Tariff concerns temporarily eased, is the bull market rally sounding again?

The whale with a 100% win rate has not taken profits yet and has increased their ETH long positions again this morning.

Original Title: "Tariff Clouds Temporarily Lifted, Is the Bull Market Coming Back?"

Original Author: Azuma, Odaily

With new progress in tariff negotiations between China and the US, sentiment in the crypto market has rapidly heated up.

From last night to this morning, the market saw another significant surge. According to Okx market data (as of 9:30), BTC broke through 115,000 USDT, reaching as high as 115,590 USDT, a 24-hour increase of 3.02%; ETH approached 4,200 USDT, peaking at 4,194.84 USDT, up 5.88% in 24 hours; SOL reclaimed the 200 USDT mark, reaching up to 205.09 USDT, with a 24-hour increase of 5.58%.

In addition to BTC, ETH, and SOL, the altcoin market finally saw a decent recovery, with some tokens posting impressive gains. For example, the consistently strong ZEC once hit 368 USDT, up 30.03% in 24 hours; benefiting from renewed AI concept hype, VIRTUAL reached 1.5761 USDT, up 22.25% in 24 hours; other popular protocols like PUMP, PENDLE, and ENA also performed well, with 24-hour increases of 17.64%, 10.06%, and 9.22% respectively...

Driven by the overall market uptrend, the total crypto market cap has rebounded sharply. According to CoinGecko, the total crypto market cap has now returned to 3.984 trillion USD, a 24-hour increase of 3.5%, just one step away from reclaiming the 4 trillion USD mark. The panic among crypto users has also clearly subsided, with today's Fear and Greed Index reaching 51, shifting from "Fear" to "Neutral".

In derivatives trading, Coinglass data shows that in the past 24 hours, total liquidations across the network reached 421 million USD, with the vast majority being short liquidations, totaling 345 million USD. By token, BTC liquidations amounted to 169.7 million USD, and ETH liquidations reached 110.7 million USD.

Tariff Clouds Temporarily Lifted

From a news perspective, the most direct reason for the rapid market rebound is undoubtedly the new progress in tariff negotiations between China and the US.

From October 25 to 26, the Chinese lead for China-US economic and trade talks, Vice Premier He Lifeng, met with the US leads, Treasury Secretary Bessent and Trade Representative Greer, in Kuala Lumpur for China-US economic and trade consultations.

After the talks, Li Chenggang, China's Vice Minister of Commerce and International Trade Negotiator, told Chinese and foreign media that both sides had reached a preliminary consensus on properly resolving several major economic and trade issues of mutual concern, and the next step would be to go through their respective domestic approval procedures.

After the meeting, US Treasury Secretary Bessent also told US media that after two days of talks in Kuala Lumpur, both sides had reached a "very substantive framework agreement," laying the groundwork for a meeting between the two countries' leaders, and the US side is "no longer considering" imposing a 100% tariff on China. US Trade Representative Greer also stated at a press conference that the China-US trade talks were productive, covering various topics, and both sides are discussing the final details of a trade agreement proposal, which is almost ready to be submitted to the two leaders for review.

Since Trump suddenly reignited the tariff issue earlier this month, a cloud has hung over the crypto market and even the global financial markets. On October 11, the market suffered a historic crash. As the related tensions gradually ease, the market naturally warms up as well—speaking of which, this seems to be another classic Trump "raise high, put down gently" strategy, but in the process, a massive wealth transfer has already taken place.

This Week's Focus: Interest Rate Decision

The main focus for the rest of this week is undoubtedly the Federal Reserve's interest rate decision early Thursday morning—at 2:00 AM (GMT+8) on October 30 (Thursday), the Fed FOMC will announce its interest rate decision and economic outlook summary; then at 2:30 AM, Fed Chair Powell will hold a monetary policy press conference.

Last Friday, the US Bureau of Labor Statistics released September's overall and core inflation indicators, both of which were below expectations, paving the way for the Fed to further advance rate cuts—US September unadjusted CPI year-on-year came in at 3%, slightly up from last month's 2.9%, the highest since January 2025, but slightly below the market consensus of 3.1%; September seasonally adjusted CPI month-on-month was 0.3%, lower than both the market expectation and previous value of 0.4%. US September unadjusted core CPI year-on-year was 3%, below both the market expectation and previous value of 3.1%; September seasonally adjusted core CPI month-on-month was 0.2%, also below the market expectation and previous value of 0.3%.

After the CPI data was released, traders increased their bets that the Fed will cut rates twice more this year. According to CME "FedWatch" data, the probability of a 25 basis point rate cut by the Fed in October is currently 97.3%, with only a 2.7% chance of rates remaining unchanged; the probability of a cumulative 50 basis point rate cut by December is 95.5%.

"Insider" Whale Moves: Still Bullish

Putting aside all traditional uncertain influencing factors and abstracting market trends into a minimalist problem, the most influential player recently is undoubtedly the whale with a 100% win rate since the 10.11 crash.

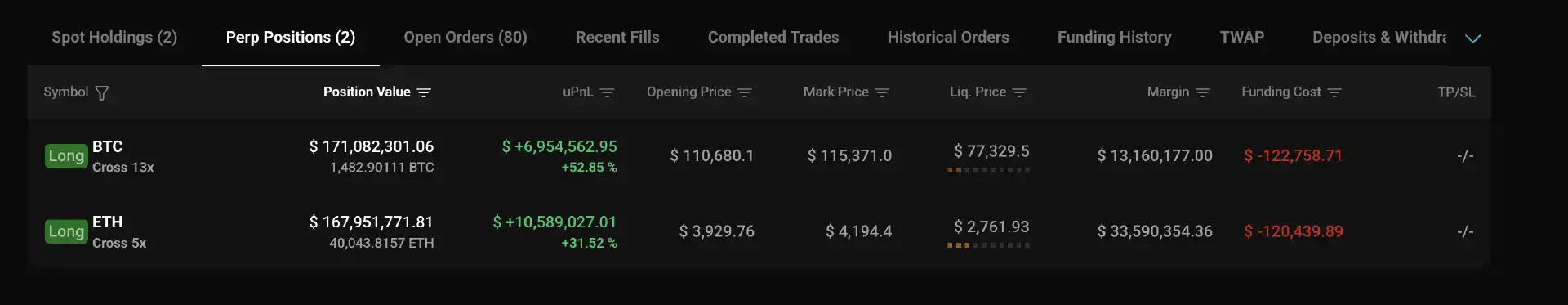

According to HyperBot data, the "100% win rate whale since 10.11" currently holds 13x leveraged BTC long positions and 5x leveraged ETH long positions, with unrealized profits of about 17.54 million USD, and has not yet taken profit. Three hours ago, this whale even added another 1,868 ETH long positions. Currently, the total value of this whale's holdings is about 339 million USD, with BTC long positions valued at about 171 million USD at an entry price of 110,680 USD; ETH long positions are valued at about 168 million USD at an entry price of 3,929 USD.

Clearly, this whale remains bullish. Whether it's due to insider information or technical analysis, closely following this whale's moves in the short term may be the optimal strategy for dealing with the current market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The co-founder of Solana challenges the security of Ethereum Layer-2s

Strategic Trade De-escalation Underway Between US And China

Western Union Modernizes Payment System With Stablecoins

Ethena’s Synthetic Stablecoin Model Challenges USDC’s Market Dominance