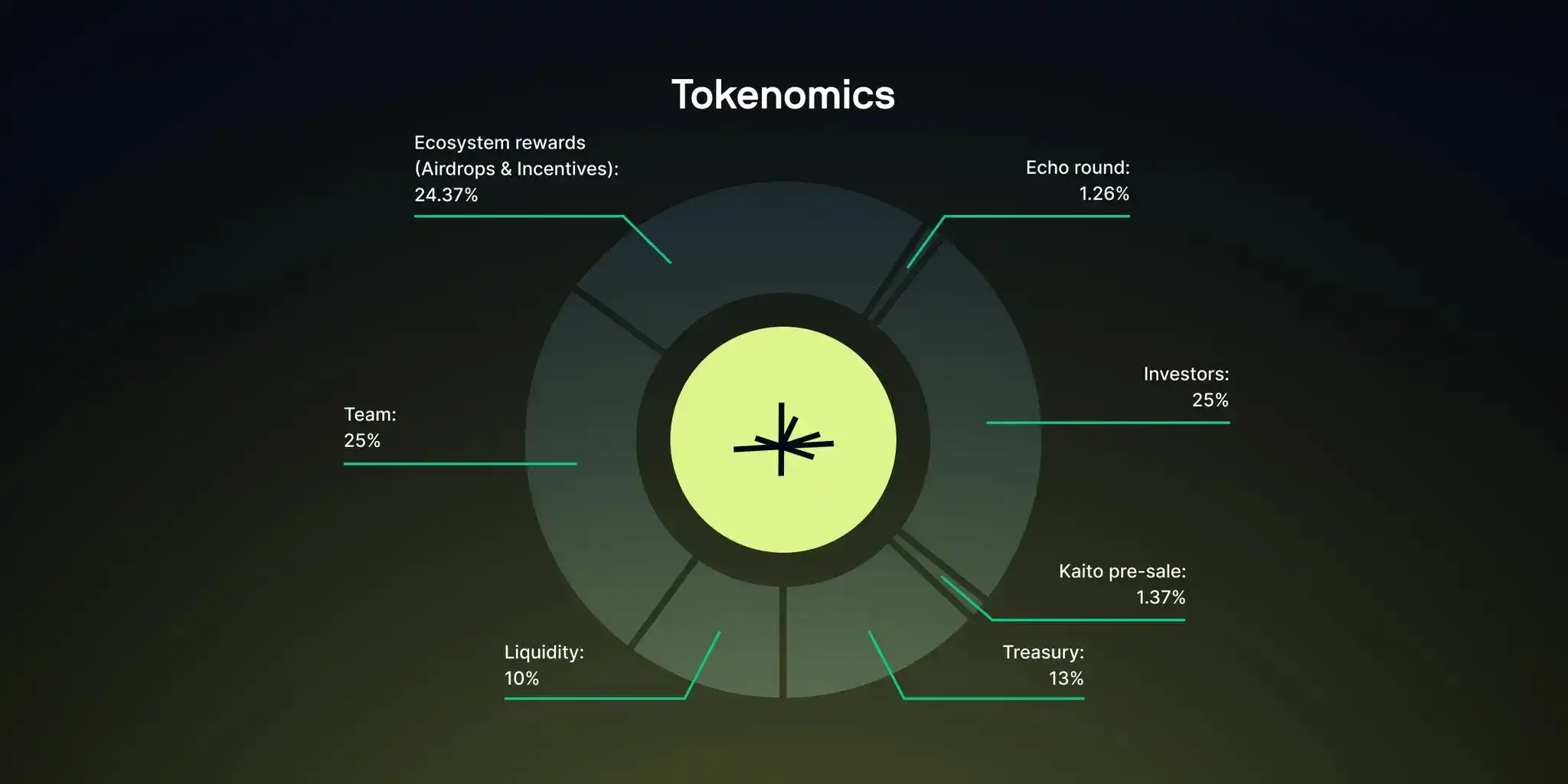

According to the official blog, the total supply of LMTS tokens for this Limitless TGE is 1 billion, with a TGE circulation of 13.159868%. The specific allocation is as follows:

· Kaito Presale: 1.37%

· Investors: 25%

· Echo Round: 1.26%

· Team: 25%

· Ecosystem Rewards (Airdrops and Incentives): 24.37%

· Treasury: 13%

· Liquidity: 10%

At the same time, Limitless announced that the airdrop is now live, and both Limitless Points Season 1 traders and Wallchain Epoch 1 Quackers users may be eligible for the airdrop.

