Written by: San, Deep Tide TechFlow

As the publicly listed company holding the most BTC in the world, Strategy (MicroStrategy) announced on December 1, 2025, that it had raised $1.44 billion by selling Class A common stock to establish a reserve fund.

The official statement indicated that this move aims to support the payment of preferred stock dividends and outstanding debt interest over the next 21 to 24 months, thereby reinforcing its commitment to credit investors and shareholders.

This company, regarded as the "BTC shadow ETF," has had an extremely simple and aggressive core strategy in recent years: finance at the lowest possible cost and convert the funds into bitcoin as soon as they arrive.

Under Michael Saylor's grand narrative of "Cash is Trash," Strategy's balance sheet typically retains only the minimum amount of fiat currency needed for daily operations.

This clearly contradicts its latest statement. Against the backdrop of BTC prices recently retreating from highs and increased market volatility, Strategy's move has once again unsettled the market. What impact will it have on the market when the largest BTC holder is not buying, or even selling, BTC?

Strategic Turning Point

The most significant aspect of this event is that it marks the first time Strategy has publicly acknowledged the possibility of selling its BTC holdings.

Company founder and executive chairman Michael Saylor has long been hailed as a staunch bitcoin evangelist, with a core strategy of "always buy and hold." However, CEO Phong Le stated explicitly on a podcast that if the company's mNAV indicator (the ratio of enterprise value to the value of its crypto asset holdings) falls below 1, and the company cannot finance through other means, it will sell bitcoin to replenish its dollar reserves.

This stance breaks the market's impression of Strategy as "all-in on BTC," and has been interpreted as a major strategic turning point, raising doubts about the sustainability of its business model.

Market Reaction

Strategy's strategic adjustment immediately triggered a sharp negative chain reaction in the market.

After the CEO hinted at a possible BTC sale, Strategy's share price plunged as much as 12.2% intraday, reflecting investors' panic over its strategic shift.

Following the announcement, BTC's price simultaneously fell by more than 4%. While this drop may not have been entirely caused by MicroStrategy's actions, the dangerous signal that the largest buyer is pausing aggressive purchases was clearly picked up by the market.

This expectation of major funds moving to the sidelines amplified the market's risk-off correction.

Compared to the "surface crisis" of share and BTC price declines, a deeper crisis comes from institutional investors' responses.

Data shows that in Q3 2025, several top investment institutions, including Capital International, Vanguard, and BlackRock, proactively reduced their exposure to MSTR, with total reductions amounting to about $5.4 billion.

This data indicates that with the emergence of more direct and compliant investment channels such as BTC spot ETFs, Wall Street is gradually abandoning the old logic of "MSTR as a BTC proxy."

