Helius raised 500 million dollars to buy SOL, but now the Solana community just wants it to change its name.

Source: Odaily Azuma

Digital asset treasury companies focusing on Solana (SOL) are rapidly emerging.

Following Forward Industries’ completion of a $1.65 billion financing round and its swift acquisition of 6.82 million SOL, on September 15, the US-listed company Helius (full name Helius Medical Technologies, stock code HSDT) completed a $500 million private placement to transform into a SOL treasury company. This round was led by Pantera Capital and Summer Capital. The financing terms included selling common shares at $6.881 per share and attached warrants at $10.134 each. If all warrants are exercised, the total amount raised could exceed $1.25 billion.

- Odaily note: For details, see "After $1.6 Billion Buy Orders, Another $1.25 Billion Follows—Where Is the Ceiling for SOL Reserve Strategies?"

However, compared to the enthusiastic response from the Solana community towards Forward Industries, discussions around Helius have been somewhat awkward.

The issue lies in the name Helius—long before this Helius transformed into a SOL treasury company, there was already another Helius in the Solana ecosystem. This Helius is the largest infrastructure development company in the Solana ecosystem, and its CEO, 0xmert, is arguably the most active developer in the entire Solana ecosystem (personally, I think you can omit "one of"). Not only has he long played the role of community leader, but he has also been instrumental at several key points in Solana’s history, including upgrades and maintenance.

After the treasury company Helius made its official debut, many community members who were unaware of the details initially assumed that the treasury was led by the infrastructure company Helius, but this was not the case.

0xmert himself responded directly on X, stating that he had nothing to do with the matter: "Personal statement: Seriously, I have nothing to do with this—this name overlap is yet another coincidence. The universe is just messing with me. To reiterate, I am not involved, whether it’s Helius, Helium, Helio, Heliux, or Helicopter, none of them are related."

Soon after, the "name collision" between the two companies quickly became a hot topic in the Solana community, with heated debates about whether this was a case of "riding on the reputation" or "pure coincidence."

- Deep Ventures investor Mike Chan directly called out Pantera, saying: "When everyone knows the most famous Solana infrastructure company is called Helius, why would you choose this name? Didn’t you consult 0xmert about this? This is so strange."

- Overseas KOL Mister Todd commented under a post by Pantera founder Dan Morehead: "It’s hard to believe you would choose the name Helius to imitate 0xmert’s achievements. I believe the intermediaries of these shell companies could have had many other options. I hope this ultimately benefits the development of Helius, as their work is crucial to the Solana ecosystem."

- Solana developer korg.sol sarcastically said: "Why don’t we just call everything Helius from now on, so there’s no confusion."

- Marinade Finance team member NickyScanz followed up: "When I launch my own Solana company in the future, I’m going to name it Helius too. No one can stop me."

- Ranger developer Dhrumil also mentioned: "My next company will also be called Helius, so I can join for free."

Clearly, judging from the statements of several community members, the Solana community as a whole is not satisfied with the treasury company Helius’s "name collision," especially given the strong reputation of the infrastructure company Helius in the Solana ecosystem.

Although some voices claim this is purely coincidental, arguing that institutions like Pantera chose Helius as a treasury shell simply because it was the most convenient listed company from a financial perspective, in theory, they could have done as other treasury companies have (for example, Justin Sun renaming SRM Entertainment to Tron) and announced in advance in their financing announcement that a name change would follow, to avoid potential confusion. But in reality, they did not do this.

