US spot Bitcoin ETFs’ 15-day net inflow streak ends as $342 million exits funds

Quick Take The latest 15-day net inflow streak into U.S. spot Bitcoin ETFs has come to an end after they witnessed $342.2 million in combined net outflows on Tuesday. BlackRock’s IBIT individual 15-day streak also came to an end, witnessing zero flows for the day.

The U.S. spot Bitcoin exchange-traded funds' 15-day, $4.7 billion net inflow streak came to an end on Tuesday, with a combined $342.2 million in net outflows, according to data compiled by The Block.

BlackRock's usually dominant IBIT product ended its 15-day, $3.8 billion inflow run, registering zero flows for the day. Fidelity's FBTC led the net outflows with $172.7 million, followed by Grascale's GBTC, Ark Invest's ARKB, and Bitwise's BITB, with $119.5 million, $27 million, and $23 million, respectively.

"This marks a pause in institutional accumulation but not necessarily a trend reversal," BRN Lead Research Analyst Valentin Fournier told The Block after warning on Monday that the declining pace of daily inflows during the run suggested a cooling in short-term institutional enthusiasm, raising doubts about bitcoin's ability to break $110,000 without new catalysts.

The U.S. spot Bitcoin ETFs have generated $48.9 billion in cumulative net inflows since their debut in January 2024 and $13.5 billion year-to-date, with $128 billion in assets now under management amid the concurrent price rise, per The Block's Bitcoin ETF Tracker page.

Meanwhile, the U.S. spot Ethereum ETFs saw $40.7 million in net inflows on Tuesday, led by $54.8 million into BlackRock's ETHA fund, extending their net inflow streak to three days, totaling $150 million. Total net inflows for the Ethereum funds, which launched later in July 2024, currently stand at $4.3 billion.

Weighing up key US data releases

Bitcoin dipped below $105,500 early Wednesday as traders weigh up key U.S. economic data releases this week.

"Markets remain in a cooling consolidation period, as participants await clarity from upcoming jobless claims on July 3 or broader macro resolution," Kronos Research CIO Vincent Liu said. "For now, liquidity remains weak, and positioning is patient."

However, bitcoin subsequently rebounded to trade for around $107,800, according to The Block's BTC price page . Bitcoin's consolidation between $105,000 and $110,00 is ultimately a bullish setup, BRN's Fournier said, especially if new regulatory clarity or fresh institutional players reignite momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Perpetual Futures: Unveiling the Shocking 24-Hour Liquidation Storm