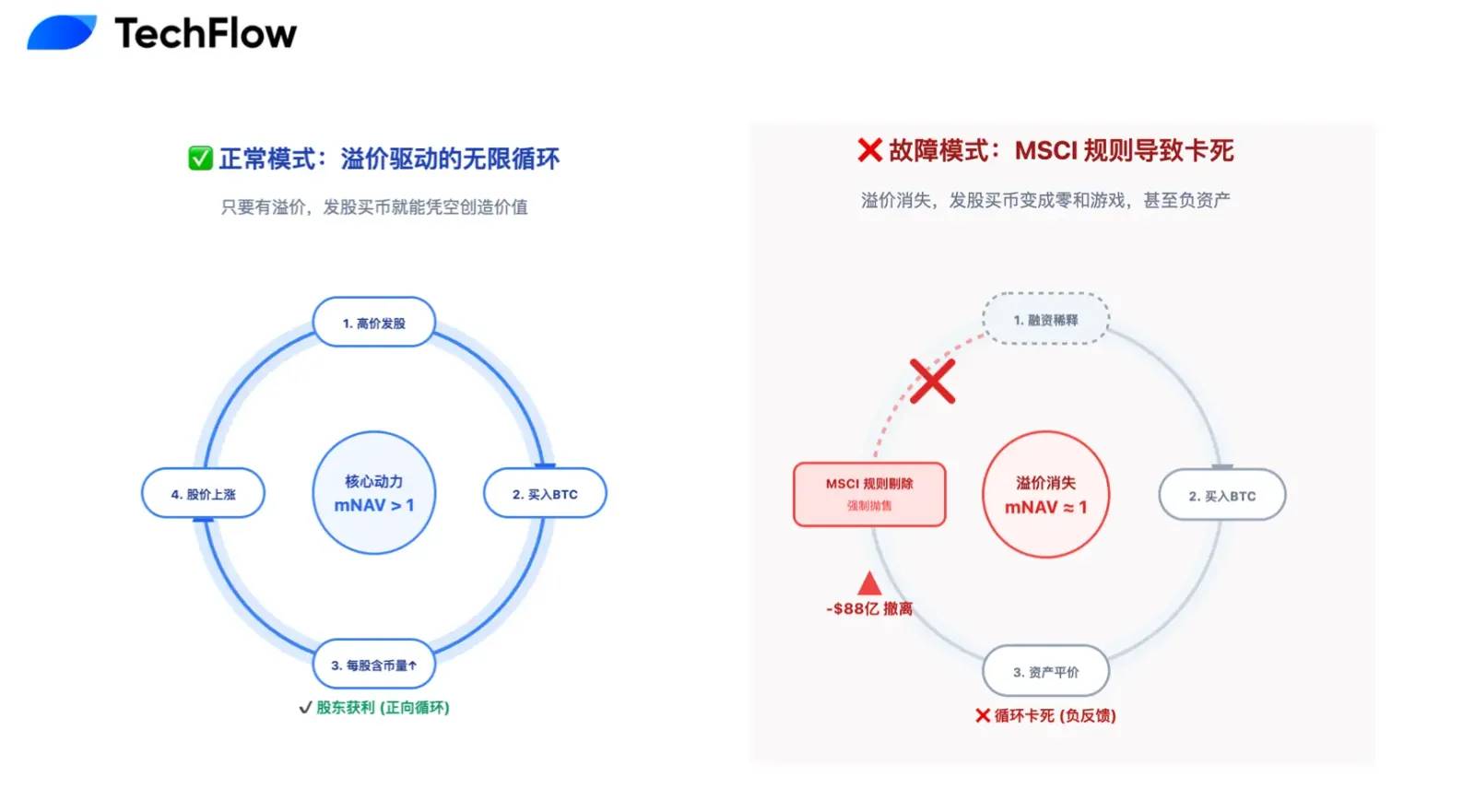

Among all DAT companies, mNAV is the key metric for understanding their business models.

In a bull market, the market is willing to pay a high premium for MSTR (mNAV far above 1, reaching as high as 2.5 at its peak), enabling it to create value through the flywheel model of "issuing new shares → buying bitcoin → share price rises due to premium."

However, as the market cools, its mNAV premium has basically disappeared, dropping to around 1.

This means that issuing new shares to buy BTC has become a zero-sum game that no longer enhances shareholder value, and its core growth engine may have stalled.

The Collapse of the Perpetual Motion Narrative

From a short-term and rational financial perspective, the market's current bearishness on Strategy is not unfounded.

This $1.44 billion cash reserve actually signals the end of the once-obsessive "buy BTC perpetual motion machine" narrative. The previously favored logic of "issuing new shares to buy BTC" was built on the optimistic assumption that the share price would always be higher than the convertible bond conversion price.

Strategy currently carries as much as $8.2 billion in convertible bonds, and S&P Global has clearly rated its credit as "B-" junk status, warning of potential liquidity crises.

The core of the crisis is that if the share price remains depressed, bondholders will refuse to convert to shares at maturity (as converting would mean greater losses), and instead demand full cash repayment of principal. Notably, one $1.01 billion bond could face redemption as early as 2027, posing a clear and rigid medium-term cash flow repayment pressure.

In this context, the establishment of the reserve fund is not just for paying interest, but also to cope with potential "runs." However, with the mNAV premium now at zero, this funding mainly comes from diluting existing shareholders' equity.

In other words, the company is overdrawing shareholder value to fill the debt gap of the past.

If debt pressure is a chronic illness, then being removed from the MSCI index is a potentially fatal acute condition.

As Strategy has continued to aggressively increase its holdings in recent years, BTC now accounts for more than 77% of its total assets, far exceeding the 50% red line set by index compilers such as MSCI.

Related reading: 88 billion dollars in outflows countdown, MSTR is becoming the abandoned child of global index funds

This has triggered a fatal classification issue, with MSCI considering reclassifying it from an "operating company" to an "investment fund." This administrative reclassification could trigger a disastrous chain reaction.

Once classified as a fund, MSTR would be removed from mainstream stock indices, triggering forced liquidation by trillions of dollars tracking these indices.

According to JPMorgan's estimates, this mechanism could trigger up to $8.8 billion in passive sell-offs. For MSTR, whose average daily trading volume is only several billion dollars, such a level of selling would create a liquidity black hole, likely causing a cliff-like drop in share price with no fundamental buyers to absorb it.

An Expensive but Necessary Premium

In the crypto market, an industry that follows "cycles," if you extend the time horizon, Strategy's seemingly "self-amputating" defensive measure may actually be the expensive but necessary premium it pays to win in the end.

"Staying at the table is the most important thing."

The past cycles of bull and bear markets have proven this: the culprit that causes investors to "go to zero" is not falling coin prices, but reckless "all-in" bets that ignore risk, ultimately forcing them off the table due to a sudden event, with no hope of a comeback.