In the half hour following the TGE, LMTS's price action once made people think it was a "dream chart opening."

The buying sentiment driven by the hype pushed the price from below $0.2 directly up to $0.8, a surge of over 400%. However, the good times didn't last long, as the market quickly reversed downward, dropping to a low of $0.196, with the current price rebounding to $0.313.

Honestly, this kind of rhythm is all too common with new token launches: first a spike, then a pullback, with even the timing window being almost identical. In theory, such volatility shouldn't arouse suspicion, as short-term capital is abundant in the market and price emotions are the norm.

But this time, the drop still made some people feel that something was off.

At 22:58 on October 22, KOL @ManaMoonNFT posted an on-chain tracking report on X, pointing out that the Limitless team appeared to be engaging in continuous selling. Monitoring data showed:

A team-associated wallet (0x3c583Be48D2796534f8FC8EA214674Ff055d01d7, initially holding 40 million tokens) transferred 5 million LMTS to a selling address (0xBF3132977d9801506deF8E927c4Ff06E5b0801d1), and sold them all within a few hours, making a total profit of about $2.3 million.

After a brief rebound, about 10 million more tokens were transferred to the same wallet for continued selling.

The market began to grow cautious. This looked too much like a carefully orchestrated cash-out. At this moment, public opinion showed a clear rift.

CJ's Response: Explanation or Declaration of War?

