Artikel untuk saat ini tidak mendukung bahasa yang kamu pilih, artikel ini telah otomatis direkomendasikan ke bahasa Inggris untuk kamu.

What is Stock Futures and How to Trade It on Bitget?

[Estimated Reading Time: 3 mins]

This article explains what stock futures are and provides a step-by-step guide on how to trade them on the Bitget website and app.

What is Stock Futures?

Stock Futures is Bitget’s innovative stock index perpetual futures contract. Its underlying asset is composed of tokenized indexes of stocks that are already circulating in the market. For example, the NVDAUSDT Stock futures contract on Bitget is priced based on a composite index of NVDA stock tokens issued by different third-party issuers (e.g., xStock, ONDO).

Key highlights:

-

Trading hours: 5×24 (Monday 00:00 – Saturday 00:00, UTC-4).

-

Settlement currency: USDT.

-

Margin mode: Isolated only (cross margin and unified account are not supported).

-

Max leverage: 10x.

-

Index price: Calculated from multiple stock token issuers, with weighting determined by measurable factors such as market activity, trading volume, and liquidity conditions.

-

Funding rate: every 1 hour.

Differences Between Stock Futures and Regular USDT Perpetual Contracts

| Feature | Stock Futures | Regular USDT perpetual contract |

| Trading hours | 5×24 (closed on weekends and special periods) | 7×24 (always open) |

| Settlement currency | USDT | USDT |

| Underlying asset | Basket of tokenized stock indexes (multiple issuers) | Single token (e.g., BTC, ETH) |

| Margin mode | Isolated only | Isolated, cross, or unified account |

| Max leverage | 10x | Up to 125x |

| Index price | Weighted composite index | Spot market price of the token |

| Funding rate | 1h | 1h, 2h, 4h, or 8h |

Risk Management for Stock Futures

-

Liquidation mechanism: Same as conventional isolated-margin futures, based on margin ratio and liquidation price.

-

No liquidation during suspension: When the market is closed, positions are not liquidated. However, if the market gaps up or down on reopening, your position could face liquidation. Always add margin before reopening to reduce risk.

-

Insurance fund: Each Stock Futures contract has an initial 50,000 USDT risk fund with ADL (Auto-Deleveraging) protection enabled.

How to Trade Stock Futures on Bitget Website?

