AMD Stock Price Targeting $275: See Analyst Targets After Oracle & OpenAI Deals

Curious about what’s next for AMD stock after its impressive run and a string of high-profile partnerships? Whether you’re a tech investor or cautious observer, AMD stock is drawing heightened attention in the latter part of 2025. Strategic moves with Oracle and OpenAI are making headlines and could signal a powerful new phase for the semiconductor giant. This article offers a detailed look at AMD stock’s latest performance, expert forecasts, game-changing deals, key risks, and where it stands against major rival Nvidia.

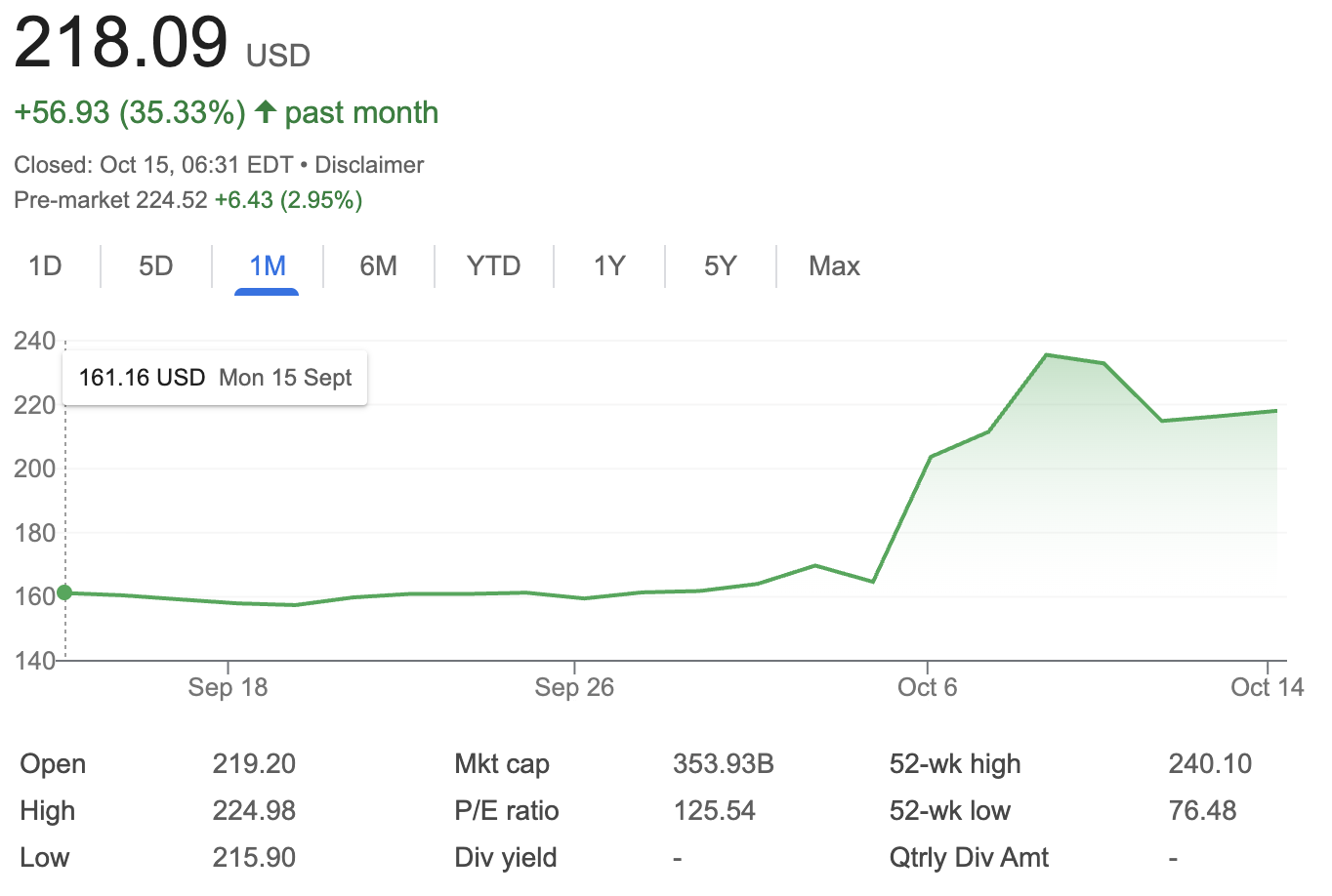

Source: Google Finance

AMD Stock Price Performance (October 2025)

AMD stock has gained significant momentum in 2025. As of October 2025, AMD shares are trading around $220, marking a remarkable surge of about 130% over the past six months. The tremendous growth of AMD stock stands as a testament to bullish investor sentiment regarding AMD’s position in the artificial intelligence and data center markets.