USDT Transfer: Unveiling the Massive $200M Move to Aave and Its Market Impact

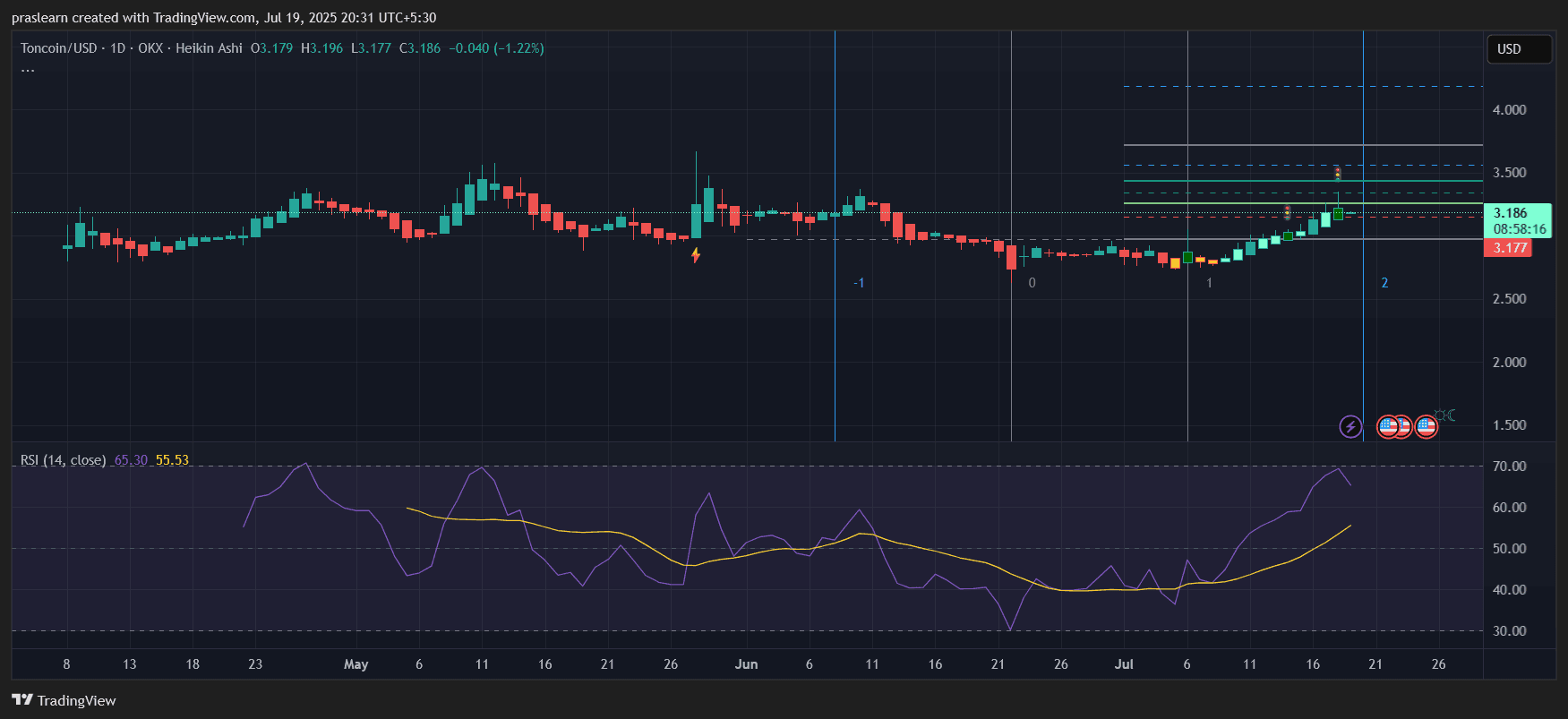

TON Price Prediction: Is a 30% Surge to $4 Next?

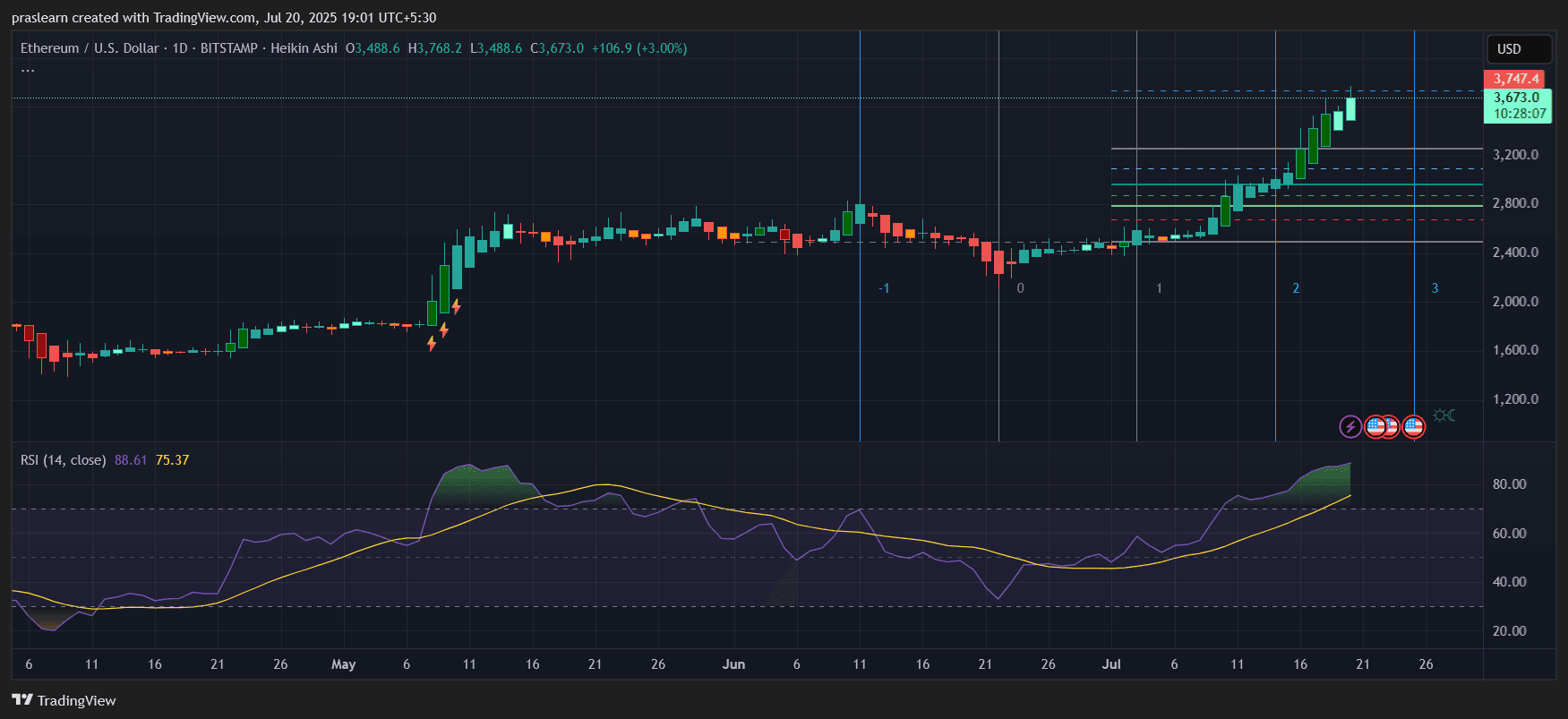

Ethereum Price Skyrockets: What’s Coming Next?