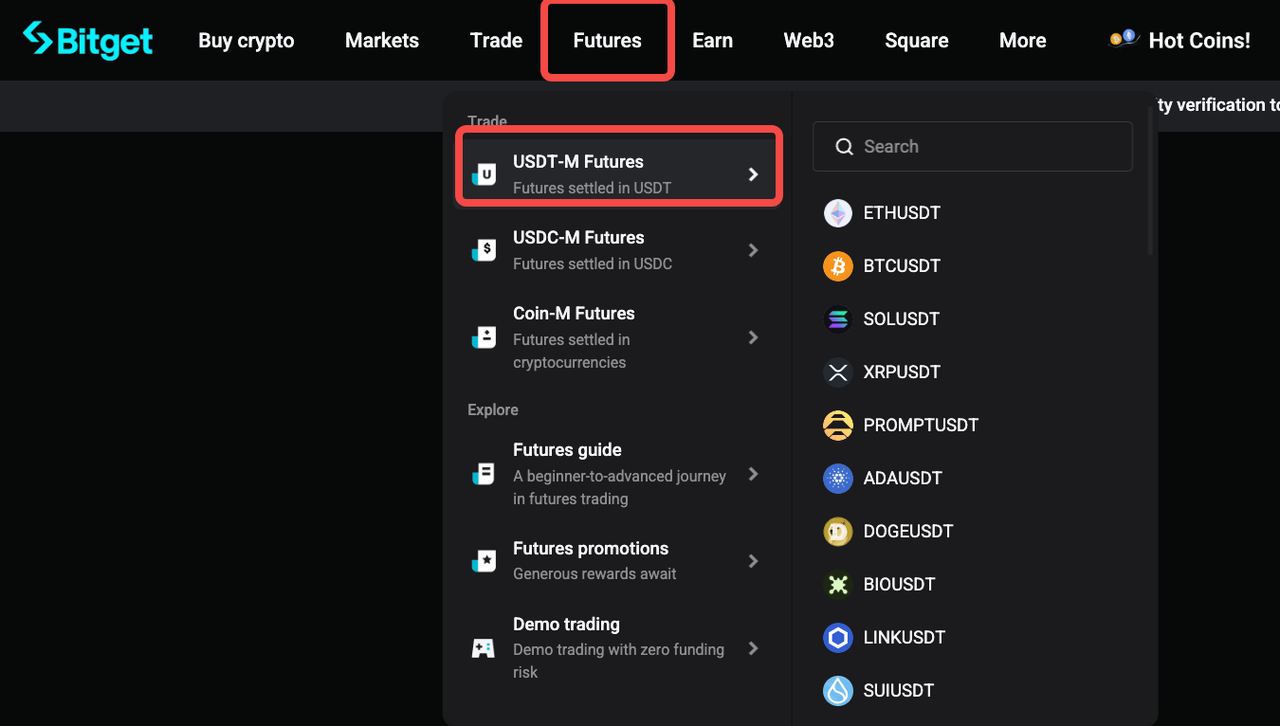

Step 1: Go to USDT-M Futures

1. Hover over Futures in the top navigation bar and click USDT-M Futures.

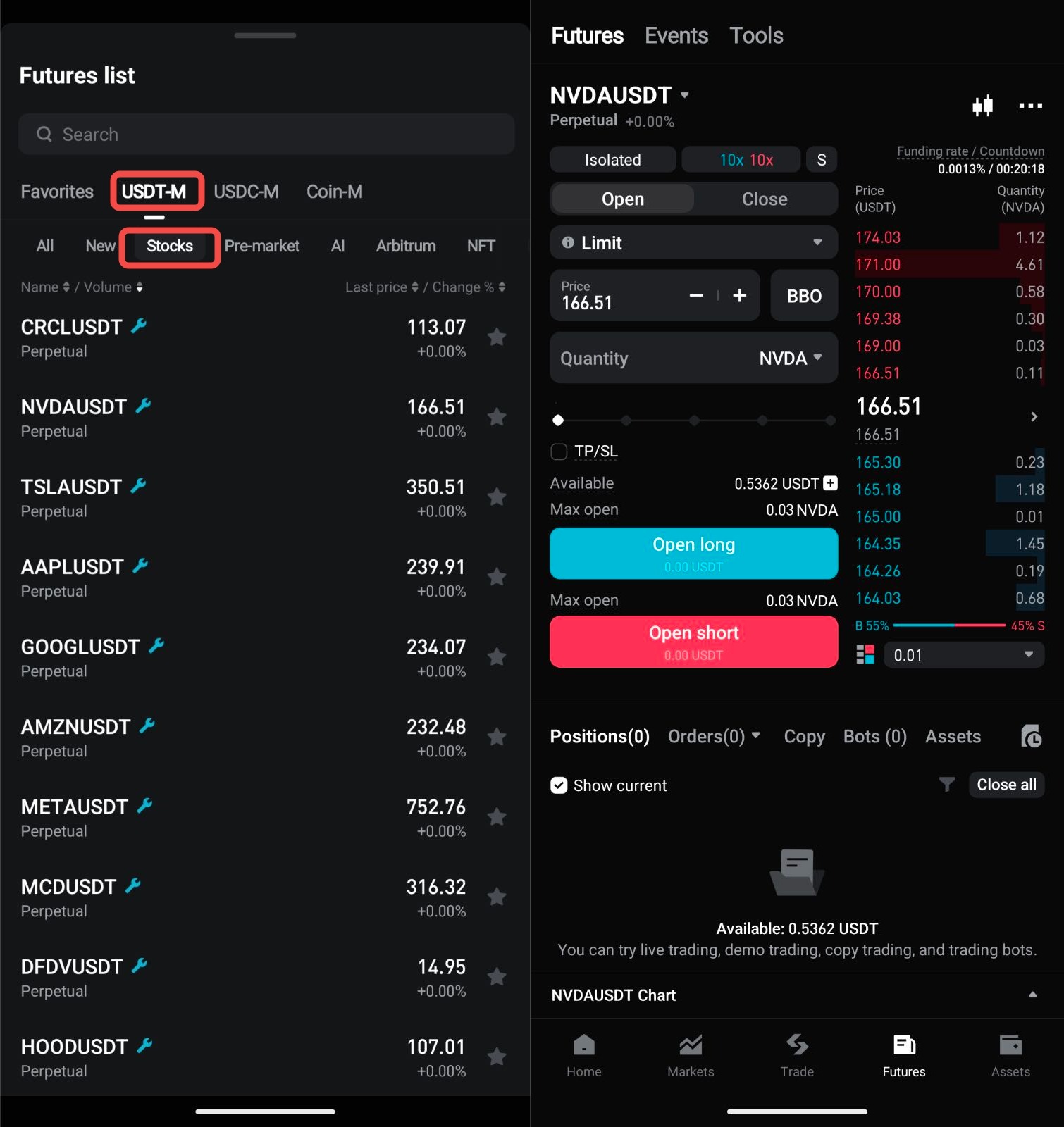

2. In the contract list, click the Stock tab to filter available Stock futures.

3. Choose from the available Stock futures (e.g., NVDAUSDT, TSLAUSDT, CRCLUSDT) and click it to open the trading page.

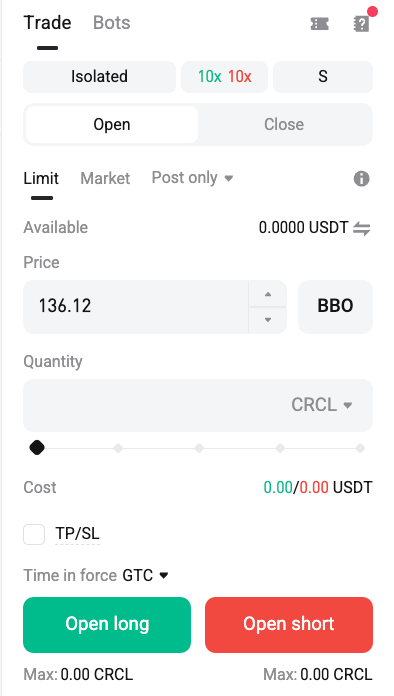

Step 2: Place your order

1. Select Isolated margin mode.

2. Click Leverage and adjust the Multiplier for your trade.

3. Choose Order Type

4. Enter the order details and select Open long or Open short based on your market expectations.

5. Confirm the order.

How to Trade Stock Futures on Bitget App?