Notably, following the announcement of a major partnership with Oracle, AMD stock jumped around 2% in a single morning, while Oracle’s stock slipped roughly the same amount. The share price of AMD has shown elevated volatility, reflecting both growing expectations and aggressive trading activity.

It’s worth noting that AMD stock’s valuation is now relatively high, trading at a price-to-earnings (P/E) ratio of approximately 130. According to InvestingPro analysis, this suggests high investor expectations for future revenue and profit growth, propelled by AMD’s unique market positioning and strong financial health metrics.

AMD Stock Price Forecast

Technical Analysis

Technically, AMD stock is in a clear uptrend, consistently closing above its key moving averages, including the crucial 50-day average. The RSI indicator sits at 70—a sign that AMD stock is currently in overbought territory. This could foreshadow short-term corrections, even as long-term momentum remains robust. For traders and longer-term investors, AMD stock appears technically strong but may warrant careful timing for new entries.

Revenue Forecast

Wall Street analysts have taken a rosy view of AMD’s future thanks to two headline deals. Mizuho Securities recently raised its forecast for AMD stock, setting a new price target of $275, up from $205, after the announcement of the OpenAI deal. The firm predicts AMD’s revenues could reach $14 billion extra in fiscal 2027, growing to a massive $22 billion annually by 2030. Such upgrades have rippled across the market, with TD Cowen and Piper Sandler also lifting their price targets for AMD stock to $270 and $240, respectively.

Mizuho further estimates that AMD stock’s earnings per share could double, reaching about $11 by 2027-2028, though gross margin pressures may arise from warrant deals connected to large-scale AI hardware deployments.

Moody’s has upgraded AMD’s credit rating (and that of subsidiary Xilinx) to A1, specifically citing soaring multi-year growth expectations based on the OpenAI partnership. Other analysts—including Bernstein SocGen Group and BofA Securities, which maintains a $250 target—underscore that Microsoft-backed OpenAI’s deal with AMD is transforming revenue prospects for AMD stock and putting it firmly on watch lists.

Key Drivers Fueling AMD Stock Growth

AMD’s Transformative Oracle Collaboration

One of the strongest catalysts for AMD stock is its extended partnership with Oracle. In October 2025, AMD announced that Oracle Cloud will deploy 50,000 of its Instinct MI450 Series AI accelerators to power new artificial intelligence infrastructure superclusters. The first wave will be installed in Q3 2026, with expansion set to continue through 2027 and beyond.

This next chapter in the Oracle-AMD relationship builds upon a decade-long engineering partnership and is specifically designed to deliver high-performance scalability for advanced AI model training and inference. Investors instantly recognized the move’s impact: AMD stock popped 2% on the news. Meanwhile, the announcement sent ripples through the supply chain. Astera Labs—a major supplier for cloud and AI hardware connectivity—experienced a 19% one-day drop in its own stock, highlighting how AMD stock moves can affect sector peers.

The OpenAI Deal: A Potential Game-Changer

AMD stock has also been turbocharged by an ambitious deal with OpenAI. This “6 Gigawatt Deal” will see AMD deliver advanced chip solutions to OpenAI, in six massive tranches rolling out from Q4 2026 through 2030. The deal also comes with about 160 million warrant shares, tied directly to the scale and pricing of the deployments—meaning AMD stock could see significant upside, with projections for the stock eventually hitting as high as $600 per share if every milestone is achieved.

Analysts expect the OpenAI agreement to supercharge AMD’s revenues, delivering an incremental $14 billion in 2027 alone and as much as $22 billion per year by the end of the decade. The scope and certainty of this partnership have already pushed many investment houses to raise outlooks for AMD stock.

Nvidia’s Challenge: How AMD Stock Measures Up

While AMD stock is riding high, it faces tough competition from Nvidia, the undisputed heavyweight in AI and GPU chips. Following AMD’s Oracle announcement, Nvidia shares dropped over 4%, reflecting market anxiety about AMD’s growing threat in the accelerating AI chip sector.

Despite AMD’s big moves, Nvidia’s established leadership and broad ecosystem mean AMD stock still faces hurdles in capturing long-term market share. Innovations like new chip interconnects or broader Intel-Nvidia cooperations could also impact the competitive landscape for AMD stock, as evidenced by recent moves affecting Astera Labs.

Conclusion: Should You Buy AMD Stock?

Between its explosive share price gains, groundbreaking collaborations with Oracle and OpenAI, and a wave of bullish analyst upgrades, AMD stock is at the center of the AI hardware boom. All eyes are on future earnings and continued execution, as well as competition from industry leader Nvidia.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.