The crypto market witnessed a historic day on December 5, as Bitcoin not only breached the psychological $100,000 mark but also endured one of its sharpest flash crashes, liquidating hundreds of millions of dollars in leveraged positions within 24 hours.

Record Liquidations Shake the Market

On Thursday evening, European time, Bitcoin’s price plunged from $96,200 to $90,600 in a single minute—a sudden 5.8% drop that triggered massive liquidations across major exchanges.

Sponsored

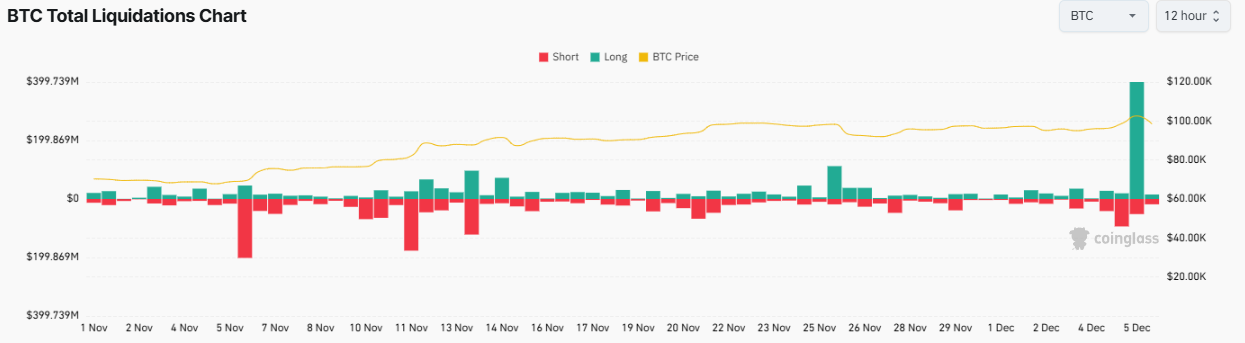

While Bitcoin quickly rebounded to around $96,000, data from CoinGlass shows over $869.91 million in leveraged positions were wiped out within 24 hours.

Long position traders suffered the most, with $703.35 million liquidated as they bet on continued price growth. Short sellers saw comparatively smaller losses, amounting to $166.56 million.

Liquidated BTC trader’s positions during Bitcoin flash crash. Source: CoinGlass

Liquidated BTC trader’s positions during Bitcoin flash crash. Source: CoinGlass

OKX clients were hit the hardest, recording a staggering $378.7 million in liquidations. Binance traders faced $241.6 million in losses, while Bybit users saw nearly $132 million wiped out as the crypto market turmoil unfolded.

Bitcoin Traders Take the Biggest Hit in Liquidations

According to CoinGlass, Bitcoin traders suffered the heaviest losses, with $415.6 million in long positions and $71.52 million in shorts liquidated within 24 hours.

Crypto market flash-crash liquidated dramatic number of leveraged positions. Source: CoinGlass

Crypto market flash-crash liquidated dramatic number of leveraged positions. Source: CoinGlass

Ethereum traders faced significantly smaller losses, with $67.24 million in longs and $18.26 million in shorts wiped out.

Suspect Market Manipulation

While there are various theories about the sudden crash, market experts point to a potential case of manipulation, citing the current bull market environment where perpetual swaps have more liquidity than spot markets, despite their price being tied to spot prices.

“This means traders who have large LONG spot, SHORT swap (balanced positions) can, when markets seem to be at a point with lower liquidity, “sweep the leg” by dumping their spot holdings to push down the price, which drops faster due to less overall liquidity,” explained crypto market analyst Dave Weisberger, emphasizing the dangers of speculation on leverage in such scenarios.

In simpler terms, traders can trigger a sharp drop in spot prices by selling off their holdings, forcing perpetual swap prices to follow. This lets them profit from their short swap positions while keeping spot losses contained.

On the Flipside:

- The crypto market has just begun its bull cycle. While many coins showed impressive gains in November, the full growth potential has yet to be realized, and not all coins have entered the price discovery phase.

Why This Matters

As large, experienced institutional players enter the market, similar surprises may become the new norm. These big traders could exploit liquidity gaps, triggering sharp price declines that lead to liquidations and magnify retail losses.

Check out DailyCoin’s trending crypto news:

Bitcoin Hits $100K as Trump Names Pro-Crypto Paul Atkins as SEC Chair

SHIB Burn Rate Brakes Record Ahead Bitcoin’s Milestone