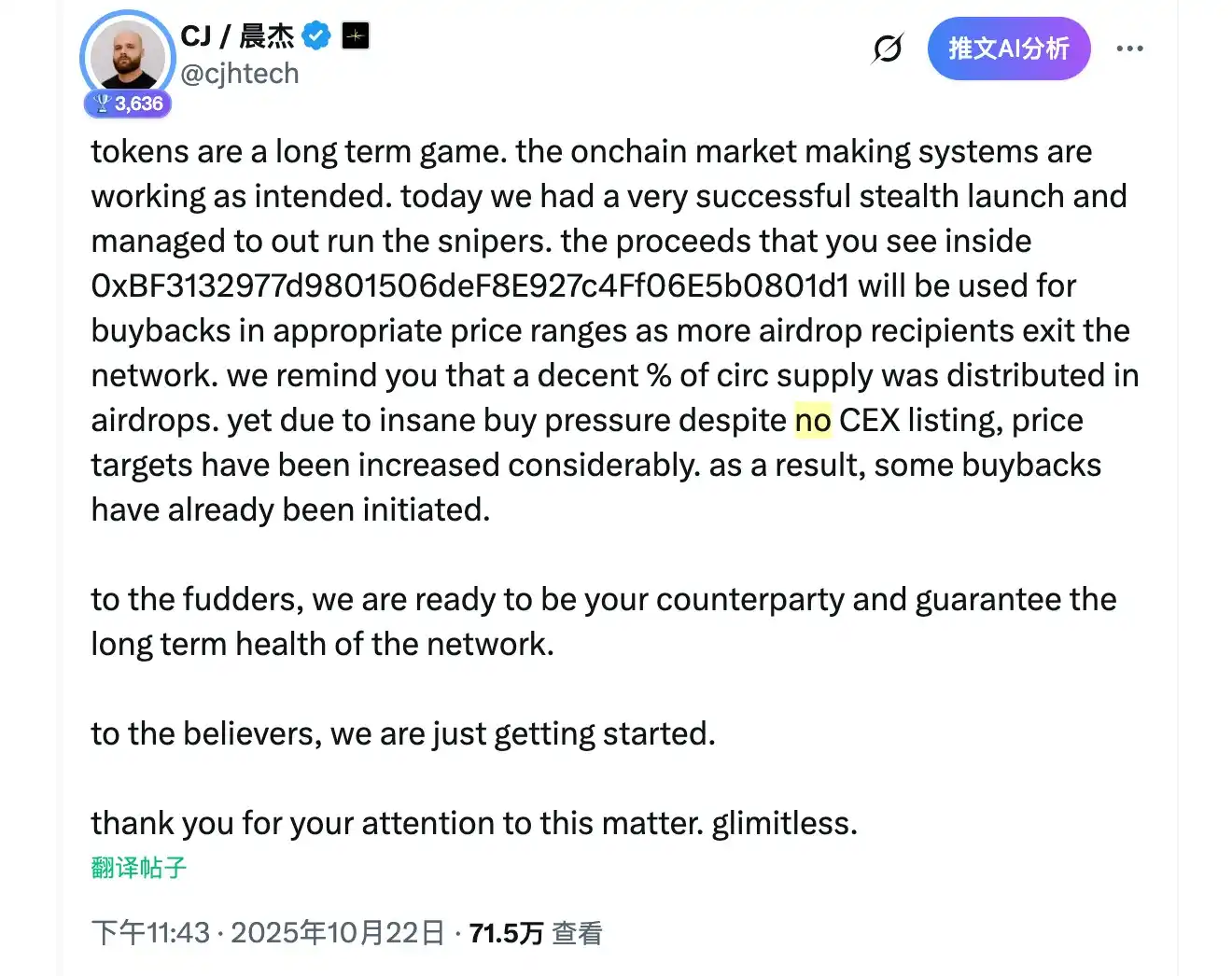

As FUD sentiment spread, Limitless CEO CJ finally responded.

At 23:43 on October 22, he wrote on X, "Tokens are a long-term game, and the on-chain market maker mechanism is operating as designed."

CJ explained that the observed capital flows were from the team's buyback plan, especially during the airdrop claimants' selling phase. He emphasized that the project has not yet been listed on centralized exchanges, but buying pressure is strong and the price target has been raised.

The final sentence was rather tough: "For those spreading FUD, we are ready to be your counterparty. For the believers, we are just getting started."

This response seemed like both an "explanation" and a "declaration of war."

This made the direction of the incident even more subtle: on the surface, the team was stabilizing the market, but in reality, community trust had already begun to fracture.

What is a Secretive Launch?

The term "secretive launch" may be unfamiliar to many. Simply put, it is a defensive mechanism used by project teams to prevent tokens from being sniped by bots at launch, which could cause extreme price volatility.

The usual practice is: quietly deploy the contract and conduct small-scale testing first. After confirming there are no large-scale sniping or arbitrage risks, the token contract address is made public for free market trading.

