Analysis: Bitcoin's current price shows "almost no bubble," with nearly 40% of holdings at a loss

BlockBeats News, November 6, analyst Murphy stated in a post that Bitcoin has recently dropped to a level almost equal to its fair value—$98,000. The fair price of Bitcoin is calculated as the historical average of the MVRV ratio. If the market valuation level (MVRV) is at its historical average, then the price of BTC should be near this level, so the fair price is regarded as a "mean reversion center." Compared to the average cost of all active positions, the current price has almost no bubble.

If the market remains rational, value discovery should occur and buying should enter the market. If it continues to fall below this level, it indicates that the market has entered an irrational phase (oversold), or even a collapse of confidence, which would ignore value reversion and instead lean more towards active risk aversion. Currently, the proportion of profitable BTC supply (PSIP) is 72%, which has already fallen into the extreme range of a bull market correction (70%-75%). If Satoshi Nakamoto's and lost BTC are excluded, this proportion would be even lower, meaning that at least nearly 40% of positions are currently in a floating loss. It has also been observed that the proportion of long-term holders at a loss has surged, which is also a signal that the correction has entered a relatively bottom range.

The analyst believes that if the recent decline is not the extreme of a bull market correction, then it is the beginning of a cycle turning bearish. The analysis is for learning and communication purposes only and does not constitute investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US-listed company Solmate Infrastructure launches SOL validation node in the UAE

The privacy-first wallet Hush, based on Solana, will be launched on the Chrome Web Store within a few days.

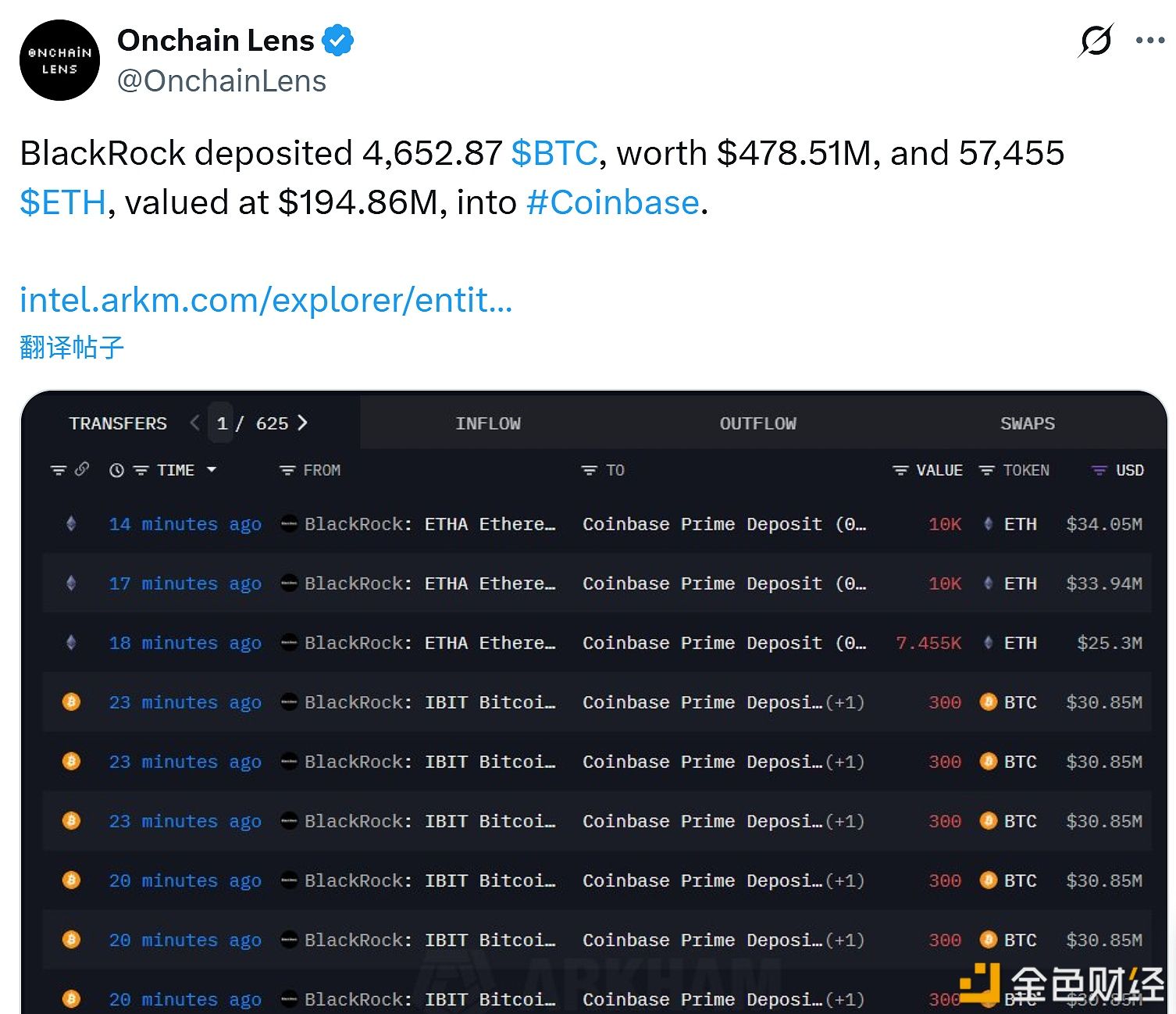

BlackRock deposits 4,652.87 BTC and 57,455 ETH into a certain exchange