Bitcoin News Today: Bitcoin Approaches Its "Gold 2025 Moment" as Institutional Interest Matches Bullion’s Surge

- JPMorgan enables institutional clients to use Bitcoin/Ethereum as loan collateral by 2025, signaling crypto's integration into traditional finance frameworks. - Analysts predict Bitcoin could mirror gold's 2025 rally or reach $1.6M-$2M, citing institutional demand and scarcity-driven value propositions from figures like Tom Lee and Michael Saylor. - Technical indicators show Bitcoin in a Wyckoff accumulation phase near $105k-$115k, with MVRV ratios and capital rotation from gold potentially pushing price

Bitcoin’s price movement is once again in the spotlight, as both analysts and major institutions increasingly view the cryptocurrency as a key winner in the ongoing global asset reallocation. With forecasts ranging from $130,000 up to $2 million and leading financial firms weaving crypto into mainstream finance, discussions about Bitcoin’s future worth are growing more heated.

JPMorgan Chase & Co. plans to let its institutional clients use

Matt Hougan, CIO at Bitwise Asset Management, believes Bitcoin could follow gold’s 2025 surge if short-term selling pressure eases and institutional interest takes the lead, according to an

Elsewhere, prominent industry voices are making ambitious forecasts. BitMine Chairman Tom Lee projects Bitcoin could climb to $1.6–$2 million if it reaches gold’s total market capitalization, as reported by

From a technical perspective, indicators suggest further upside potential. The 8-hour Bitcoin chart reveals a Wyckoff reaccumulation pattern, with price consolidating between $105,000 and $115,000, hinting at a possible upward breakout, according to

Bitcoin’s potential for further gains is tied to capital moving from gold and other assets. Bitwise estimates that a mere 3–4% shift from gold to Bitcoin could drive BTC above $240,000, while VALR’s Farzam Ehsani notes that macro events—such as lower U.S. CPI numbers or easing trade tensions—could speed up this transition.

Despite the bullish sentiment, critics warn of ongoing risks. Bitcoin’s price swings remain a major concern, and JPMorgan’s collateral program is limited to institutions, so retail investors won’t see immediate liquidity benefits, as detailed in

As the crypto sector adapts to evolving regulations and economic conditions, Bitcoin’s reputation as a store of value continues to strengthen. Whether it can surpass $160,000 or more will depend on ongoing institutional participation, macroeconomic developments, and how short-term volatility is managed.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin News Today: Meme Coin Battle: Excitement Versus Practical Use in the Quest for Supremacy

- Meme coin investors shift focus to Layer Brett ($LBRETT), an Ethereum L2 project combining meme appeal with utility, as Dogecoin (DOGE) ETF delays stall its momentum. - Pepe Coin (PEPE) struggles to sustain engagement despite social media-driven surges, lacking infrastructure for long-term on-chain activity. - Layer Brett offers low fees, instant transactions, and 590% APY staking, attracting $4.4M in pre-sales amid DOGE's 17% three-month price drop. - Shiba Inu (SHIB) retains brand strength but faces sc

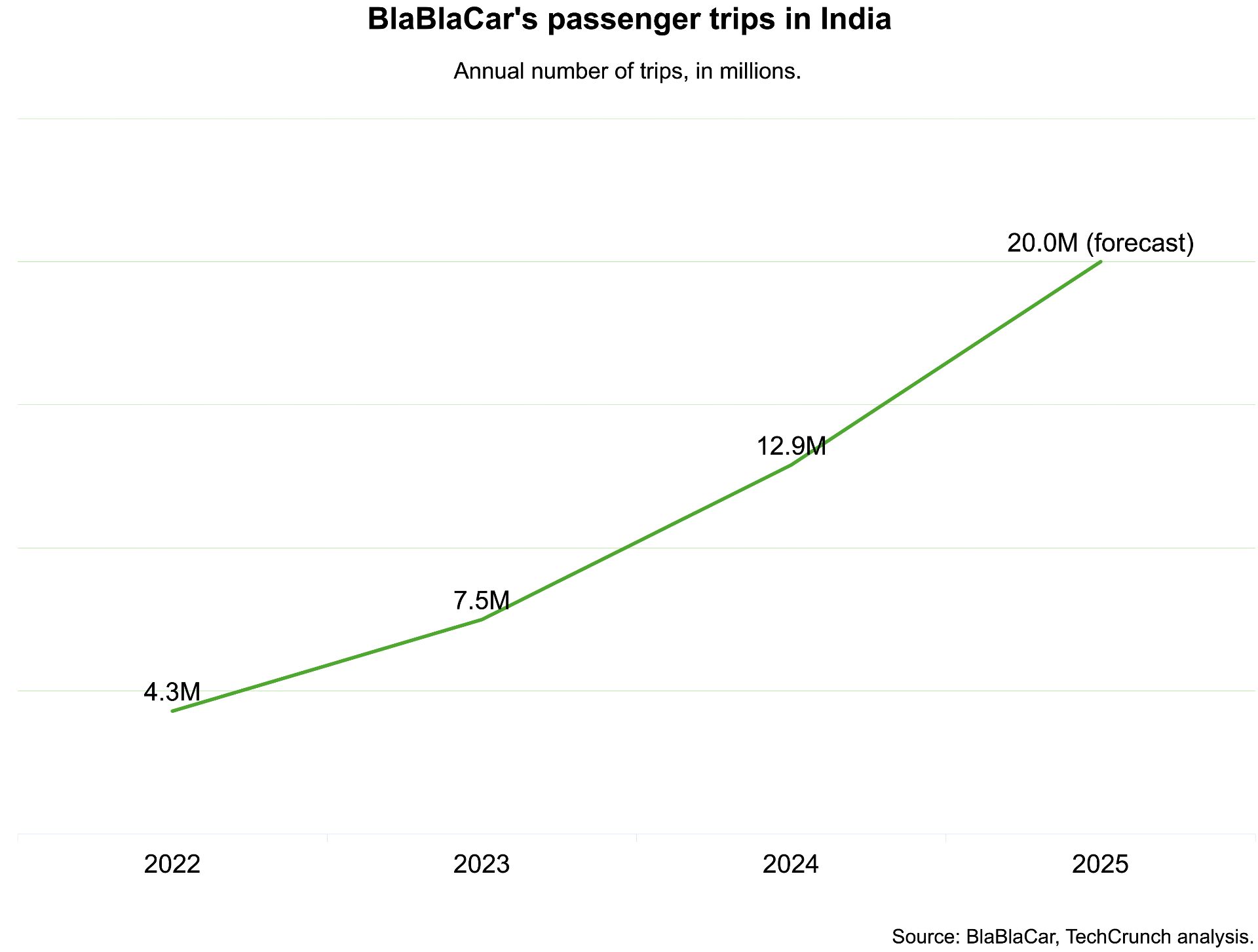

India, which BlaBlaCar previously exited, has now become its largest market

TechCrunch Mobility: The debate over the ‘robot army’