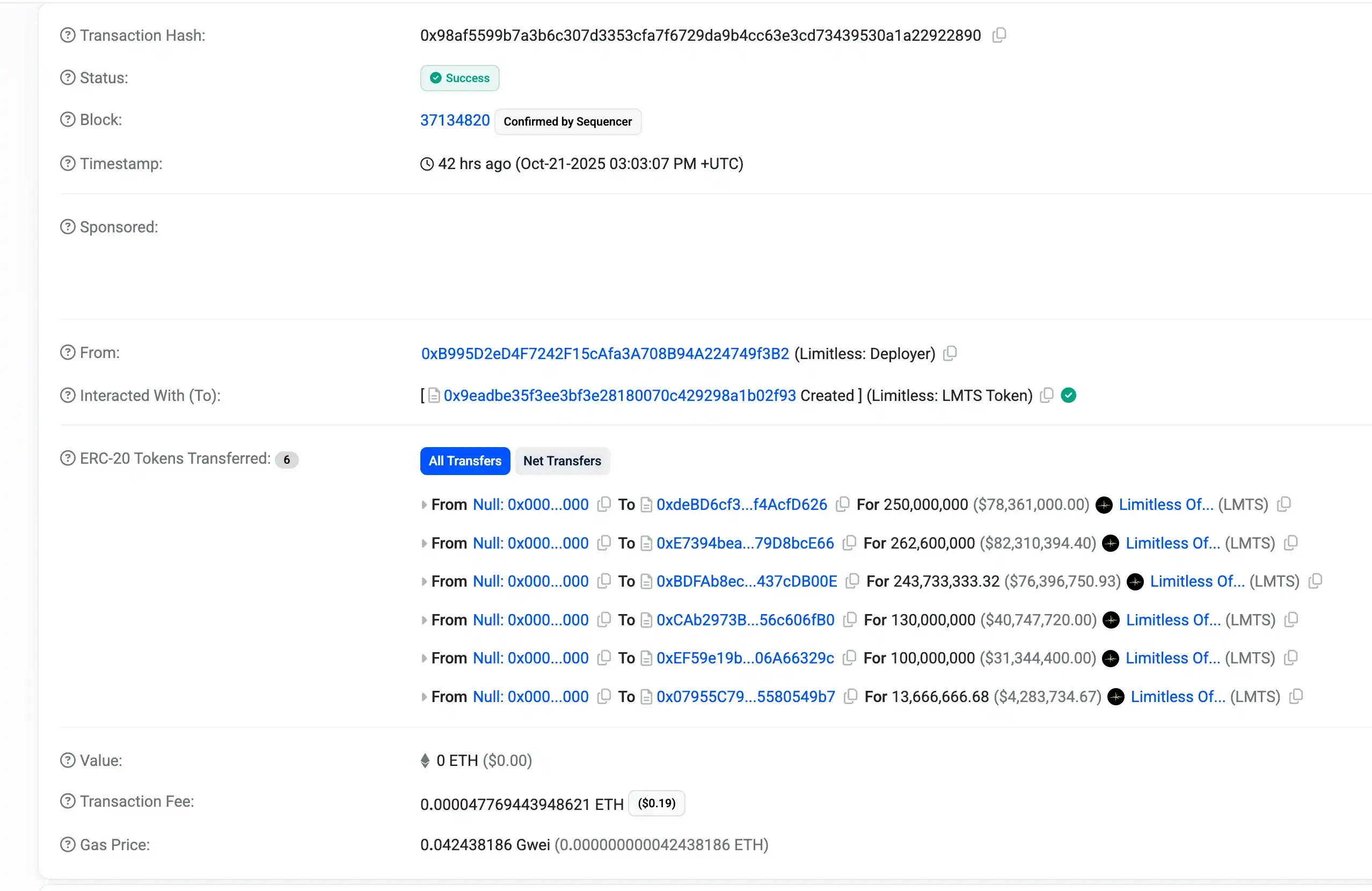

In this Limitless TGE, the team claimed to have used this strategy. According to on-chain data, the LMTS token was created only about 21 hours before the official announcement. During this period, the team completed token distribution and contract deployment, and only after confirming everything was "safe" did they officially announce the contract address.

In effect, this approach did allow Limitless to avoid technical sniping, but it also made it harder for outsiders to trace early capital flows.

The intention to defend and the resulting lack of transparency have now become a new point of controversy.

Summary

As of now, this incident is still fermenting, and many doubts remain unresolved.

For example, the wallet alleged to be associated with the team seems to hold tokens not included in the officially disclosed 25% team allocation (according to on-chain analysis, the wallet's initial 40 million tokens came from the "ecosystem incentive" portion). Why do these tokens have no vesting period? In the tokenomics model, only 2.45% of the airdrop and early incentive portions are immediately unlocked. Also, why were these so-called "internal buyback" operations not disclosed in advance?

There are no answers to these questions for now.

Market sentiment is also gradually cooling, and LMTS's price seems to have sunk to the bottom of the lake—calm, but with a hint of oppression.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

x402 ignition, $PING 8x! Earn first, understand later

From the Courtroom to the White House: CZ’s Pardon Is Far More Than a Presidential Order

MegaETH public sale = money-making opportunity? Vitalik has already joined