Ethereum News Update: Is Ethereum Facing an ETF Sell-Off or Poised for a November Surge with Its Triple-Bottom Pattern?

- Ethereum's price stabilizes at $3,958 amid shrinking exchange reserves, whale accumulation, and rising Layer-2 adoption, signaling potential breakout conditions. - The November 2025 Fusaka upgrade aims to boost scalability, with analysts projecting $6,925 by 2025 and $15,575 by 2030 driven by ETF adoption and institutional demand. - ETF outflows ($127.5M) contrast Bitcoin inflows, while on-chain data suggests a "triple-bottom" pattern around $3,750 could precede a strong rally. - Macroeconomic risks from

As November 2025 draws near, Ethereum’s price movement has reached a crucial juncture, with experts pointing to a mix of on-chain trends, broader economic influences, and anticipated protocol enhancements that could reshape its valuation. Following a 5.59% decrease so far this month,

Recent figures indicate that Ethereum’s price has been steady between $3,700 and $4,000, buoyed by heightened network usage. Daily transaction counts have exceeded 1.2 million, and the total value locked in decentralized finance (DeFi) has climbed 8% over the past week, according to

Nevertheless, the recovery faces several obstacles. Ethereum exchange-traded funds have experienced $127.51 million in withdrawals this month, in contrast to Bitcoin’s $20.33 million in net inflows, as noted by

The Fusaka upgrade, set for November 2025, could provide further impetus. This hard fork is designed to improve Ethereum’s scalability and performance, tackling persistent network limitations, according to

Broader economic factors are also at play. Ongoing tensions between the U.S. and China, along with changes in Federal Reserve policy, have created a turbulent environment, causing risk assets like cryptocurrencies to react sharply to shifts in sentiment, as reported by CryptoNews. Ethereum’s performance in November could depend on whether macroeconomic conditions stabilize, enabling ETF inflows to counteract short-term selling.

At present, Ethereum is navigating a precarious situation. Although the recent 5.59% monthly decline and ETF withdrawals are cause for caution, underlying strengths—from a DeFi resurgence to increased whale holdings—indicate durability. The upcoming Fusaka upgrade and potential improvements in the macro environment could prove decisive, making November a key turning point for Ethereum’s price outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

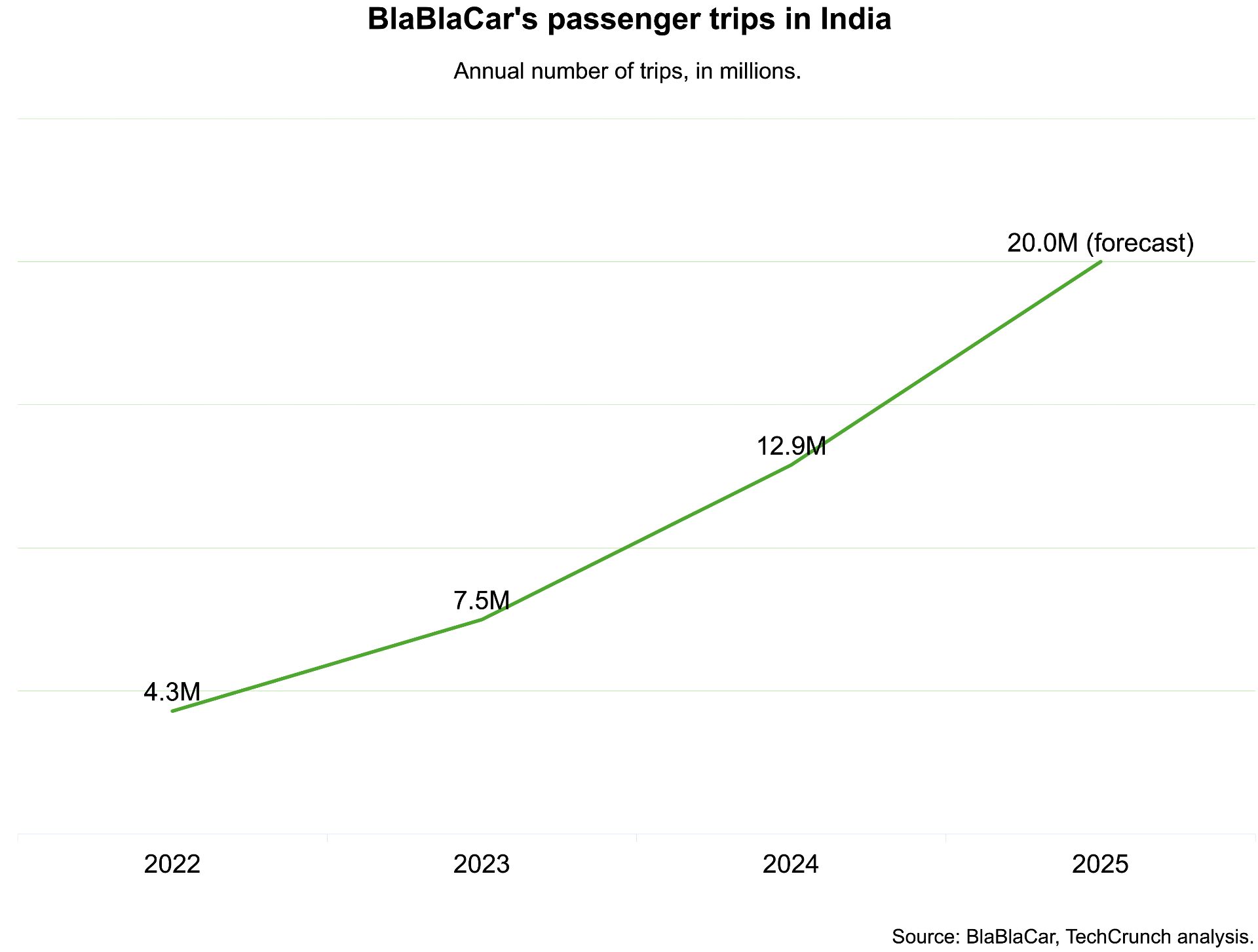

India, which BlaBlaCar previously exited, has now become its largest market

TechCrunch Mobility: The debate over the ‘robot army’

Harris's 2028 Aspirations Ignite Democratic Party Debate on Messaging and Cohesion

- Kamala Harris signals 2028 presidential ambitions, asserting a woman could become U.S. president in her lifetime despite 2024 election loss to Trump. - Democratic critics like Sen. John Fetterman blame her "fascist" Trump label for alienating voters, highlighting party tensions over rhetoric and messaging strategies. - Gov. Gavin Newsom and other governors test 2028 waters, with polls showing Newsom leading Harris in California Democratic primary projections. - Internal Democratic fractures deepen as Har