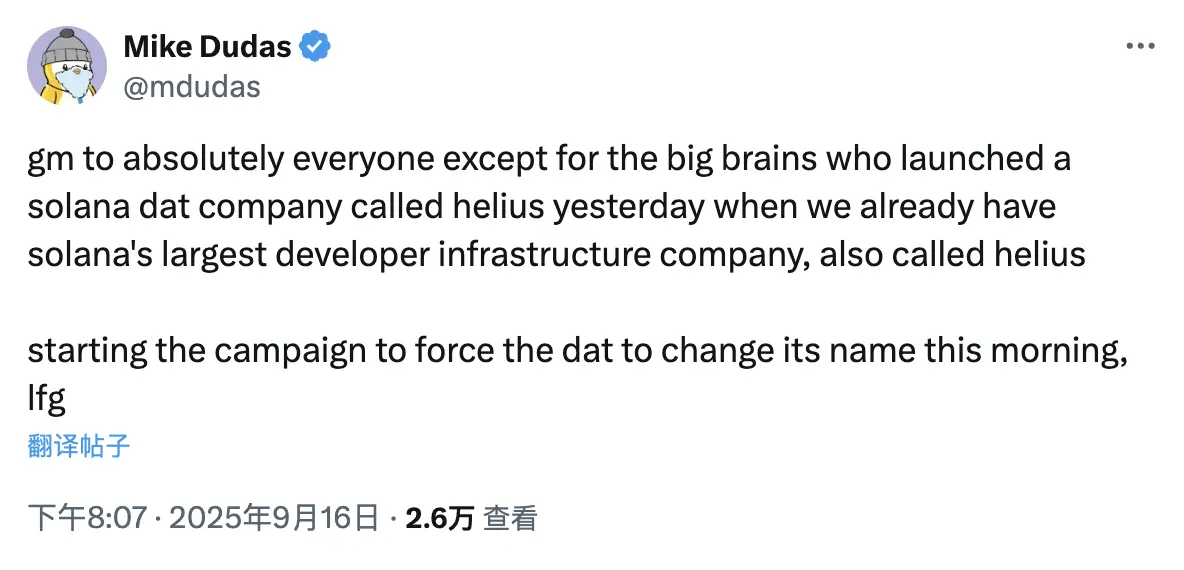

Last night, The Block co-founder and 6MV founder Mike Dudas publicly called on X, urging the Solana community to force the treasury company Helius to change its name—"GM, except for those smart alecks. Yesterday, they set up a SOL treasury company called Helius, apparently unaware that the largest infrastructure development company in Solana is already called that. This morning, I will officially launch an initiative to force this DAT to change its name. Let’s go, everyone!"

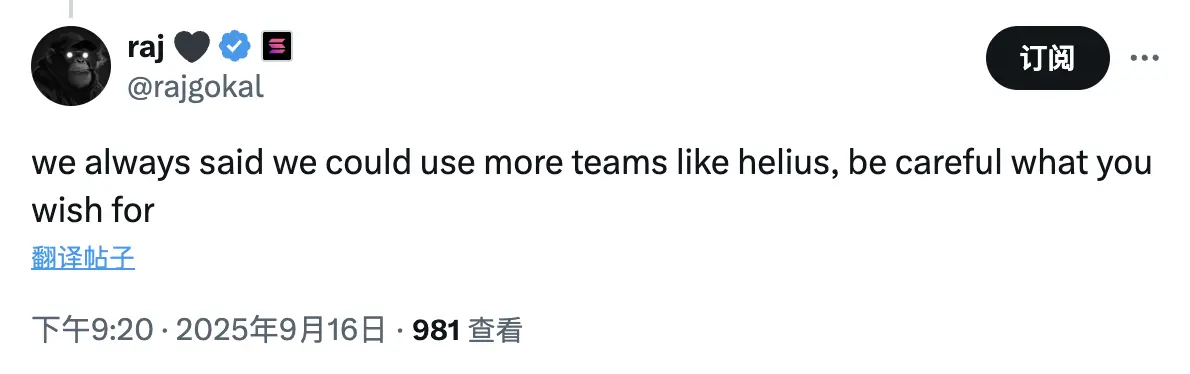

Under Mike Dudas’s post, many people, including Compound founder Robert Leshner, expressed their support. But the most interesting response came from Solana co-founder raj (Raj Gokal)—"We always say we want to see more teams like Helius. Looks like we shouldn’t make such wishes lightly in the future..."

As one of the two co-founders of Solana, raj undoubtedly represents the highest level of Solana’s stance, and from his subtle expression, one can more or less sense his dissatisfaction with the treasury company Helius’s "name collision."

Looking ahead, it’s possible that the treasury company Helius may change its name in the future to appease community sentiment (though it may also insist on not changing), but whether such an initial move that immediately loses community goodwill will have a greater ripple effect in the increasingly competitive treasury sector remains to be seen.

Original link