From this perspective, the $1.44 billion cash reserve Strategy has established this time is also to ensure it stays at the table at the lowest possible cost.

By sacrificing short-term shareholder equity and market premium in exchange for initiative over the next two years, this is also a form of strategic wisdom: furl the sails before the storm, weather it, and when the next liquidity cycle arrives and the skies clear, Strategy, holding 650,000 BTC, will still be the irreplaceable "crypto blue chip."

Ultimate victory does not belong to those who live most brilliantly, but to those who live the longest.

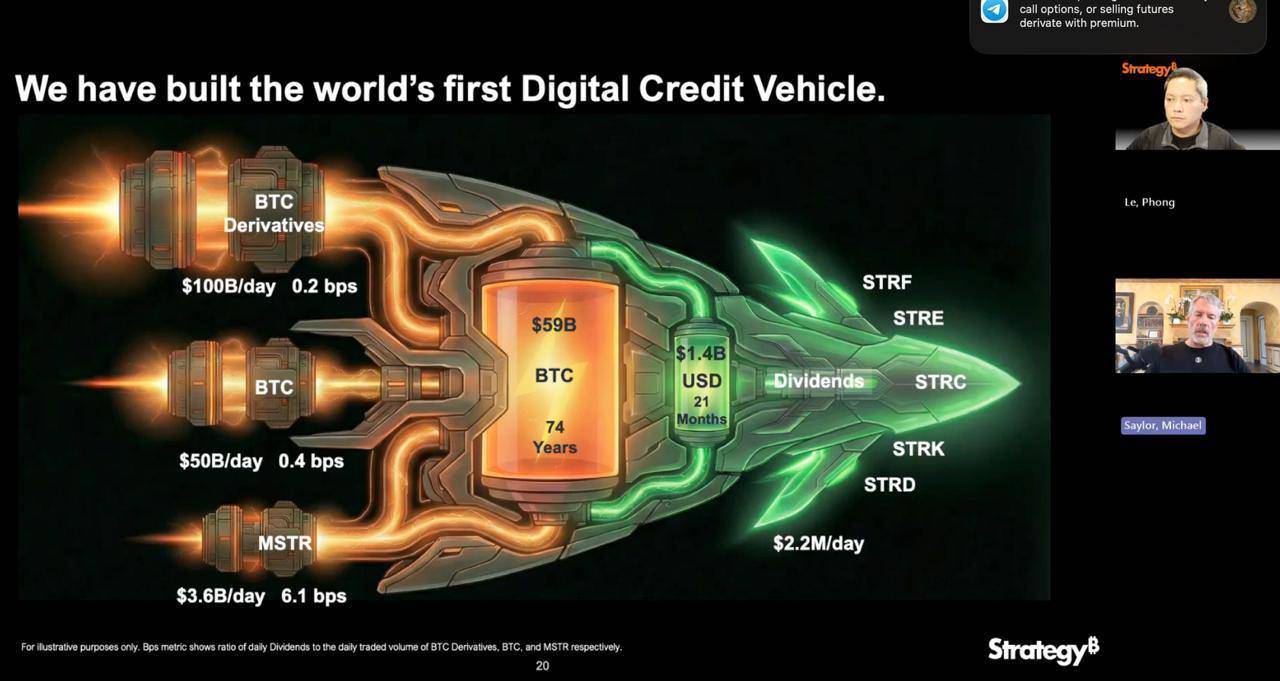

Beyond ensuring its own longevity, the deeper significance of Strategy's move is that it has explored a viable compliance path for all DAT companies.

If Strategy had continued its previous "all-in" approach, it would have been highly likely to face collapse, and the annual narrative of "public companies holding virtual currencies" would have been completely discredited, potentially triggering an unprecedented negative storm in the crypto world.

Conversely, if it can successfully find a balance between BTC's high volatility and the financial stability required of a listed company by introducing the "reserve system" of traditional finance, it will no longer be just a coin-hoarding company, but will have forged a brand new path.

This transformation is, in fact, Strategy's statement to S&P, MSCI, and traditional Wall Street capital: not only does it have fervent belief, but also the ability to conduct professional risk control in extreme environments.

This mature strategy may be its ticket to being accepted by mainstream indices and obtaining lower-cost financing in the future.

The Strategy ship carries the hopes and funds of countless people in the crypto industry. Compared to how fast it can sail in fair weather, what matters more is whether it has the stability to weather the storm.

This $1.44 billion reserve fund is both a correction of the previous one-sided betting strategy and a pledge in the face of future uncertainty.

In the short term, this transformation is full of growing pains: the disappearance of the mNAV premium, passive dilution of equity, and the temporary halt of the growth flywheel are all necessary costs of growth.

But in the long run, this is a hurdle that Strategy and countless future DAT companies must go through.

To reach for the heavens, you must first ensure your feet are firmly planted on solid ground.