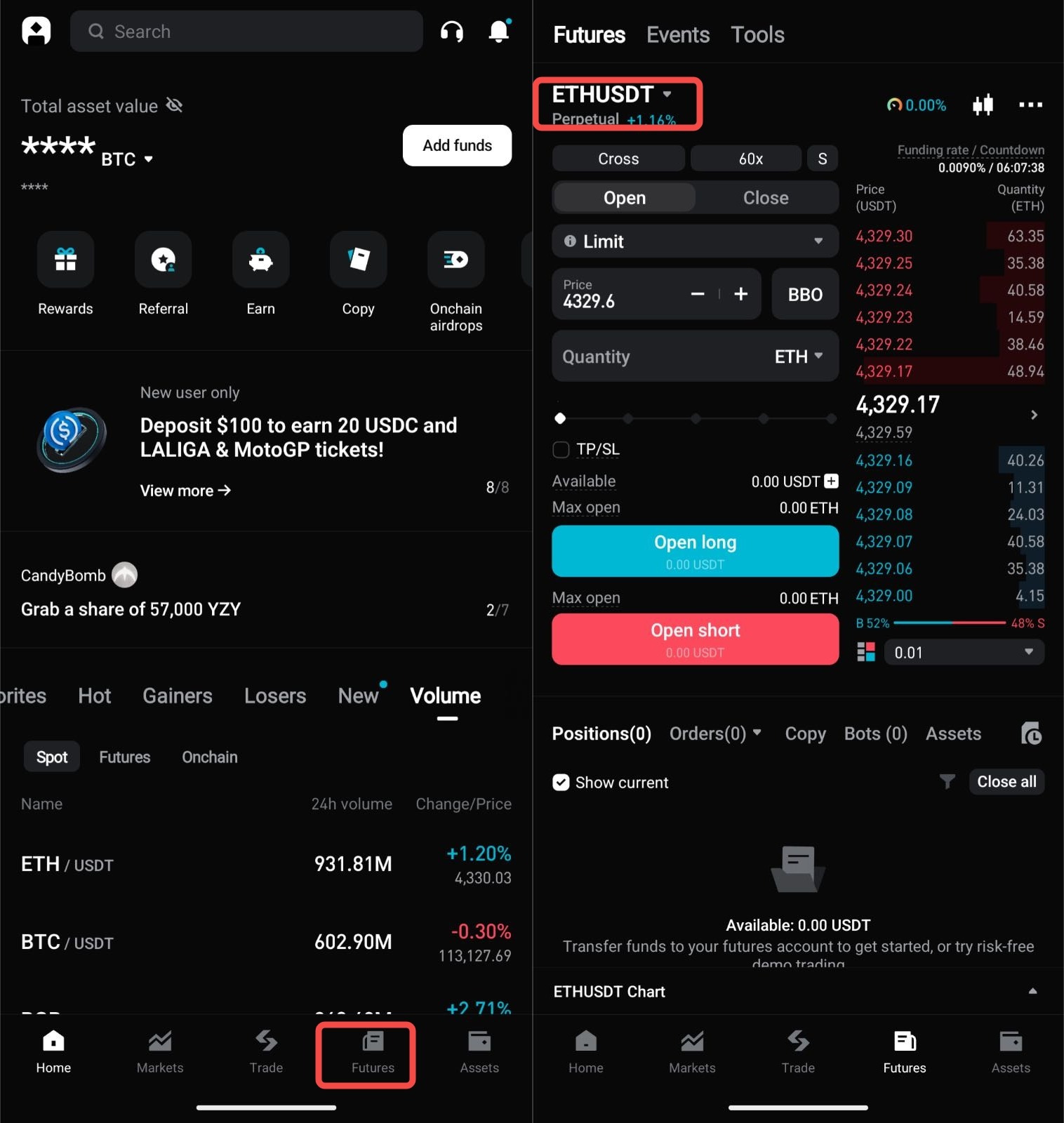

Step 1: Navigate to USDT-M Futures

1. Tap Futures on the bottom menu bar.

2. In the futures list, select the Stocks tab to display all Stock futures.

3. Tap the Stock futures you want to trade (e.g., NVDAUSDT, TSLAUSDT, CRCLUSDT) to open its trading interface.

Step 2: Place your order

1. Select Isolated margin mode.

2. Click Leverage and adjust the Multiplier for your trade.

3. Choose Order Type

4. Enter the order details and select Open long or Open short based on your market expectations.

5. Confirm the order.

Important Notes Before Trading Stock Futures

-

Stock Futures close on weekends and special periods (Bitget will publish announcements in advance).

-

Orders cannot be placed during suspension, but you can cancel existing ones.

-

Funding fees do not accrue during suspension.

-

Always monitor price gaps before reopening and add margin to avoid liquidation risk.

FAQs

1. What is the maximum leverage available for Stock futures?

-

Stock futures support a maximum leverage of 10x.

2. Can I trade Stock futures using cross margin or unified account mode?

-

No. Stock futures only support Isolated margin mode. Cross margin and unified account are not available.

3. Why are Stock futures not available for trading on weekends?

-

Stock futures follow a 5×24 schedule (Monday 00:00 – Saturday 00:00, UTC-4). They are closed on weekends and certain special dates to ensure fair and accurate pricing.

4. Will my position be liquidated when the market is closed?

-

No. During suspension, positions are not liquidated. However, if the market gaps significantly at reopening, liquidation risk may occur. It’s recommended to add margin before trading resumes.

5. Do Stock futures have an insurance fund?

-

Yes. Each Stock futures contract has an initial 50,000 USDT insurance fund with ADL (Auto-Deleveraging) enabled to protect traders.

Risk Warning: Stock futures (the "Product") are built on a composite of tokenized stock indices already circulating in the market. However, the Product is not a security and does not represent actual ownership of the underlying stocks or related stock tokens or indices. The Product does not give you any dividends, interest, voting rights, shareholder privileges, or rights offerings (including but not limited to share splits, spin-offs, or subscription rights) of any underlying stocks or related stock tokens or indices. The Product is neither insured, approved nor guaranteed by any government or agency. Bitget is neither the issuer nor the distributor of the underlying stock or related stock tokens or indices. Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to our Terms of Use and Futures Services Agreement.

Join Bitget, the World's Leading Crypto Exchange and Web3 Company

Bagikan